Rise of Cloud-Based BPM Solutions

The Brazil business process management market is witnessing a significant shift towards cloud-based BPM solutions. The increasing adoption of cloud technology among Brazilian enterprises is driven by the need for scalability, flexibility, and cost-effectiveness. Cloud-based BPM solutions enable organizations to access their processes from anywhere, facilitating remote work and collaboration. Recent statistics indicate that over 60% of Brazilian companies are considering or have already implemented cloud-based BPM systems. This trend is further supported by the growing availability of high-speed internet and advancements in cloud infrastructure. As businesses seek to enhance their operational capabilities, the demand for cloud-based BPM solutions is expected to rise, thereby contributing to the overall growth of the business process management market in Brazil.

Digital Transformation Initiatives

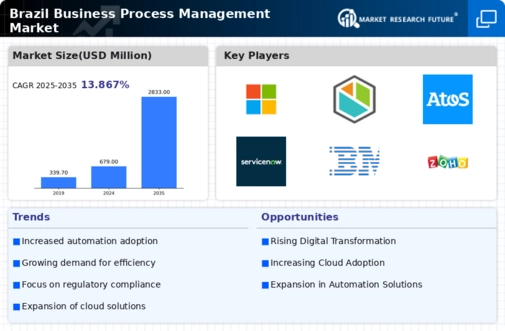

The ongoing digital transformation initiatives across Brazil are significantly influencing the business process management market. As organizations embrace digital technologies, there is a pressing need to reengineer processes to leverage these advancements effectively. The Brazilian government has been promoting digitalization through various programs, encouraging businesses to adopt innovative solutions. This shift is evident in sectors such as finance and retail, where companies are integrating BPM solutions to enhance customer experiences and operational agility. The market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years. As digital transformation continues to reshape the business landscape, the demand for BPM solutions that align with these initiatives is likely to increase.

Regulatory Compliance and Governance

In the Brazil business process management market, regulatory compliance has emerged as a critical driver. The Brazilian government has implemented stringent regulations across various sectors, necessitating organizations to adopt BPM solutions that ensure adherence to these laws. For instance, the General Data Protection Law (LGPD) mandates strict data handling practices, compelling companies to reassess their processes. BPM tools facilitate compliance by automating documentation and reporting, thereby reducing the risk of penalties. As organizations navigate the complexities of regulatory frameworks, the demand for BPM solutions that support compliance efforts is expected to grow. This trend not only enhances governance but also fosters trust among stakeholders, further propelling the business process management market in Brazil.

Focus on Customer Experience Enhancement

Enhancing customer experience has become a paramount focus for organizations within the Brazil business process management market. Companies are increasingly aware that streamlined processes directly impact customer satisfaction and loyalty. BPM solutions provide the tools necessary to analyze customer interactions and optimize service delivery. Recent surveys indicate that organizations that prioritize customer experience through BPM initiatives report a 20% increase in customer retention rates. As Brazilian consumers become more discerning, businesses are compelled to adapt their processes to meet evolving expectations. This emphasis on customer-centricity is likely to drive the adoption of BPM solutions, fostering a more responsive and agile business environment in Brazil.

Growing Demand for Operational Efficiency

The Brazil business process management market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their processes to enhance productivity and reduce costs. According to recent data, companies that have implemented business process management solutions have reported up to a 30% increase in operational efficiency. This trend is driven by the competitive landscape in Brazil, where businesses are striving to maintain a competitive edge. The adoption of BPM tools allows organizations to identify bottlenecks and optimize workflows, ultimately leading to improved service delivery and customer satisfaction. As Brazilian companies continue to prioritize efficiency, the business process management market is likely to expand, offering innovative solutions tailored to local needs.