Evolving Consumer Behavior

Consumer behavior in China is undergoing significant transformation, which is impacting the advertising software market. With the rise of e-commerce and social media platforms, consumers are increasingly seeking personalized and engaging content. This shift has prompted advertisers to adopt more targeted strategies, utilizing advanced software tools to analyze consumer data and preferences. Reports indicate that over 60% of consumers in China prefer brands that offer tailored experiences. As a result, advertising software solutions that facilitate data-driven decision-making and audience segmentation are becoming essential for businesses aiming to connect with their target demographics effectively.

Regulatory Changes and Compliance

the advertising software market in China is influenced by changing regulatory frameworks and compliance requirements.. Recent government initiatives aimed at enhancing consumer protection and data privacy have necessitated that businesses adapt their advertising strategies accordingly. Companies are increasingly investing in software solutions that ensure compliance with these regulations, which may include data encryption and user consent management features. This focus on compliance not only mitigates legal risks but also fosters consumer trust. As the regulatory landscape continues to evolve, the demand for advertising software that aligns with these requirements is likely to grow, shaping the future of the market.

Increased Competition Among Brands

The competitive landscape in China is intensifying, leading to a greater emphasis on innovative advertising strategies. As more brands enter the market, the need for effective advertising software solutions becomes paramount. Companies are seeking to differentiate themselves through unique campaigns and targeted messaging, which necessitates the use of advanced software tools. This competitive pressure is driving investments in advertising technology, with businesses aiming to enhance their return on investment (ROI) through more efficient ad placements and performance tracking. Consequently, the advertising software market is likely to witness robust growth as brands strive to maintain their market positions.

Rising Digital Advertising Expenditure

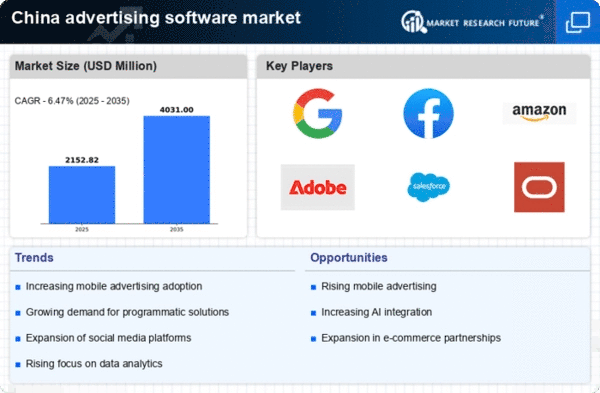

the advertising software market in China is seeing a significant increase in digital advertising expenditure.. In recent years, businesses have increasingly allocated their budgets towards digital platforms, with a reported growth rate of approximately 20% annually. This trend is driven by the growing number of internet users and the increasing penetration of smartphones. As companies seek to enhance their online presence, the demand for sophisticated advertising software solutions has escalated. This software enables businesses to optimize their campaigns, track performance metrics, and engage with consumers more effectively. Consequently, the advertising software market is set for continued growth as organizations capitalize on the digital landscape..

Technological Advancements in Data Analytics

Technological advancements in data analytics are significantly shaping the advertising software market in China. The integration of big data and machine learning technologies allows businesses to gain deeper insights into consumer behavior and campaign performance. As a result, companies are increasingly leveraging these technologies to enhance their advertising strategies. Reports suggest that the use of advanced analytics tools can improve campaign effectiveness by up to 30%. This trend indicates a growing reliance on sophisticated advertising software that can process vast amounts of data and provide actionable insights, thereby driving market growth.