Aroma Chemicals Size

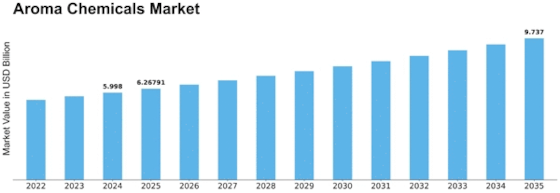

Aroma Chemicals Market Growth Projections and Opportunities

The aroma chemical substances market is the situation to a myriad of things that collectively shape its trajectory, influencing demand, innovation, and normal growth within the fragrance and taste enterprise. Consumer options for particular scents and evolving perfume trends have a profound impact on the aroma chemical compounds marketplace. The demand for unique and novel fragrance reports shapes the development and adoption of new aroma chemicals to meet changing customer expectations. The aroma chemicals market is intently tied to the cosmetics and personal care enterprise. Aroma chemical compounds are crucial components within the flavor enterprise, influencing flavor and aroma profiles in meals and liquids. The preference between herbal and synthetic aroma chemical substances is a defining aspect within the marketplace. Consumer preferences for natural ingredients and the industry's dedication to sustainability contribute to the developing demand for herbal aroma chemical substances. Compliance with regulatory standards and safety considerations is essential. Ongoing technological advancements impact manufacturing procedures within the aroma chemical substances marketplace. Emerging markets and globalization affect the aroma chemical compounds marketplace. As patron markets enlarge globally, there is an extended demand for diverse and culturally applicable fragrances, influencing the varieties of aroma chemical compounds in demand. The COVID-19 pandemic has altered perfume alternatives and consumption styles. Research and development initiatives are pivotal for riding innovation in aroma chemicals. The marketplace responds to improvements in the expertise of olfactory science, mainly to the invention of recent aroma compounds and stepped-forward manufacturing methods. Brand alternatives and advertising and marketing techniques play a position in shaping the aroma chemicals market. Companies collaborate with perfumers and flavorists to create signature scents, and advertising and marketing efforts have an impact on the popularity and call for precise aroma chemical substances. The rise of e-trade and direct-to-customer developments has implications for the aroma chemical compounds marketplace. The presentation and packaging of fragrance products notably affect consumer perceptions.

Leave a Comment