Growth of Electric Mobility

The growth of electric mobility in Brazil is a significant driver for the battery monitoring-system market. With the increasing adoption of electric vehicles (EVs), there is a corresponding need for sophisticated battery management systems to monitor and optimize battery performance. The Brazilian EV market is projected to reach 1 million units by 2030, driven by government initiatives and consumer demand for sustainable transportation options. This surge in electric mobility necessitates advanced battery monitoring solutions to ensure safety, efficiency, and longevity of EV batteries. Consequently, the battery monitoring-system market is poised to expand as manufacturers and fleet operators seek reliable systems to manage their battery assets effectively.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the battery monitoring-system market in Brazil. The Brazilian government has introduced various initiatives aimed at promoting the adoption of clean energy technologies, including tax breaks and subsidies for energy storage systems. These policies not only encourage investment in battery technologies but also stimulate the demand for monitoring systems that ensure optimal performance and longevity of batteries. For instance, the National Electric Energy Agency (ANEEL) has implemented regulations that support the integration of battery storage in the national grid, which is expected to drive the market growth significantly. As a result, the battery monitoring-system market is likely to benefit from these favorable regulatory frameworks.

Rising Demand for Energy Storage Solutions

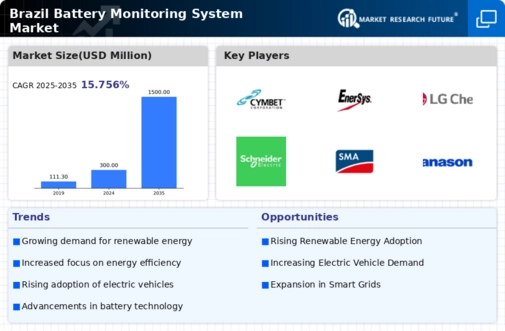

The increasing demand for energy storage solutions in Brazil is a pivotal driver for the battery monitoring-system market. As the country seeks to enhance its energy security and integrate renewable energy sources, the need for efficient battery management systems becomes paramount. The Brazilian government has set ambitious targets for renewable energy, aiming for 45% of its energy matrix to come from renewable sources by 2030. This transition necessitates advanced battery monitoring systems to optimize performance and ensure reliability. Furthermore, the energy storage market in Brazil is projected to grow at a CAGR of 20% from 2025 to 2030, indicating a robust opportunity for battery monitoring-system providers to cater to this expanding sector.

Technological Advancements in Battery Technologies

Technological advancements in battery technologies are propelling the battery monitoring-system market in Brazil. Innovations such as solid-state batteries and lithium-sulfur batteries are gaining traction, offering higher energy densities and improved safety profiles. These advancements necessitate sophisticated monitoring systems to manage the unique characteristics and performance metrics of new battery chemistries. As Brazilian companies invest in research and development to enhance battery technologies, the demand for advanced monitoring solutions is likely to increase. The battery monitoring-system market is expected to evolve in tandem with these technological innovations, providing critical data analytics and performance insights to manufacturers and end-users.

Increasing Focus on Sustainability and Environmental Regulations

The increasing focus on sustainability and environmental regulations in Brazil is driving the battery monitoring-system market. As environmental concerns rise, regulatory bodies are implementing stricter guidelines for energy efficiency and emissions reductions. This trend compels industries to adopt battery monitoring systems that not only optimize performance but also ensure compliance with environmental standards. The Brazilian government has set ambitious goals for reducing greenhouse gas emissions, which includes promoting the use of energy storage systems. Consequently, the battery monitoring-system market is likely to experience growth as companies seek solutions that align with sustainability objectives and regulatory requirements.