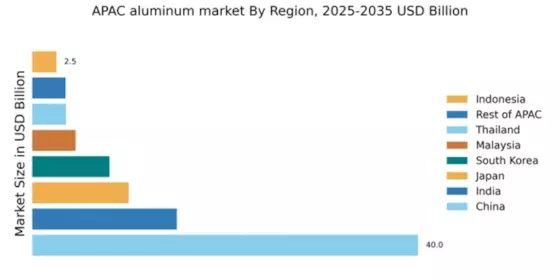

China : Unmatched Market Share and Growth

China holds a commanding 40.0% share of the APAC aluminum market, valued at approximately $XX billion. Key growth drivers include robust industrial demand, particularly in construction and automotive sectors, alongside government initiatives promoting sustainable practices. The country is witnessing a shift towards recycled aluminum, supported by regulatory policies aimed at reducing carbon emissions. Infrastructure development, especially in urban areas, is further fueling consumption patterns.

India : Strong Growth and Demand Trends

India accounts for 15.0% of the APAC aluminum market, with a value of around $XX billion. The growth is driven by increasing demand in the automotive and packaging sectors, supported by government initiatives like the National Aluminium Policy. Consumption patterns are shifting towards lightweight materials, enhancing efficiency. Infrastructure projects, including smart cities, are also boosting demand for aluminum products.

Japan : High-Quality Production Standards

Japan holds a 10.0% share of the APAC aluminum market, valued at approximately $XX billion. The market is driven by technological advancements in manufacturing processes and a strong focus on high-quality products. Demand is particularly strong in the electronics and automotive sectors, with government policies promoting innovation and sustainability. The country is also investing in recycling initiatives to enhance resource efficiency.

South Korea : Focus on High-Tech Applications

South Korea represents 8.0% of the APAC aluminum market, valued at around $XX billion. Key growth drivers include the demand for lightweight materials in the automotive and aerospace industries, supported by government initiatives for technological advancement. The competitive landscape features major players like Korea Aluminum and Hyundai Aluminum, with a focus on high-tech applications and innovative solutions.

Malaysia : Growing Demand and Eco-Friendly Practices

Malaysia captures 4.5% of the APAC aluminum market, valued at approximately $XX billion. The growth is driven by increasing demand in the construction and packaging sectors, alongside government initiatives promoting sustainable practices. The country is focusing on eco-friendly production methods, supported by regulatory policies aimed at reducing environmental impact. Infrastructure development is also a key factor in boosting consumption.

Thailand : Growing Market with Export Potential

Thailand holds a 3.5% share of the APAC aluminum market, valued at around $XX billion. The market is driven by demand in the automotive and construction sectors, with government policies supporting export-oriented growth. Key cities like Bangkok and Chonburi are central to aluminum production and trade. The competitive landscape includes local players and international firms, enhancing market dynamics and business opportunities.

Indonesia : Emerging Demand and Infrastructure Growth

Indonesia accounts for 2.5% of the APAC aluminum market, valued at approximately $XX billion. The growth is driven by increasing demand in construction and consumer goods, supported by government initiatives to boost industrial development. Key cities like Jakarta and Surabaya are focal points for aluminum consumption. The competitive landscape features both local and international players, contributing to a dynamic business environment.

Rest of APAC : Varied Demand Across Sub-Regions

The Rest of APAC holds a 3.46% share of the aluminum market, valued at around $XX billion. Growth is driven by diverse demand across various sectors, including construction, automotive, and packaging. Government initiatives in several countries are promoting sustainable practices and industrial development. The competitive landscape varies significantly, with local players dominating in some areas while international firms lead in others.