Advancements in Mobile Technology

The continuous advancements in mobile technology are significantly impacting the geofencing market in Brazil. With the proliferation of 5G networks and enhanced GPS capabilities, businesses are now able to implement more precise and effective geofencing solutions. The Brazilian mobile market is expected to grow by 15% annually, reaching over $20 billion by 2026. This growth facilitates the development of innovative applications that utilize geofencing for various purposes, including marketing, logistics, and customer engagement. As mobile technology evolves, the geofencing market is likely to expand, offering new opportunities for businesses to connect with consumers in real-time.

Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms in Brazil is significantly influencing the geofencing market. With the increasing number of online shoppers, businesses are leveraging geofencing technology to enhance their delivery services and improve customer experience. In 2025, the e-commerce sector in Brazil is projected to surpass $30 billion, creating a fertile ground for geofencing applications. Retailers are utilizing geofencing to send notifications about nearby stores, special offers, and delivery updates, thereby bridging the gap between online and offline shopping experiences. This integration not only boosts sales but also fosters customer loyalty, indicating a promising future for the geofencing market in the context of e-commerce.

Increased Focus on Customer Experience

In Brazil, there is a growing emphasis on enhancing customer experience, which is driving the geofencing market. Businesses are increasingly adopting geofencing solutions to create personalized experiences for their customers. By utilizing location data, companies can tailor their offerings and communications to meet the specific needs of consumers. In 2025, it is anticipated that companies investing in customer experience technologies will see a return on investment of up to 300%. This focus on customer-centric strategies is likely to lead to greater adoption of geofencing technologies, as businesses seek to differentiate themselves in a competitive market. The geofencing market is thus positioned to benefit from this trend.

Rising Demand for Location-Based Marketing

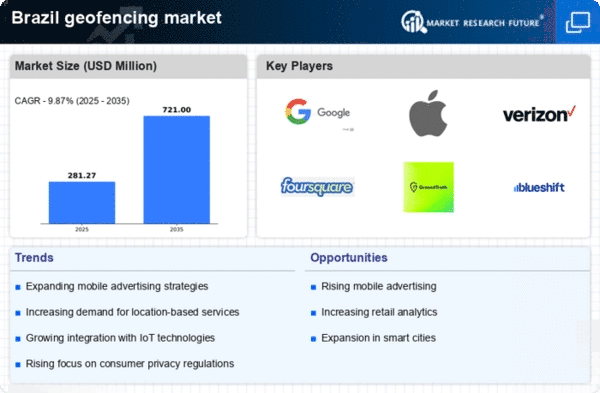

The geofencing market in Brazil is experiencing a notable surge in demand for location-based marketing strategies. Businesses are increasingly recognizing the potential of geofencing to enhance customer engagement and drive sales. In 2025, it is estimated that the market for location-based services in Brazil will reach approximately $1.5 billion, reflecting a growth rate of around 25% annually. This trend is largely driven by the proliferation of smartphones and mobile applications, which enable businesses to deliver targeted promotions and advertisements to consumers based on their real-time location. As companies seek to optimize their marketing efforts, the geofencing market is poised to play a crucial role in shaping the future of retail and advertising in Brazil.

Government Initiatives for Smart City Development

Brazil's government initiatives aimed at developing smart cities are likely to propel the geofencing market forward. As urban areas increasingly adopt smart technologies, the demand for geofencing solutions is expected to rise. The Brazilian government has allocated significant funding for smart city projects, with investments projected to reach $10 billion by 2027. These initiatives often include the implementation of geofencing for traffic management, public safety, and urban planning. By utilizing geofencing technology, municipalities can enhance service delivery and improve the quality of life for residents. This trend suggests a growing intersection between public policy and technological innovation within the geofencing market.