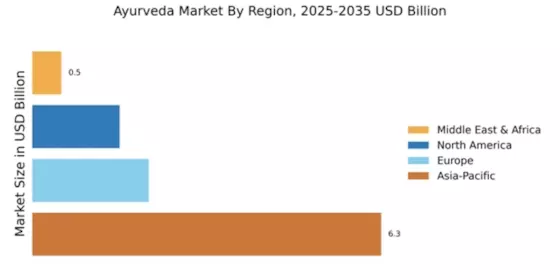

North America : Growing Interest in Ayurveda

The North American Ayurveda market is witnessing significant growth, driven by increasing consumer awareness of natural health products and holistic wellness. With a market size of $1.59 billion, the region is experiencing a shift towards alternative medicine, supported by favorable regulations and a growing trend of preventive healthcare. Ayurvedic medicines in USA are increasingly found in mainstream pharmacies as consumers seek out natural alternatives.

The demand for Ayurveda in USA further fueled by the rising prevalence of chronic diseases and the desire for organic and natural solutions. The competitive landscape is characterized by a mix of established brands and emerging startups focusing on Ayurvedic formulations. The market is also supported by a growing number of wellness centers and online platforms promoting Ayurvedic products, enhancing accessibility for consumers.

Europe : Emerging Market for Ayurveda

Europe is emerging as a significant market for Ayurveda, with a market size of €1.8 billion. The growth is driven by rising health consciousness among consumers and a shift towards natural and organic products. Regulatory support for herbal medicines and dietary supplements is fostering a conducive environment for Ayurvedic brands.

The increasing popularity of wellness tourism and holistic health practices is also contributing to market expansion, as consumers seek alternative therapies for health and wellness. Countries like Germany, the UK, and France are leading the way in adopting Ayurvedic practices. The competitive landscape features key players such as Dabur India and Baidyanath, alongside local brands that cater to the growing demand for Ayurvedic products. The presence of wellness retreats and holistic health centers further enhances the market, providing consumers with direct access to Ayurvedic treatments and products.

Asia-Pacific : Dominant Market Leader

Asia-Pacific is the dominant region in the Ayurveda market, boasting a substantial market size of $7.0 billion. The region's growth is propelled by a rich cultural heritage of traditional medicine, increasing health awareness, and a rising preference for natural remedies. Regulatory frameworks in countries like India support the promotion of Ayurvedic practices, further driving market expansion. Ayurvedic Products from India stands out as India is among the leading countries in this market, with key players such as Patanjali Ayurved, Himalaya Wellness, and Dabur India leading the charge. High-quality ayurvedic products from India are dominating international exports thanks to new government quality certification programs. The competitive landscape is vibrant, with numerous local brands and startups emerging to cater to the increasing demand for Ayurvedic products. The presence of educational institutions and research centers dedicated to Ayurveda also bolsters the market, ensuring a steady supply of innovative products and services.

Middle East and Africa : Niche Market Potential

The Middle East and Africa region represents a niche market for Ayurveda, with a market size of $0.2 billion. Growth in this region is gradual, driven by increasing awareness of alternative medicine and the rising popularity of natural health products. Regulatory bodies are beginning to recognize the potential of Ayurvedic practices, which may lead to more supportive policies in the future. The demand for holistic health solutions is slowly gaining traction among consumers seeking alternatives to conventional medicine.

Countries like South Africa and the UAE are showing interest in Ayurvedic products, with a few local players beginning to emerge. However, the competitive landscape remains limited compared to other regions. Key players from India are exploring opportunities to enter this market, aiming to educate consumers about the benefits of Ayurveda and expand their reach through partnerships with local distributors and wellness centers.