Technological Advancements

Rapid technological advancements in smart metering solutions are driving the Brazil smart meters market industry. Innovations such as advanced data analytics, IoT integration, and enhanced communication protocols are making smart meters more efficient and user-friendly. The introduction of smart grid technologies has enabled real-time monitoring and management of energy consumption, which is crucial for both consumers and utility providers. In 2025, it is estimated that the market for smart meters in Brazil will grow by 15% annually, largely due to these technological improvements. This trend suggests that the Brazil smart meters market industry is poised for significant growth as technology continues to evolve.

Consumer Awareness and Engagement

Consumer awareness regarding energy consumption and sustainability is on the rise in Brazil, which is positively impacting the Brazil smart meters market industry. Educational campaigns and initiatives aimed at informing the public about the benefits of smart meters are gaining traction. As consumers become more engaged in energy management, the demand for smart metering solutions is expected to increase. Surveys indicate that over 60% of Brazilian consumers are now aware of smart meters and their advantages, such as cost savings and environmental benefits. This heightened awareness is likely to drive adoption rates, further propelling the growth of the Brazil smart meters market industry.

Government Regulations and Policies

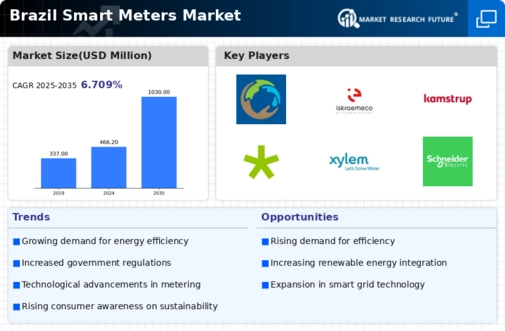

The Brazilian government has been actively promoting the adoption of smart meters through various regulations and policies. The National Electric Energy Agency (ANEEL) has established guidelines that encourage utilities to implement smart metering systems. This regulatory framework aims to enhance energy efficiency and reduce operational costs within the Brazil smart meters market industry. As of 2025, approximately 30% of Brazilian households have adopted smart meters, reflecting a growing trend towards modernization in energy management. The government's commitment to sustainability and energy conservation further supports the expansion of smart metering technologies, indicating a robust future for the Brazil smart meters market industry.

Rising Demand for Energy Efficiency

There is a growing demand for energy efficiency among Brazilian consumers and businesses, which is significantly influencing the Brazil smart meters market industry. As energy costs rise, consumers are increasingly seeking ways to monitor and reduce their energy consumption. Smart meters provide real-time data that empowers users to make informed decisions about their energy usage. According to recent studies, households equipped with smart meters have reported a reduction in energy consumption by up to 20%. This shift towards energy efficiency not only benefits consumers but also aligns with national goals for sustainable energy practices, thereby fostering growth in the Brazil smart meters market industry.

Increased Investment in Infrastructure

Investment in energy infrastructure is a critical driver for the Brazil smart meters market industry. The Brazilian government and private sector are channeling significant funds into upgrading the existing energy grid and implementing smart metering technologies. In 2025, it is projected that investments in smart grid infrastructure will exceed $1 billion, reflecting a strong commitment to modernizing energy systems. This influx of capital is expected to facilitate the widespread deployment of smart meters across urban and rural areas, enhancing energy management capabilities. Consequently, the Brazil smart meters market industry is likely to experience accelerated growth as infrastructure improvements take shape.