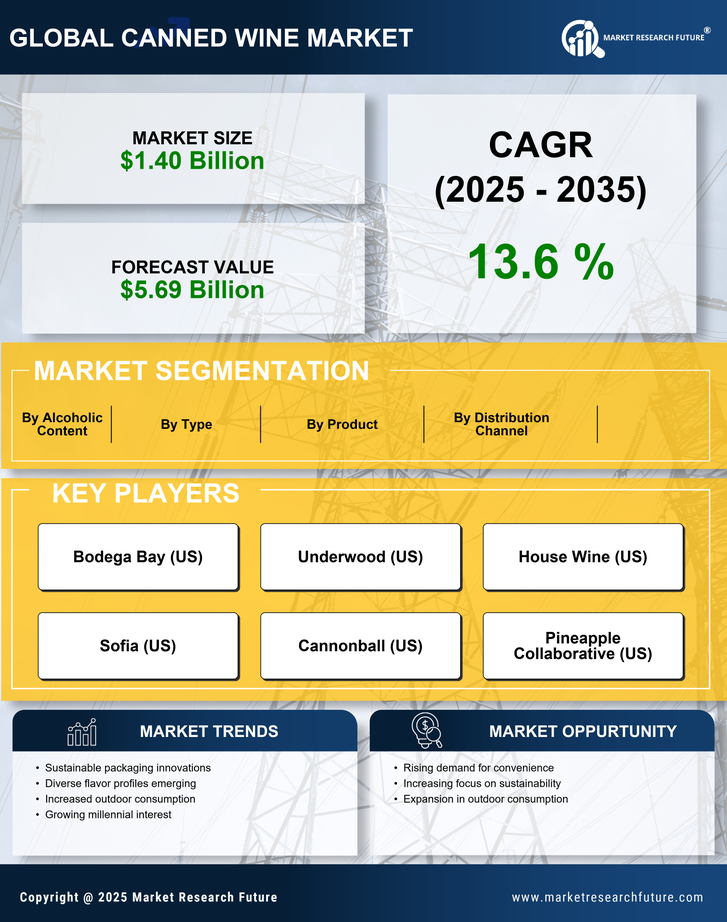

The canned wine market is currently characterized by a dynamic competitive landscape, driven by evolving consumer preferences and a growing inclination towards convenience and portability. Key players such as Bodega Bay (US), Underwood (US), and House Wine (US) are strategically positioning themselves to capitalize on these trends. Bodega Bay (US) focuses on premium offerings, emphasizing quality and unique flavor profiles, while Underwood (US) leverages its strong brand identity to appeal to younger demographics. House Wine (US) adopts a more inclusive approach, targeting a broad audience with a diverse product range. Collectively, these strategies foster a competitive environment that encourages innovation and responsiveness to market demands.In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market appears moderately fragmented, with several players vying for market share, yet the influence of major brands remains substantial. This competitive structure allows for a variety of offerings, catering to different consumer segments and preferences, while also fostering a spirit of collaboration among companies seeking to optimize their operations.

In August Bodega Bay (US) announced a partnership with a local vineyard to create a limited-edition canned wine series, which aims to highlight regional terroir and attract wine enthusiasts. This strategic move not only enhances Bodega Bay's product portfolio but also strengthens its ties to local producers, potentially increasing brand loyalty among consumers who value local sourcing. The collaboration underscores the growing trend of authenticity in the wine market, where consumers are increasingly drawn to products with a story.

In September Underwood (US) launched a new marketing campaign targeting outdoor enthusiasts, promoting its canned wines as the ideal companion for adventures. This initiative reflects a strategic pivot towards experiential marketing, aiming to connect with consumers in lifestyle contexts. By aligning its brand with outdoor activities, Underwood (US) seeks to differentiate itself in a crowded market, appealing to a demographic that values both convenience and quality.

In July House Wine (US) expanded its distribution network by entering into agreements with several major retailers across the United States. This strategic expansion is likely to enhance its market presence and accessibility, allowing the brand to reach a wider audience. By increasing its footprint in retail, House Wine (US) positions itself to capture a larger share of the growing canned wine segment, which is increasingly favored by consumers seeking convenience.

As of October the canned wine market is witnessing trends such as digitalization, sustainability, and the integration of artificial intelligence in marketing strategies. Companies are forming strategic alliances to enhance their competitive edge, focusing on innovation and technology to meet consumer demands. The shift from price-based competition to differentiation through quality, sustainability, and supply chain reliability is becoming increasingly evident. Looking ahead, it seems that the competitive landscape will continue to evolve, with companies that prioritize innovation and consumer engagement likely to thrive.