Market Growth Projections

The Global Catheter Securement Device Market Industry is projected to experience substantial growth over the next decade. With an anticipated increase from 0.43 USD Billion in 2024 to 1.73 USD Billion by 2035, the market is poised for a robust expansion. The compound annual growth rate (CAGR) of 13.42% from 2025 to 2035 indicates a strong upward trajectory, driven by various factors including technological advancements, rising chronic disease prevalence, and an aging population. This growth presents opportunities for stakeholders to innovate and enhance their product offerings in response to evolving healthcare needs.

Growing Geriatric Population

The increasing geriatric population globally is a notable driver for the Global Catheter Securement Device Market Industry. Older adults often require medical interventions that involve catheterization, leading to a higher demand for securement devices. As the global population ages, healthcare systems must adapt to meet the needs of this demographic, which is more susceptible to chronic illnesses and requires ongoing medical care. This demographic shift is anticipated to contribute significantly to market growth, as the demand for effective and reliable catheter securement solutions continues to rise.

Increased Focus on Patient Safety

There is a growing emphasis on patient safety within healthcare systems worldwide, which acts as a crucial driver for the Global Catheter Securement Device Market Industry. Healthcare providers are increasingly prioritizing the prevention of catheter-related complications, such as infections and dislodgement. This focus has led to the implementation of best practices and guidelines that advocate for the use of securement devices. Consequently, hospitals and clinics are investing in high-quality securement solutions to enhance patient care. This trend is likely to bolster market growth as institutions strive to meet safety standards and improve overall patient outcomes.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases globally is a pivotal driver for the Global Catheter Securement Device Market Industry. Conditions such as diabetes, cardiovascular diseases, and cancer necessitate frequent catheterization, thereby elevating the demand for securement devices. As healthcare systems adapt to manage these chronic conditions, the market is projected to grow from 0.43 USD Billion in 2024 to an estimated 1.73 USD Billion by 2035. This growth, reflecting a compound annual growth rate (CAGR) of 13.42% from 2025 to 2035, underscores the essential role of catheter securement devices in enhancing patient care and safety.

Expansion of Healthcare Infrastructure

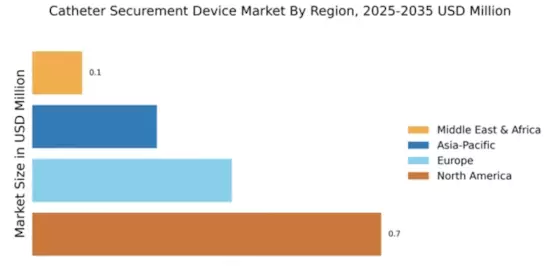

The expansion of healthcare infrastructure in emerging economies is a significant factor propelling the Global Catheter Securement Device Market Industry. As countries invest in healthcare facilities and services, the demand for medical devices, including catheter securement solutions, is expected to rise. Improved access to healthcare services in regions with previously limited resources creates opportunities for market players to introduce their products. This expansion is particularly evident in Asia-Pacific and Latin America, where rising healthcare expenditures and government initiatives are fostering a conducive environment for market growth.

Technological Advancements in Medical Devices

Innovations in medical technology significantly influence the Global Catheter Securement Device Market Industry. The development of advanced materials and designs enhances the efficacy and safety of catheter securement devices. For instance, the introduction of antimicrobial coatings and adjustable securement mechanisms has improved patient outcomes and reduced complications. These advancements not only foster greater adoption among healthcare providers but also align with regulatory standards aimed at improving patient safety. As a result, the market is expected to witness substantial growth, driven by the continuous evolution of technology in the healthcare sector.