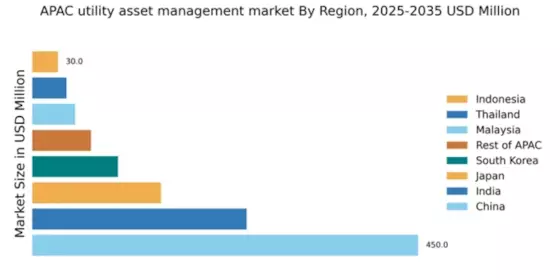

China : Rapid Growth and Innovation Hub

China holds a commanding market share of 45% in the APAC utility asset-management sector, valued at $450.0 million. Key growth drivers include robust government initiatives aimed at smart grid development and renewable energy integration. Demand trends show a shift towards digital solutions, with increasing consumption of IoT technologies. Regulatory policies, such as the 13th Five-Year Plan, emphasize sustainable energy practices, while significant infrastructure investments bolster industrial development.

India : Investment in Infrastructure and Technology

India's utility asset-management market is valued at $250.0 million, representing 25% of the APAC market. The sector is driven by increasing urbanization and government initiatives like the Smart Cities Mission. Demand for efficient energy management solutions is rising, supported by regulatory frameworks promoting renewable energy. The industrial sector is also expanding, creating a favorable environment for utility management solutions.

Japan : Focus on Sustainability and Efficiency

Japan's market, valued at $150.0 million, accounts for 15% of the APAC utility asset-management sector. Key growth drivers include a strong emphasis on sustainability and energy efficiency, supported by government policies like the Energy Efficiency Act. Demand for advanced technologies, such as AI and big data analytics, is increasing. The market is characterized by a mature infrastructure and a focus on renewable energy sources.

South Korea : Smart Technologies Driving Growth

South Korea's utility asset-management market is valued at $100.0 million, representing 10% of the APAC market. The growth is fueled by government initiatives promoting smart grid technologies and energy efficiency. Demand for integrated solutions is rising, particularly in urban areas. The competitive landscape features major players like Siemens and Schneider Electric, focusing on innovative technologies and solutions.

Malaysia : Investment in Energy Management

Malaysia's market is valued at $50.0 million, accounting for 5% of the APAC utility asset-management sector. Key growth drivers include increasing energy consumption and government policies supporting renewable energy. Demand for smart solutions is on the rise, particularly in urban centers like Kuala Lumpur. The competitive landscape includes local and international players, focusing on energy efficiency and sustainability.

Thailand : Focus on Renewable Energy Initiatives

Thailand's utility asset-management market is valued at $40.0 million, representing 4% of the APAC market. The sector is driven by government initiatives promoting renewable energy and energy efficiency. Demand for innovative solutions is increasing, particularly in urban areas. The competitive landscape features both local and international players, with a focus on sustainable practices and smart technologies.

Indonesia : Investment in Infrastructure Development

Indonesia's market is valued at $30.0 million, accounting for 3% of the APAC utility asset-management sector. Key growth drivers include increasing energy demand and government initiatives aimed at infrastructure development. Demand for efficient energy management solutions is rising, particularly in major cities like Jakarta. The competitive landscape is evolving, with both local and international players entering the market.

Rest of APAC : Varied Market Dynamics and Growth

The Rest of APAC market is valued at $68.5 million, representing 6.5% of the overall utility asset-management sector. Growth is driven by diverse regional needs and varying regulatory frameworks. Demand for utility management solutions is increasing across different sectors, including manufacturing and services. The competitive landscape features a mix of local and international players, adapting to regional market dynamics.