Increased Industrial Automation

The trend towards increased industrial automation in Brazil is influencing the busbar systems market positively. As industries adopt automated processes to enhance productivity and efficiency, the demand for reliable and efficient power distribution systems rises. Busbar systems are particularly advantageous in automated environments, providing a streamlined solution for power distribution to various machinery and equipment. In 2025, the industrial automation market in Brazil is expected to grow by approximately 20%, indicating a robust demand for supporting technologies like busbar systems. This growth may encourage manufacturers to innovate and develop advanced busbar solutions tailored for automated applications. Additionally, the integration of smart technologies into busbar systems could further enhance their appeal, aligning with the broader trends of Industry 4.0 and digital transformation.

Growth of Renewable Energy Sector

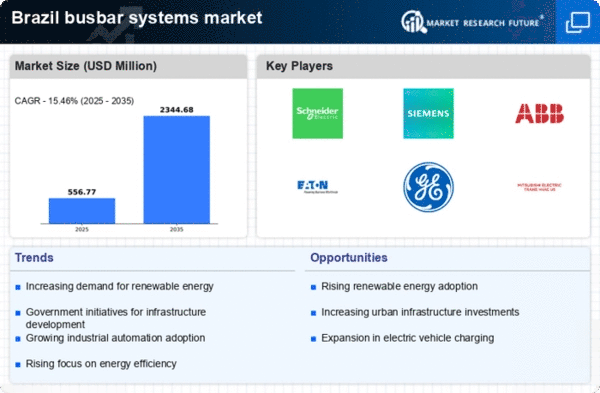

The expansion of the renewable energy sector in Brazil is a critical driver for the busbar systems market. With the country aiming to increase its renewable energy capacity, particularly in solar and wind energy, the need for efficient power distribution solutions becomes paramount. Busbar systems are well-suited for handling the variable nature of renewable energy sources, ensuring reliable power delivery. In 2025, Brazil's renewable energy capacity is projected to exceed 200 GW, representing a significant increase from previous years. This growth is likely to create substantial opportunities for busbar systems, as they are essential for connecting renewable energy installations to the grid. Furthermore, the integration of advanced technologies in busbar systems may enhance their functionality, making them more attractive to developers and operators in the renewable energy sector.

Rising Demand for Energy Efficiency

The busbar systems market in Brazil is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency. As industries and commercial establishments seek to optimize their energy consumption, busbar systems offer a compact and efficient solution for power distribution. The Brazilian government has implemented various initiatives aimed at promoting energy-efficient technologies, which further propels the adoption of busbar systems. In 2025, the energy efficiency market in Brazil is projected to grow by approximately 15%, indicating a robust opportunity for busbar systems. This trend is likely to encourage manufacturers to innovate and enhance their product offerings, thereby contributing to the overall growth of the busbar systems market. Furthermore, the integration of smart technologies into busbar systems may enhance their appeal, aligning with the broader goals of sustainability and reduced operational costs.

Infrastructure Development Initiatives

Brazil's ongoing infrastructure development initiatives significantly impact the busbar systems market. The government has prioritized investments in energy infrastructure, including the modernization of electrical grids and the expansion of renewable energy sources. These initiatives are expected to create a favorable environment for the adoption of busbar systems, which are essential for efficient power distribution in new and upgraded facilities. In 2025, Brazil's infrastructure spending is anticipated to reach $100 billion, with a substantial portion allocated to energy projects. This influx of capital is likely to stimulate demand for busbar systems, as they are integral to the efficient operation of modern electrical networks. Additionally, the focus on sustainable infrastructure development aligns with the growing trend of integrating renewable energy sources, further enhancing the relevance of busbar systems in the evolving energy landscape.

Focus on Safety and Reliability Standards

The busbar systems market in Brazil is increasingly influenced by the focus on safety and reliability standards. As industries and commercial sectors prioritize the safety of their electrical systems, the demand for high-quality busbar solutions that meet stringent safety regulations is likely to rise. The Brazilian government has established various safety standards for electrical installations, which necessitate the use of reliable busbar systems. In 2025, the market for safety-compliant electrical systems is projected to grow by 10%, indicating a strong demand for busbar systems that adhere to these standards. This trend may drive manufacturers to enhance their product offerings, ensuring compliance with safety regulations while also improving performance. Furthermore, the emphasis on safety is likely to foster consumer confidence in busbar systems, contributing to their widespread adoption across various sectors.