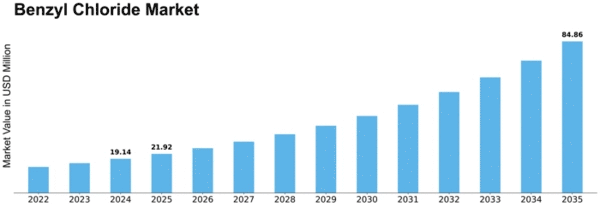

Benzyl Chloride Size

Benzyl Chloride Market Growth Projections and Opportunities

The market factors influencing the Benzyl Chloride market are diverse and multifaceted, shaping the dynamics of supply, demand, and pricing within this chemical sector. One of the primary factors impacting the Benzyl Chloride market is its wide range of industrial applications. Benzyl Chloride serves as a crucial intermediate in the production of various chemicals such as benzyl alcohol, benzyl cyanide, and benzylamine, which find utility in industries like pharmaceuticals, agrochemicals, and fragrance manufacturing. Consequently, fluctuations in demand from these downstream industries significantly influence the Benzyl Chloride market.

Moreover, regulatory frameworks play a pivotal role in shaping the market landscape of Benzyl Chloride. Environmental regulations, safety standards, and chemical handling protocols imposed by regulatory authorities have a direct impact on the production, distribution, and usage of Benzyl Chloride. Compliance with these regulations not only affects the cost structure of Benzyl Chloride manufacturers but also influences market accessibility and competitiveness.

The odor threshold might also vary for the element greatly! Therefore, one should not rely upon just the odor for identifying whether the portion of benzyl chloride is hazardous or not.

Global economic conditions also exert a considerable influence on the Benzyl Chloride market. Economic growth, consumer spending patterns, and investment trends impact the demand for products derived from Benzyl Chloride. For instance, during periods of economic expansion, there tends to be an increased demand for pharmaceuticals, cosmetics, and other consumer goods, consequently driving the demand for Benzyl Chloride as a key ingredient in their production.

Technological advancements and innovations also shape the Benzyl Chloride market. Improvements in manufacturing processes, development of novel applications, and advancements in purification techniques can enhance the efficiency of Benzyl Chloride production, thereby influencing market dynamics. Additionally, technological innovations may lead to the discovery of new applications for Benzyl Chloride, further expanding its market potential.

The availability and pricing of raw materials crucial for Benzyl Chloride production are significant market factors. Benzyl Chloride is primarily synthesized from benzyl alcohol and hydrochloric acid, among other raw materials. Fluctuations in the prices of these inputs, as well as their availability, impact the overall cost structure of Benzyl Chloride production. Supply chain disruptions, geopolitical tensions, and natural disasters can also affect the availability and pricing of raw materials, thereby influencing Benzyl Chloride market dynamics.

Market competition is another critical factor driving the Benzyl Chloride market. The presence of multiple manufacturers, varying production capacities, and competitive pricing strategies contribute to market dynamics. Factors such as product quality, reliability, and customer service play essential roles in determining the market share of Benzyl Chloride manufacturers. Additionally, mergers, acquisitions, and strategic alliances among industry players can reshape the competitive landscape and influence market trends.

Environmental and sustainability concerns are increasingly shaping the Benzyl Chloride market. With growing awareness about environmental pollution and the need for sustainable practices, there is a rising demand for eco-friendly alternatives and cleaner production methods within the chemical industry. Manufacturers are thus under pressure to adopt greener technologies, reduce emissions, and minimize waste generation, which can impact the market dynamics of Benzyl Chloride.

Lastly, geopolitical factors and trade policies can significantly influence the Benzyl Chloride market. Tariffs, trade agreements, and diplomatic relations between countries can affect the import and export of Benzyl Chloride, thereby impacting market supply and pricing dynamics. Moreover, geopolitical tensions or conflicts in regions with significant Benzyl Chloride production or consumption can disrupt supply chains and influence market stability.

Leave a Comment