- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

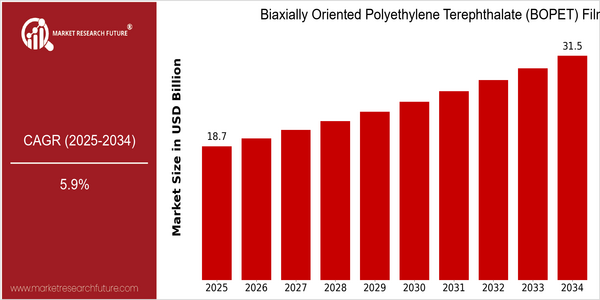

Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 18.73 Billion |

| 2034 | USD 31.46 Billion |

| CAGR (2025-2034) | 5.9 % |

Note – Market size depicts the revenue generated over the financial year

The Biaxially Oriented Polyethylene Terephthalate (BOPET) films market is poised for significant growth, with a current market size projected at USD 18.73 billion in 2025 and expected to reach USD 31.46 billion by 2034. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 5.9% over the forecast period. The increasing demand for lightweight, durable, and high-performance packaging solutions across various industries, including food and beverage, electronics, and pharmaceuticals, is a primary driver of this market expansion. Additionally, the rising trend towards sustainable packaging solutions is propelling innovations in BOPET film technologies, enhancing their appeal in environmentally conscious markets. Key players in the BOPET films sector, such as DuPont Teijin Films, Mitsubishi Polyester Film, and Toray Industries, are actively investing in research and development to enhance product performance and sustainability. Strategic initiatives, including partnerships and collaborations aimed at developing advanced BOPET film applications, are also contributing to market growth. For instance, recent product launches focusing on biodegradable and recyclable BOPET films are indicative of the industry's shift towards sustainability, aligning with consumer preferences and regulatory pressures. As these trends continue to evolve, the BOPET films market is expected to maintain its upward momentum, driven by innovation and a commitment to meeting diverse industry needs.

Regional Market Size

Regional Deep Dive

The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market is experiencing significant growth across various regions, driven by increasing demand in packaging, electronics, and automotive applications. In North America, the market is characterized by a strong emphasis on sustainability and innovation, with companies focusing on developing eco-friendly BOPET films. Europe showcases a robust regulatory framework that promotes the use of recyclable materials, while the Asia-Pacific region is witnessing rapid industrialization and urbanization, leading to heightened demand for BOPET films. The Middle East and Africa are gradually adopting BOPET films, influenced by growing packaging needs, and Latin America is seeing a rise in consumer goods packaging, further propelling market growth.

Europe

- The European Union's Circular Economy Action Plan is driving the adoption of recyclable BOPET films, with companies like Treofan and Klöckner Pentaplast leading the charge in developing sustainable products.

- Recent innovations in BOPET film technology, such as the introduction of thinner films with enhanced barrier properties, are being spearheaded by firms like Uflex and Jindal Poly Films.

Asia Pacific

- China's rapid industrial growth has led to increased demand for BOPET films in packaging and electronics, with major players like Sinopec and Jiangsu Shuangxing Color Plastic New Materials Co. expanding their production capacities.

- India's push towards 'Make in India' is fostering local manufacturing of BOPET films, with companies like Polyplex Corporation investing in state-of-the-art production facilities.

Latin America

- Brazil's growing consumer market is driving demand for BOPET films in food packaging, with companies like Amcor and Constantia Flexibles expanding their operations in the region.

- Regulatory changes in Argentina aimed at reducing plastic waste are pushing manufacturers to explore BOPET films as a more sustainable alternative for packaging.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new regulations aimed at reducing plastic waste, prompting BOPET manufacturers to innovate in producing biodegradable films.

- Companies like DuPont and Mitsubishi Polyester Film are investing in R&D to create high-performance BOPET films that cater to the growing demand for sustainable packaging solutions.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting sustainable packaging solutions, encouraging local manufacturers to adopt BOPET films for various applications.

- Companies like Al Ghurair and Jindal Films are establishing partnerships to enhance the production and distribution of BOPET films in the region, responding to the growing demand in the packaging sector.

Did You Know?

“BOPET films are known for their excellent tensile strength and dimensional stability, making them a preferred choice in various applications, including high-end packaging and electronics.” — Plastics Industry Association

Segmental Market Size

The Biaxially Oriented Polyethylene Terephthalate (BOPET) films segment plays a crucial role in the packaging and electronics industries, currently experiencing stable growth. Key drivers of demand include the increasing need for lightweight, durable packaging solutions and the rising adoption of flexible packaging formats. Additionally, regulatory policies favoring recyclable materials are pushing manufacturers to explore BOPET films as a sustainable alternative. Currently, the adoption of BOPET films is in a mature stage, with companies like DuPont and Mitsubishi Polyester Film leading in production and innovation. Primary applications include food packaging, where BOPET films enhance shelf life, and in the electronics sector for insulation and protective layers. Trends such as sustainability initiatives and the shift towards eco-friendly materials are accelerating growth, while advancements in coating technologies and production methods are shaping the segment's evolution. Overall, BOPET films are positioned to meet the evolving demands of various industries, driven by technological advancements and changing consumer preferences.

Future Outlook

The Biaxially Oriented Polyethylene Terephthalate (BOPET) films market is poised for significant growth from 2025 to 2034, with a projected market value increase from $18.73 billion to $31.46 billion, reflecting a robust compound annual growth rate (CAGR) of 5.9%. This growth trajectory is underpinned by the rising demand for lightweight, high-strength packaging solutions across various industries, including food and beverage, electronics, and pharmaceuticals. As sustainability becomes a critical focus, BOPET films, known for their recyclability and lower environmental impact compared to alternative materials, are expected to gain further traction in eco-conscious markets. By 2034, the penetration of BOPET films in packaging applications is anticipated to reach approximately 40%, driven by innovations in film technology and enhanced barrier properties that extend product shelf life. Key technological advancements, such as the development of high-performance BOPET films with improved thermal stability and optical clarity, will play a pivotal role in shaping the market landscape. Additionally, regulatory policies promoting the use of sustainable materials are likely to accelerate the adoption of BOPET films, particularly in regions with stringent environmental regulations. Emerging trends, including the integration of smart packaging solutions and the increasing use of BOPET films in the electronics sector for flexible displays and solar panels, will further bolster market growth. As the industry evolves, stakeholders must remain agile to capitalize on these opportunities and navigate the challenges posed by fluctuating raw material prices and competition from alternative materials.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.93% (2024-2032) |

Biaxially Oriented Polyethylene Terephthalate BOPET Films Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.