Advancements in Data Analytics

Advancements in data analytics technologies are significantly influencing the iot operating-systems market. In Canada, organizations are increasingly recognizing the value of data generated by IoT devices, leading to a demand for operating systems that can support advanced analytics capabilities. The ability to process and analyze large volumes of data in real-time is crucial for businesses aiming to derive actionable insights. As a result, operating systems that integrate seamlessly with data analytics tools are becoming essential. The iot operating-systems market is expected to see growth as companies invest in solutions that enhance their data processing capabilities, enabling them to make informed decisions and improve operational efficiency.

Rising Demand for Smart Devices

The increasing adoption of smart devices in various sectors, including healthcare, agriculture, and manufacturing, drives the iot operating-systems market. In Canada, the number of connected devices is projected to reach 1.5 billion by 2025, indicating a robust growth trajectory. This surge in smart devices necessitates advanced operating systems that can efficiently manage and process data. As organizations seek to enhance operational efficiency and improve customer experiences, the demand for specialized iot operating-systems is likely to rise. Furthermore, the integration of these systems with existing infrastructure is crucial for seamless functionality, thereby propelling market growth. The iot operating-systems market is expected to benefit from this trend as businesses increasingly rely on interconnected devices to streamline processes and gather actionable insights.

Government Initiatives and Support

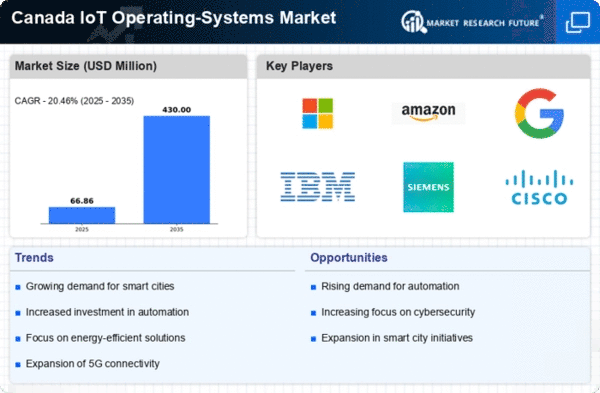

Government initiatives aimed at promoting digital transformation and smart city projects significantly impact the iot operating-systems market. In Canada, various federal and provincial programs are designed to foster innovation in technology and support the development of smart infrastructure. For instance, investments in 5G networks and funding for research and development in IoT technologies are expected to enhance connectivity and data processing capabilities. These initiatives create a conducive environment for the growth of the iot operating-systems market, as they encourage businesses to adopt advanced solutions. The Canadian government has allocated over $1 billion to support digital infrastructure, which is likely to stimulate demand for efficient operating systems tailored for IoT applications.

Growing Emphasis on Interoperability

The growing emphasis on interoperability among IoT devices is a critical driver for the iot operating-systems market. In Canada, businesses are increasingly seeking solutions that allow different devices and systems to communicate effectively. This need for interoperability is driven by the desire to create cohesive ecosystems that enhance functionality and user experience. As organizations deploy a diverse range of IoT devices, the demand for operating systems that can facilitate seamless integration and communication is likely to rise. The iot operating-systems market may experience growth as companies prioritize solutions that ensure compatibility across various platforms, ultimately leading to more efficient and effective IoT deployments.

Emergence of Industry-Specific Solutions

The emergence of industry-specific solutions tailored for various sectors is a notable driver of the iot operating-systems market. In Canada, industries such as healthcare, transportation, and energy are increasingly adopting IoT technologies to optimize operations. For example, the healthcare sector is leveraging IoT for remote patient monitoring and telemedicine, necessitating specialized operating systems that can handle sensitive data securely. The market for IoT in healthcare alone is projected to reach $10 billion by 2026, indicating a substantial opportunity for operating system providers. As industries seek customized solutions to address unique challenges, the demand for specialized iot operating-systems is likely to grow, further propelling market expansion.