Advancements in Implant Technology

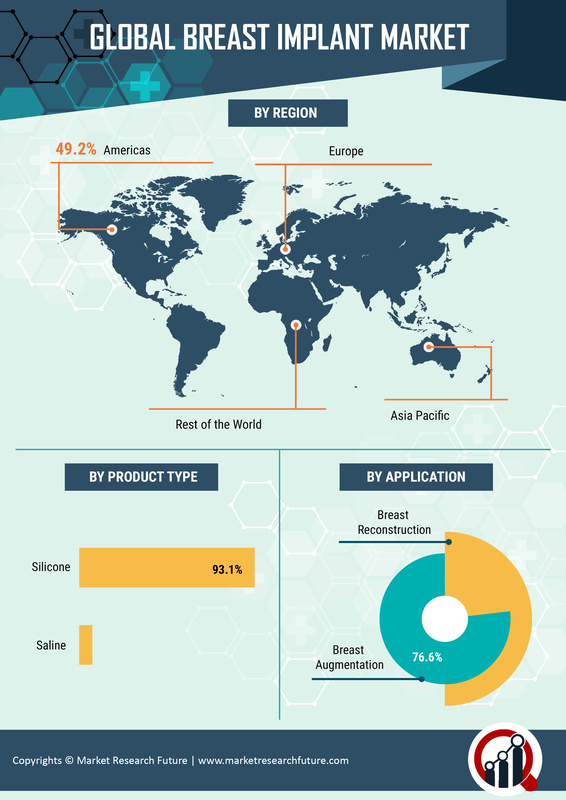

Technological innovations within the Breast Implants Market are playing a crucial role in shaping consumer preferences. Recent advancements, such as the development of cohesive gel implants and improved surgical techniques, have enhanced the safety and aesthetic outcomes of breast augmentation procedures. These innovations not only improve patient satisfaction but also reduce the risk of complications, thereby fostering greater trust in the procedures. Market data indicates that the demand for silicone implants, which are often perceived as more natural, is on the rise, accounting for a significant share of the market. As technology continues to evolve, the Breast Implants Market is expected to witness further growth driven by these enhancements.

Growing Acceptance of Cosmetic Surgery

The societal acceptance of cosmetic surgery is a pivotal driver for the Breast Implants Market. As cultural norms shift towards embracing body positivity and self-enhancement, more individuals are considering breast augmentation as a viable option. This growing acceptance is reflected in the increasing number of procedures performed annually, with estimates suggesting that millions of breast augmentations occur each year. The Breast Implants Market benefits from this trend, as more individuals view cosmetic surgery as a means of self-expression and empowerment. Furthermore, the rise of minimally invasive techniques has made these procedures more accessible, further propelling market growth.

Regulatory Support and Safety Standards

The Breast Implants Market is bolstered by regulatory support and stringent safety standards that enhance consumer confidence. Regulatory bodies are increasingly focused on ensuring the safety and efficacy of breast implants, which has led to improved product quality and patient outcomes. This regulatory framework not only protects consumers but also encourages manufacturers to innovate and adhere to high standards. As a result, the Breast Implants Market is witnessing a rise in demand for products that meet these rigorous safety criteria. Data indicates that consumers are more likely to choose implants from manufacturers that comply with established safety regulations, further driving market growth.

Increasing Awareness of Aesthetic Options

The Breast Implants Market is experiencing a notable surge in consumer awareness regarding aesthetic options. As individuals become more informed about the variety of procedures available, including breast augmentation, the demand for breast implants is likely to rise. This heightened awareness is driven by social media, celebrity endorsements, and educational campaigns that emphasize the benefits of cosmetic enhancements. According to recent data, the aesthetic procedure market is projected to grow at a compound annual growth rate of approximately 8% over the next few years. This trend suggests that as more individuals seek to enhance their appearance, the Breast Implants Market will continue to expand, catering to a diverse clientele seeking personalized solutions.

Influence of Social Media and Celebrity Culture

The impact of social media and celebrity culture on the Breast Implants Market cannot be overstated. Platforms such as Instagram and TikTok have become powerful tools for promoting aesthetic procedures, with influencers and celebrities showcasing their experiences with breast implants. This visibility not only normalizes the conversation around cosmetic surgery but also inspires potential clients to consider similar enhancements. Market analysis suggests that the visibility of breast augmentation procedures on social media correlates with increased inquiries and consultations, indicating a direct influence on consumer behavior. As this trend continues, the Breast Implants Market is likely to see sustained growth driven by social media engagement.