Increasing Cyber Threats

The antivirus software market in China is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Reports indicate that cybercrime incidents have increased by over 30% in recent years, prompting businesses and individuals to seek robust security solutions. This trend is particularly pronounced in sectors such as finance and healthcare, where sensitive data is at risk. As a result, the antivirus software market is expected to see a significant uptick in sales as organizations prioritize cybersecurity measures to protect their assets. The growing awareness of potential threats is driving consumers to invest in comprehensive antivirus solutions, thereby enhancing the overall market landscape.

Rising Adoption of Cloud Services

The shift towards cloud computing in China is significantly impacting the antivirus software market. As more businesses migrate their operations to the cloud, the need for cloud-based security solutions becomes paramount. This transition is expected to drive the antivirus software market, with cloud security solutions projected to account for nearly 40% of the total market share by 2026. The convenience and scalability offered by cloud services are appealing to organizations, leading to increased investments in antivirus software that can effectively protect cloud environments. Consequently, the antivirus software market is likely to witness a transformation as providers adapt their offerings to meet the demands of cloud users.

Growing Awareness of Cybersecurity

There is a notable increase in cybersecurity awareness among consumers and businesses in China, which is positively influencing the antivirus software market. Educational initiatives and high-profile cyber incidents have heightened public consciousness regarding the importance of digital security. As a result, individuals are more inclined to purchase antivirus solutions to protect their personal devices and data. Market data suggests that consumer spending on antivirus software has risen by approximately 20% in the past year alone. This growing awareness is expected to sustain the demand for antivirus products, as users recognize the necessity of proactive measures against cyber threats.

Regulatory Compliance Requirements

In China, stringent regulatory frameworks regarding data protection and cybersecurity are influencing the antivirus software market. The implementation of laws such as the Cybersecurity Law mandates organizations to adopt adequate security measures to safeguard personal information. This regulatory environment compels businesses to invest in antivirus solutions to ensure compliance and avoid hefty fines. As organizations strive to meet these legal obligations, the antivirus software market is expected to expand, with a projected growth rate of approximately 15% annually. The need for compliance not only drives demand for antivirus products but also encourages innovation within the industry, as companies seek to develop solutions that align with regulatory standards.

Technological Advancements in Security Solutions

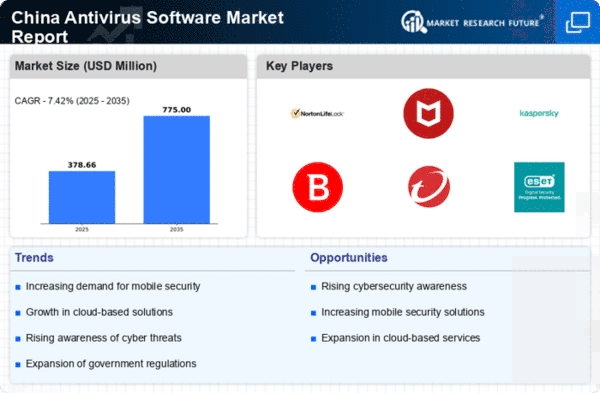

the antivirus software market is propelled by rapid technological advancements that enhance the effectiveness of security solutions. Innovations such as artificial intelligence and machine learning are being integrated into antivirus products, allowing for more accurate threat detection and response. In China, the adoption of these advanced technologies is likely to drive market growth, as businesses seek cutting-edge solutions to combat evolving cyber threats. The market is projected to grow at a compound annual growth rate (CAGR) of around 12% over the next five years, driven by the demand for sophisticated antivirus software that can adapt to new challenges in the cybersecurity landscape.