- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

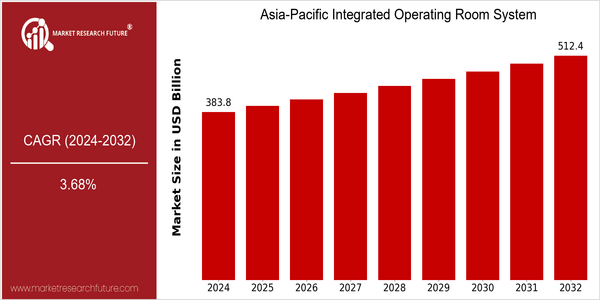

| Year | Value |

|---|---|

| 2024 | USD 383.82 Billion |

| 2032 | USD 512.4 Billion |

| CAGR (2024-2032) | 3.68 % |

Note – Market size depicts the revenue generated over the financial year

The Asia-Pacific Integrated Operating Room System Market is poised for significant growth, with a current market size of USD 383.82 billion in 2024, projected to reach USD 512.4 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.68% over the forecast period. The increasing demand for advanced surgical procedures, coupled with the rising prevalence of chronic diseases, is driving the adoption of integrated operating room systems, which enhance surgical efficiency and patient outcomes. Technological advancements, such as the integration of robotics, artificial intelligence, and real-time data analytics, are pivotal in propelling market growth. These innovations not only streamline surgical workflows but also improve precision and safety in operations. Key players in the market, including Siemens Healthineers, GE Healthcare, and Philips, are actively investing in research and development, forming strategic partnerships, and launching new products to capitalize on these trends. For instance, recent collaborations aimed at enhancing interoperability between surgical devices and hospital information systems are indicative of the industry's focus on creating more cohesive and efficient operating environments.

Regional Market Size

Regional Deep Dive

The Asia-Pacific Integrated Operating Room System Market is characterized by rapid technological advancements and increasing demand for efficient surgical environments. The region is witnessing a surge in healthcare investments, driven by a growing population, rising prevalence of chronic diseases, and a shift towards minimally invasive surgeries. Additionally, the integration of advanced technologies such as robotics, artificial intelligence, and telemedicine is reshaping the operating room landscape, enhancing surgical outcomes and operational efficiency. The market is further supported by government initiatives aimed at improving healthcare infrastructure and increasing access to advanced surgical technologies.

Europe

- The European Union has launched initiatives to standardize surgical equipment, which is expected to drive the adoption of integrated operating room systems across member states.

- Companies such as Siemens Healthineers and Philips are leading the way in developing smart operating room technologies that incorporate real-time data analytics to optimize surgical procedures.

Asia Pacific

- Countries like Japan and South Korea are at the forefront of adopting advanced integrated operating room systems, with significant investments from both the public and private sectors to modernize healthcare facilities.

- The Indian government has introduced programs to enhance healthcare infrastructure, which includes the integration of advanced surgical technologies in public hospitals, thereby increasing access to high-quality surgical care.

Latin America

- Brazil is seeing a rise in partnerships between local hospitals and international technology firms to implement integrated operating room systems, enhancing surgical capabilities.

- Regulatory bodies in Argentina are streamlining approval processes for advanced surgical technologies, encouraging faster adoption of integrated operating room systems.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines for surgical devices, promoting the adoption of integrated operating room systems that enhance patient safety and surgical precision.

- Key players like Stryker Corporation and Medtronic are investing heavily in R&D to develop innovative integrated solutions that streamline surgical workflows and improve patient outcomes.

Middle East And Africa

- The UAE is investing in smart healthcare initiatives, including integrated operating room systems, as part of its Vision 2021 strategy to enhance healthcare services.

- Organizations like the Saudi Arabian Ministry of Health are implementing advanced surgical technologies in hospitals to improve surgical outcomes and patient care.

Did You Know?

“Did you know that the Asia-Pacific region is projected to have the highest growth rate in the adoption of integrated operating room systems due to its rapidly evolving healthcare infrastructure?” — Market Research Future

Segmental Market Size

The Asia-Pacific Integrated Operating Room System Market is experiencing robust growth, driven by the increasing demand for advanced surgical solutions that enhance operational efficiency and patient outcomes. Key factors propelling this segment include the rising prevalence of chronic diseases necessitating surgical interventions, along with the push for minimally invasive procedures that require sophisticated operating room technologies. Additionally, regulatory policies promoting the adoption of digital health solutions further stimulate market demand. Currently, the adoption stage of integrated operating room systems is transitioning from pilot phases to scaled deployment, with countries like Japan and South Korea leading in implementation. Notable companies such as Siemens Healthineers and Philips are at the forefront, providing innovative solutions that integrate imaging, surgical instruments, and data management. Primary applications include complex surgeries in cardiology and orthopedics, where real-time data and imaging are critical. Trends such as the COVID-19 pandemic have accelerated the shift towards remote monitoring and tele-surgery, while sustainability initiatives are driving the development of energy-efficient operating room technologies, shaping the future landscape of this segment.

Future Outlook

The Asia-Pacific Integrated Operating Room System market is poised for significant growth from 2024 to 2032, with a projected market value increase from $383.82 million to $512.4 million, reflecting a compound annual growth rate (CAGR) of 3.68%. This growth trajectory is underpinned by the increasing demand for advanced surgical solutions that enhance operational efficiency and patient outcomes. As healthcare facilities continue to adopt integrated systems that streamline workflows and improve communication among surgical teams, penetration rates are expected to rise, with an estimated 25% of operating rooms in major hospitals adopting integrated systems by 2032. Key technological drivers, such as the advancement of robotic-assisted surgery, augmented reality, and artificial intelligence, are expected to play a pivotal role in shaping the market landscape. These innovations not only enhance surgical precision but also facilitate better training and simulation for medical professionals. Additionally, supportive government policies aimed at improving healthcare infrastructure and increasing investments in surgical technologies will further accelerate market growth. Emerging trends, including the shift towards minimally invasive procedures and the growing emphasis on patient safety and satisfaction, will also contribute to the increasing adoption of integrated operating room systems across the Asia-Pacific region.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 363.1311billion Billion |

| Growth Rate | 5.7% (2023-2032) |

Asia-Pacific Integrated Operating Room Systems Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.