Health and Wellness Trends

The growing focus on health and wellness is emerging as a significant driver in the Brazil coffee pods capsules market. Consumers are increasingly seeking products that align with their health-conscious lifestyles, leading to a rise in demand for organic and low-calorie coffee options. Recent surveys indicate that approximately 25% of Brazilian consumers prioritize health benefits when selecting coffee products. This trend is prompting brands to innovate and introduce coffee pods infused with functional ingredients, such as vitamins and antioxidants. As health awareness continues to rise, the Brazil coffee pods capsules market is likely to adapt, offering products that cater to these evolving consumer preferences.

Expansion of Retail Channels

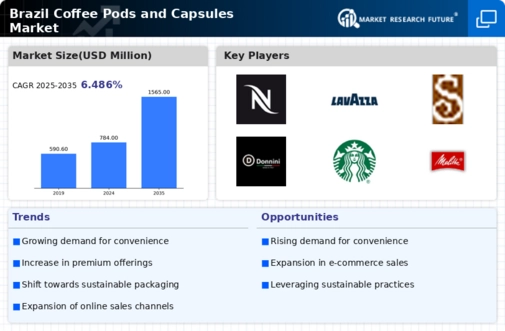

The expansion of retail channels is significantly influencing the Brazil coffee pods capsules market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, allowing consumers to access a wider variety of products. Recent data suggests that e-commerce sales of coffee pods have increased by over 20% in the past year, reflecting a shift in purchasing behavior. Retailers are also diversifying their offerings by including specialty and gourmet coffee pods, catering to the growing demand for premium products. This multi-channel approach not only enhances consumer accessibility but also fosters competition among brands, ultimately benefiting the Brazil coffee pods capsules market.

Innovations in Coffee Pod Technology

Technological advancements are playing a pivotal role in shaping the Brazil coffee pods capsules market. Innovations such as biodegradable and recyclable coffee pods are gaining traction among environmentally conscious consumers. Recent statistics indicate that around 30% of consumers in Brazil are willing to pay a premium for sustainable coffee products. Additionally, advancements in brewing technology have led to the development of machines that enhance flavor extraction and reduce brewing time. These innovations not only cater to the evolving preferences of consumers but also position brands favorably in a competitive market. As companies continue to invest in research and development, the Brazil coffee pods capsules market is poised for further growth.

Rising Consumer Demand for Convenience

The Brazil coffee pods capsules market is experiencing a notable surge in consumer demand for convenience-driven products. As urban lifestyles become increasingly fast-paced, consumers are gravitating towards coffee solutions that offer quick preparation and minimal cleanup. This trend is reflected in the growing sales of coffee pods, which have seen a year-on-year increase of approximately 15% in recent data. The appeal of single-serve coffee pods lies in their ability to deliver a consistent and high-quality coffee experience without the need for extensive brewing equipment. This shift towards convenience is likely to continue, as more consumers prioritize efficiency in their daily routines, thereby driving growth in the Brazil coffee pods capsules market.

Cultural Affinity for Coffee Consumption

Brazil's deep-rooted cultural affinity for coffee consumption serves as a fundamental driver for the Brazil coffee pods capsules market. Coffee is not merely a beverage; it is an integral part of Brazilian social life and traditions. The country is one of the largest coffee producers globally, which fosters a strong domestic market for coffee-related products. Recent statistics reveal that over 80% of Brazilians consume coffee daily, with a growing segment embracing the convenience of coffee pods. This cultural inclination towards coffee consumption, combined with the increasing availability of diverse flavors and blends, is likely to sustain the growth trajectory of the Brazil coffee pods capsules market.