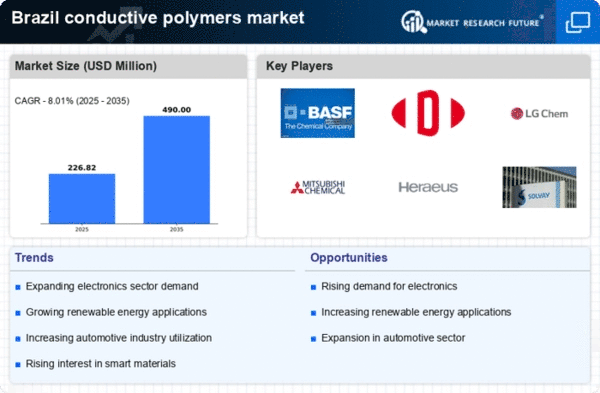

The conductive polymers market in Brazil is characterized by a dynamic competitive landscape, driven by increasing demand for advanced materials in electronics, automotive, and renewable energy sectors. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and sustainability. Companies such as BASF SE (Germany) and DuPont de Nemours Inc (US) are focusing on enhancing their product portfolios through research and development, while LG Chem Ltd (South Korea) is leveraging partnerships to strengthen its market presence. These strategies collectively contribute to a competitive environment that is increasingly oriented towards technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to reduce costs and improve supply chain efficiency. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Mitsubishi Chemical Corporation (Japan) and Solvay SA (Belgium) shapes the overall market dynamics, fostering a competitive atmosphere that encourages innovation and collaboration.

In October BASF SE (Germany) announced a strategic partnership with a local Brazilian firm to develop sustainable conductive polymer solutions tailored for the growing electric vehicle market. This collaboration is significant as it not only enhances BASF's product offerings but also aligns with Brazil's push towards greener technologies, potentially positioning the company as a leader in sustainable materials within the region.

In September DuPont de Nemours Inc (US) launched a new line of conductive polymers designed for high-performance applications in consumer electronics. This introduction is noteworthy as it reflects DuPont's commitment to innovation and its strategy to capture a larger share of the electronics market, which is expected to grow substantially in the coming years. The focus on high-performance materials may also provide a competitive edge against other players in the sector.

In August LG Chem Ltd (South Korea) expanded its production capacity for conductive polymers in Brazil, responding to the increasing demand from the renewable energy sector. This expansion is crucial as it not only enhances LG Chem's operational capabilities but also signifies the company's intent to solidify its market position amidst rising competition. The move is likely to improve supply chain reliability and reduce lead times for customers in the region.

As of November current trends in the conductive polymers market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances are becoming more prevalent, as companies recognize the need for collaboration to drive innovation and meet evolving customer demands. Looking ahead, competitive differentiation is expected to shift from price-based strategies to a focus on technological innovation, sustainability, and supply chain resilience, indicating a transformative phase in the market.