- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

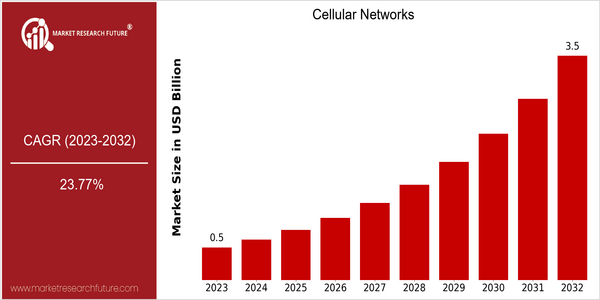

| Year | Value |

|---|---|

| 2023 | USD 0.5 Billion |

| 2032 | USD 3.5 Billion |

| CAGR (2024-2032) | 23.77 % |

Note – Market size depicts the revenue generated over the financial year

The cell-phone market is expected to grow at a rapid pace, and it is expected to be worth $ 0.5 billion in 2023, growing to $ 3.5 billion in 2032. The compound annual growth rate from 2024 to 2032 is 23.77%. The proliferation of IoT devices and the development of 5G technology are the main drivers of this growth. The cell-phone industry is evolving rapidly to meet the needs of businesses and consumers. The leading companies, including Ericsson, Nokia and Huawei, are investing heavily in R&D to maintain their market positions. Strategic alliances with operators and investment in future technology are also driving growth. The industry is also becoming more receptive to the market, and this is reflected in the number of alliances being formed. The market is expected to grow further as a result of the development of technology and the growing importance of mobile communication.

Regional Market Size

Regional Deep Dive

North America is characterized by the high penetration of 4G and 5G and by the heavy investment of the major operators in the network. Europe is witnessing a strong drive towards 5G, supported by a regulatory framework that encourages innovation and competition. The growth of the Asia-Pacific region is based on the large population and the rising penetration of smart phones. The Middle East and Africa are characterized by the rapid deployment of mobile networks in underserved areas. Latin America, too, is a major player with its investments in network modernization and digital transformation. Each region has its own challenges and opportunities.

Europe

- The European Union has introduced the European Electronic Communications Code (EECC), which aims to harmonize regulations across member states and facilitate the rollout of 5G networks.

- Telecom companies such as Deutsche Telekom and Vodafone are collaborating on cross-border 5G projects, enhancing connectivity and fostering innovation in various sectors.

Asia Pacific

- China is at the forefront of 5G technology, with companies like Huawei and ZTE leading the development and deployment of advanced cellular networks.

- India's government is actively promoting the Digital India initiative, which aims to enhance mobile connectivity and digital infrastructure, significantly impacting the cellular networks market.

Latin America

- Countries like Brazil and Mexico are witnessing increased investments in mobile network infrastructure, driven by the need for improved connectivity and digital services.

- Regulatory bodies in Latin America are working to streamline spectrum allocation processes, which is expected to accelerate the deployment of next-generation cellular networks.

North America

- Major telecom operators like Verizon and AT&T are leading the charge in 5G deployment, with significant investments in infrastructure to enhance network capabilities and coverage.

- The Federal Communications Commission (FCC) has implemented policies to promote competition and innovation in the telecommunications sector, which is expected to drive further advancements in cellular technology.

Middle East And Africa

- Telecom operators in the Middle East, such as Etisalat and STC, are investing in expanding their 5G networks to cater to the growing demand for high-speed mobile internet.

- The African Union has launched initiatives to improve mobile connectivity across the continent, focusing on rural areas to bridge the digital divide.

Did You Know?

“As of 2023, over 1 billion 5G subscriptions are projected globally, highlighting the rapid adoption of this technology across various regions.” — GSMA Intelligence

Segmental Market Size

The Cellular Communications Market, especially the 5G market, plays a key role in enhancing communication and enabling advanced applications across a range of industries. This market is currently undergoing strong growth, driven by the increasing demand for high-speed Internet and the proliferation of IoT devices. The need for faster data transmission and low latency in real-time applications is also driving demand for 5G, as is regulatory support for 5G development in regions such as North America and Asia-Pacific. In the United States, 5G is already being used in some urban areas by companies such as Verizon and Huawei. The most important applications are smart cities, driverless vehicles and enhanced mobile broadband. The trend towards digital transformation in the enterprise sector, and the government’s mandate to improve the telecommunications network, are also driving the market. Also influencing the evolution of cellular communications is the development of network slicing and edge computing, which enable the more efficient allocation of network resources and the improved provision of services.

Future Outlook

The cellular telephones market will be worth $ 500,000,000 in 2023, and will have risen to $ 3,500,000,000 in 2032, a CAGR of 23.77%. The growth is mainly due to the growing demand for mobile Internet, the increase in the number of connected objects and the gradual rollout of 5G. It is estimated that by 2032, more than 80% of the mobile users will be connected to 5G, against about 20% in 2023. Further technological developments, such as the development of network slices and edge computing, will further increase the capabilities of cellular networks, enabling more efficient data management and improved end-user experience. In addition, the support of the government and the improvement of the telecommunications network will play a major role in this growth. Artificial intelligence in network management and the development of private cellular networks for companies are expected to reshape the competition and create new revenue opportunities. In short, the cellular telephones market is on a promising path, with a fast evolution and increasing penetration, paving the way for a decade of great changes.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.4 Billion |

| Market Size Value In 2023 | USD 0.5 Billion |

| Growth Rate | 27.10% (2023-2032) |

Cellular Networks Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.