- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

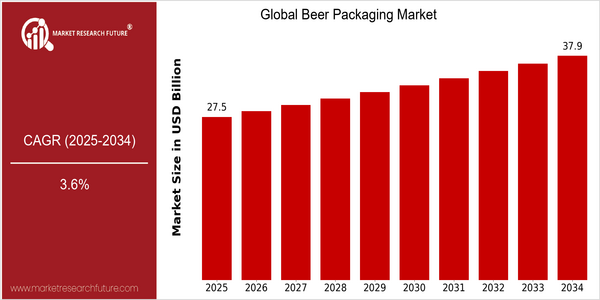

| Year | Value |

|---|---|

| 2025 | USD 27.49 Billion |

| 2034 | USD 37.86 Billion |

| CAGR (2025-2034) | 3.6 % |

Note – Market size depicts the revenue generated over the financial year

The beer-packaging market is destined to grow steadily, with the market size reaching $37.86 billion in 2034 from $27.49 billion in 2025. The growth rate is 3.6%. The reasons for the market growth are many, including the growing demand for craft beers, which often require new and sustainable packaging, and the growing demand for environmentally friendly materials. Also, technological developments in the area of lightweight materials and smart packaging, which improve the shelf life of products and consumer engagement, will further drive the market. The leading beer-packaging companies, such as Ball, Crown Holdings, and Amcor, are actively investing in R & D to develop more efficient and sustainable packaging. Strategic alliances with breweries and investments in sustainable materials will also affect the market. Ball, for example, is committed to producing 100% recyclability of aluminum cans. These developments will continue, and the beer-packaging market will continue to grow, following changes in consumer behavior and technological developments.

Regional Market Size

Regional Deep Dive

The beer packaging market is characterized by the diverse nature of the regions, influenced by local preferences, regulatory conditions and economic conditions. In North America, the market is characterized by a strong craft beer culture and an increasing demand for sustainable packaging solutions. In Europe, the mixture of traditional and new packaging methods is gaining ground. In Asia-Pacific, the market is growing rapidly due to the rise in income and the changing consumption patterns. The Middle East and Africa represent special opportunities and challenges, with different market maturity and regulatory conditions. In Latin America, there is a shift from traditional to modern packaging, mainly due to urbanization and changing preferences.

Europe

- The European market is increasingly focusing on circular economy principles, with initiatives from organizations like the European Commission promoting the use of recyclable and reusable packaging materials.

- Innovations in lightweight packaging technologies are being spearheaded by companies such as Amcor and Ardagh Group, which are developing solutions that reduce carbon footprints and improve logistics efficiency.

Asia Pacific

- Rapid urbanization and a growing middle class in countries like China and India are driving demand for convenient and premium packaging solutions, with local companies like O-I Glass adapting to these trends.

- The rise of e-commerce in the region is prompting breweries to invest in packaging that ensures product safety during transit, leading to innovations in tamper-proof and durable packaging designs.

Latin America

- The Latin American market is seeing a shift towards modern packaging technologies, with companies like Grupo Modelo investing in advanced packaging solutions to meet the demands of urban consumers.

- Government initiatives aimed at reducing plastic waste are encouraging breweries to explore biodegradable and recyclable packaging alternatives, which is expected to reshape the competitive landscape.

North America

- The craft beer movement in North America has led to a surge in demand for unique and sustainable packaging options, with companies like Ball Corporation and Crown Holdings investing in innovative solutions to cater to this trend.

- Regulatory changes in several states are promoting the use of recyclable materials, pushing breweries to adopt eco-friendly packaging practices, which is expected to enhance brand loyalty among environmentally conscious consumers.

Middle East And Africa

- In the Middle East, cultural factors and regulatory restrictions on alcohol consumption are shaping the market, with companies like Al Ahram Beverages adapting their packaging strategies to cater to local preferences.

- The African market is witnessing a rise in local breweries, which are increasingly focusing on affordable and sustainable packaging options to attract price-sensitive consumers.

Did You Know?

“In Europe, approximately 70% of beer packaging is recycled, making it one of the highest recycling rates for beverage containers globally.” — European Commission

Segmental Market Size

The world beer packaging market is currently growing at a steady pace, primarily due to the rising demand for sustainable and inventive packaging solutions. The use of eco-friendly materials and the need to increase the shelf life of beer are the main factors driving the growth of this market. Moreover, the increasing regulatory focus on the use of recycled materials and the environment is further increasing the demand for such materials, as brands seek to comply with the wishes of consumers and meet the required standards. Today, the use of sustainable packaging solutions is in a mature stage, with the leading companies in this area being AB InBev and Heineken. The most common forms of beer packaging are bottles, cans, and kegs. Notable examples of new beer packaging solutions include aluminum cans, which are lightweight, re-usable, and lightweight. The shift towards sustainable packaging and the government’s restrictions on the use of plastics are also driving the growth of this segment. In addition, digital printing and smart packaging are influencing the development of beer packaging, as they help to increase the level of consumer engagement and to optimize the production process.

Future Outlook

The beer cans market is expected to grow steadily from 2025 to 2034, with a projected market value increase from $27.49 billion to $37.86 billion, at a CAGR of 3.6%. This growth is driven by rising beer consumption, especially in emerging markets, where changing consumer preferences are driving demand for diverse packaging solutions. As a result, a significant shift towards eco-friendly packaging solutions, such as biodegradable plastics and recycled materials, is expected to be witnessed by 2034. Also, technological developments will play a crucial role in shaping the future of beer cans. Smart packaging, for example, is expected to become more popular as it enhances the consumer experience and optimizes the supply chain. Moreover, government regulations that aim to reduce the industry’s carbon footprint will further encourage the uptake of sustainable solutions. By 2034, it is expected that sustainable packaging solutions will account for more than 40% of the beer cans market, indicating a significant shift in priorities among consumers and producers. The beer cans market will be a strong growth driver in the next 10 years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 24.7 Billion |

| Market Size Value In 2023 | USD 25.6 Billion |

| Growth Rate | 3.6% (2023-2032) |

Beer Packaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.