- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

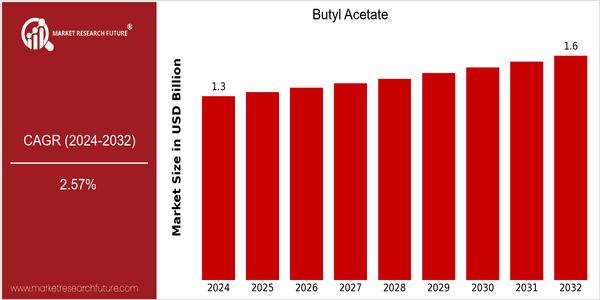

| Year | Value |

|---|---|

| 2024 | USD 1.27 Billion |

| 2032 | USD 1.55 Billion |

| CAGR (2024-2032) | 2.57 % |

Note – Market size depicts the revenue generated over the financial year

Butyl acetate is a chemical used in the manufacture of acetic acid. The market is expected to grow steadily from $1.27 billion in 2024 to $1.55 billion in 2032. The annual growth rate of the market is 2.57 percent over the forecast period. The market is growing because of the increasing demand for butyl acetate in various applications, especially in the paints, adhesives and lacquers industry where it is used as a solvent and intermediate. Butyl acetate is also used in the manufacture of other chemicals such as acetic acid. The growing demand for eco-friendly and low-VOC products has led to the development of more sustainable formulations. The growth of the construction and automobile industries will also increase the demand for butyl acetate, as these industries are increasingly using high-performance paints and adhesives. However, the main players in the market, such as BASF, Eastman, and Celanese, are engaged in strategic initiatives such as collaborations and R & D, in order to increase their product offerings and gain a larger market share. These efforts are due to the dynamic market, which is adapting to the preferences of consumers and the regulatory environment.

Regional Market Size

Regional Deep Dive

Butyl acetate is used in the manufacture of paints, lacquers, and glues, and is found in the greatest quantities in North America, Europe, and Asia-Pacific. The market is driven by a number of factors, including the growing demand for eco-friendly solvents, the regulatory push to reduce VOC emissions, and the expansion of end-use industries, such as the automotive and construction industries. Each region has its own growth potential, which is influenced by the local economy, regulations, and consumers’ preferences, which makes it essential to understand these differences to devise a successful strategy.

Europe

- In Europe, the Butyl Acetate Market is significantly influenced by the REACH regulations, which require manufacturers to ensure the safety of chemicals, leading to increased investment in research and development for safer alternatives.

- The rise of the automotive sector in Eastern Europe, particularly in countries like Poland and Hungary, is driving demand for butyl acetate in coatings and adhesives, as manufacturers seek high-performance solutions.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization, particularly in countries like China and India, which is boosting the demand for butyl acetate in various applications, including textiles and electronics.

- Innovations in production processes, such as the adoption of advanced catalytic technologies by companies like Mitsubishi Gas Chemical, are enhancing the efficiency and sustainability of butyl acetate manufacturing in the region.

Latin America

- The Latin American market is seeing a gradual increase in demand for butyl acetate, driven by the growth of the automotive and construction sectors, particularly in Brazil and Mexico.

- Local manufacturers are focusing on enhancing production capabilities and sustainability practices, with initiatives supported by government programs aimed at promoting the use of environmentally friendly chemicals.

North America

- The North American market is witnessing a shift towards sustainable practices, with companies like Eastman Chemical Company investing in bio-based butyl acetate production to meet environmental regulations and consumer demand for greener products.

- Recent regulatory changes, such as the EPA's stricter VOC emissions standards, are pushing manufacturers to innovate and develop low-emission formulations, thereby enhancing the market for butyl acetate as a safer alternative.

Middle East And Africa

- In the Middle East and Africa, the Butyl Acetate Market is being shaped by the growing construction industry, particularly in the Gulf Cooperation Council (GCC) countries, where there is a high demand for paints and coatings.

- Government initiatives aimed at diversifying economies away from oil dependency are fostering investments in chemical manufacturing, with companies like SABIC expanding their product portfolios to include butyl acetate.

Did You Know?

“Butyl acetate is not only used as a solvent but also as a flavoring agent in the food industry, where it imparts a fruity aroma, making it a versatile compound across various sectors.” — American Chemical Society

Segmental Market Size

Butyl acetate is the most important of the solvents and plays a major role in the paint, varnish and adhesive industries. The solvents market is growing steadily at the moment, and is based on the growing demand for high-quality paints and the expansion of the construction and automobile industries. The need for efficient solvents that improve the performance of products is also increasing, as is the regulatory trend towards reducing VOC emissions from industrial applications. Butyl acetate has now reached the stage of technological maturity, and is being produced in large quantities by companies such as BASF and Eastman. Its main applications are as a solvent in nail varnish removers, lacquers and inks, thereby demonstrating its versatility in a wide variety of fields. The trend towards a more sustainable approach to production and towards the use of biodegradable products is a further growth driver. This means that manufacturers are looking for alternatives that meet the required standards. However, it is the development of formulation technology that is shaping the industry’s future, enabling the development of more efficient and less harmful solvents.

Future Outlook

Butyl acetate will grow steadily from 2024 to 2032, with a CAGR of 2.5%. Butyl acetate is in great demand for its use in a variety of applications, especially in the paint, adhesive, and automobile industries. Butyl acetate is a very good solvent and has a very good environment. However, the key role of butyl acetate will be played by the development of new technology and the impact of regulations. The resulting development of the process will be conducive to the development of the market. In addition, the stricter regulations on volatile organic compounds will also push manufacturers to replace them with cleaner products, which will also increase the penetration of butyl acetate. Butyl acetate will also benefit from the increasing demand for green and biodegradable solvents, as consumers and businesses are increasingly concerned about the environment. Ultimately, butyl acetate will see a significant increase in demand and development.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.23 Billion |

| Growth Rate | 2.57% (2024-2032) |

Butyl Acetate Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.