Focus on Environmental Sustainability

The emphasis on environmental sustainability in APAC is becoming a significant driver for the composite repair market. As industries strive to reduce their carbon footprint, the use of composite materials, which are often more sustainable than traditional materials, is on the rise. The composite repair market is likely to benefit from this focus, as repairing existing composite structures is often more environmentally friendly than replacing them. In 2025, it is estimated that the market for sustainable repair solutions will grow by 20%, driven by regulatory pressures and consumer demand for eco-friendly practices. This shift towards sustainability not only aligns with The composite repair market as a key player in the transition towards greener practices in various sectors.

Growing Demand for Lightweight Materials

The increasing demand for lightweight materials across various industries in APAC is a crucial driver for the composite repair market. Industries such as automotive, aerospace, and construction are increasingly adopting composite materials due to their superior strength-to-weight ratio. This trend is expected to propel the composite repair market as manufacturers seek efficient repair solutions for these materials. In 2025, the automotive sector alone is projected to account for approximately 30% of the composite repair market, driven by the need for fuel-efficient vehicles. Furthermore, the aerospace industry is anticipated to grow at a CAGR of 5% from 2025 to 2030, further boosting the demand for composite repair solutions. As companies strive to enhance performance while reducing weight, the composite repair market is likely to experience significant growth.

Technological Innovations in Repair Techniques

Technological innovations in repair techniques are emerging as a vital driver for the composite repair market in APAC. Advancements in repair technologies, such as the use of advanced adhesives and automated repair systems, are enhancing the efficiency and effectiveness of composite repairs. The composite repair market is likely to benefit from these innovations, as they reduce repair times and costs while improving the quality of repairs. For instance, the introduction of robotic systems for composite repairs is expected to streamline processes and minimize human error. As industries increasingly adopt these technologies, the market is projected to grow, with an estimated increase of 15% in the adoption of advanced repair techniques by 2027. This trend suggests a promising future for the composite repair market.

Increased Investment in Infrastructure Development

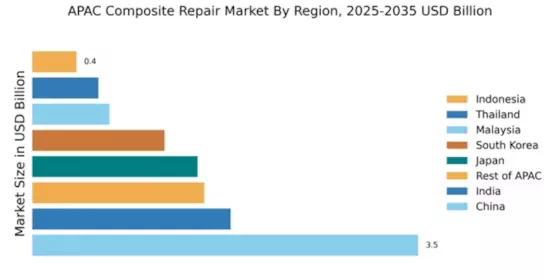

The ongoing infrastructure development projects across APAC are likely to serve as a significant driver for the composite repair market. Governments in countries such as India, China, and Japan are investing heavily in infrastructure, including bridges, roads, and buildings, which often utilize composite materials for their durability and strength. The composite repair market is expected to benefit from this trend, as the need for maintenance and repair of these structures will rise. For instance, the Indian government has allocated approximately $1 trillion for infrastructure development by 2025, which could lead to a substantial increase in the demand for composite repair solutions. This investment not only enhances the longevity of infrastructure but also creates opportunities for companies specializing in composite repair.

Rising Awareness of Maintenance and Repair Solutions

There is a growing awareness among industries in APAC regarding the importance of maintenance and repair solutions for composite materials. As companies recognize the benefits of timely repairs, the composite repair market is likely to see increased demand. This awareness is particularly evident in sectors such as marine and wind energy, where composite materials are extensively used. The marine industry, for example, is projected to grow at a CAGR of 4% from 2025 to 2030, leading to a heightened focus on repair solutions to extend the lifespan of vessels. Additionally, the wind energy sector is expected to invest around $100 billion in maintenance and repair by 2025, further driving the composite repair market. This trend indicates a shift towards proactive maintenance strategies, which could significantly impact the market.