Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is likely to have a positive impact on the Antihistamine Drugs Market. As individuals allocate more resources towards health and wellness, the demand for effective allergy treatments, including antihistamines, is expected to rise. Data indicates that healthcare spending has been steadily increasing, with many countries investing in better healthcare infrastructure and access to medications. This trend may lead to greater availability of antihistamine drugs in pharmacies and healthcare facilities, thereby enhancing consumer access. Furthermore, as healthcare systems evolve, there is a growing emphasis on preventive care, which may further drive the utilization of antihistamines as a proactive measure against allergic reactions.

Growing Self-Medication Trends

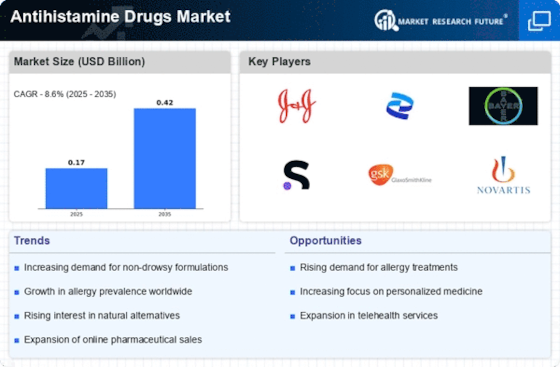

The trend towards self-medication is becoming more pronounced, particularly in the Antihistamine Drugs Market. Consumers are increasingly opting for over-the-counter antihistamines to manage mild allergic reactions and symptoms without the need for a prescription. This shift is likely driven by greater accessibility to these medications and heightened awareness of their efficacy. Market data indicates that the over-the-counter segment is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This trend not only empowers consumers but also reflects a broader acceptance of self-care practices, which may further stimulate the demand for antihistamines in various forms, including tablets, liquids, and nasal sprays.

Increase in Allergic Conditions

The prevalence of allergic conditions, such as allergic rhinitis and urticaria, appears to be on the rise, contributing to the expansion of the Antihistamine Drugs Market. According to recent estimates, approximately 30% of the population experiences some form of allergy, which drives demand for effective antihistamine treatments. This increase in allergic conditions is likely influenced by environmental factors, including pollution and climate change, which may exacerbate symptoms. As a result, healthcare providers are increasingly recommending antihistamines as a first-line treatment, thereby bolstering market growth. Furthermore, the rising incidence of allergies among children and adults alike suggests a sustained demand for antihistamine drugs, indicating a robust market trajectory in the coming years.

Advancements in Drug Formulations

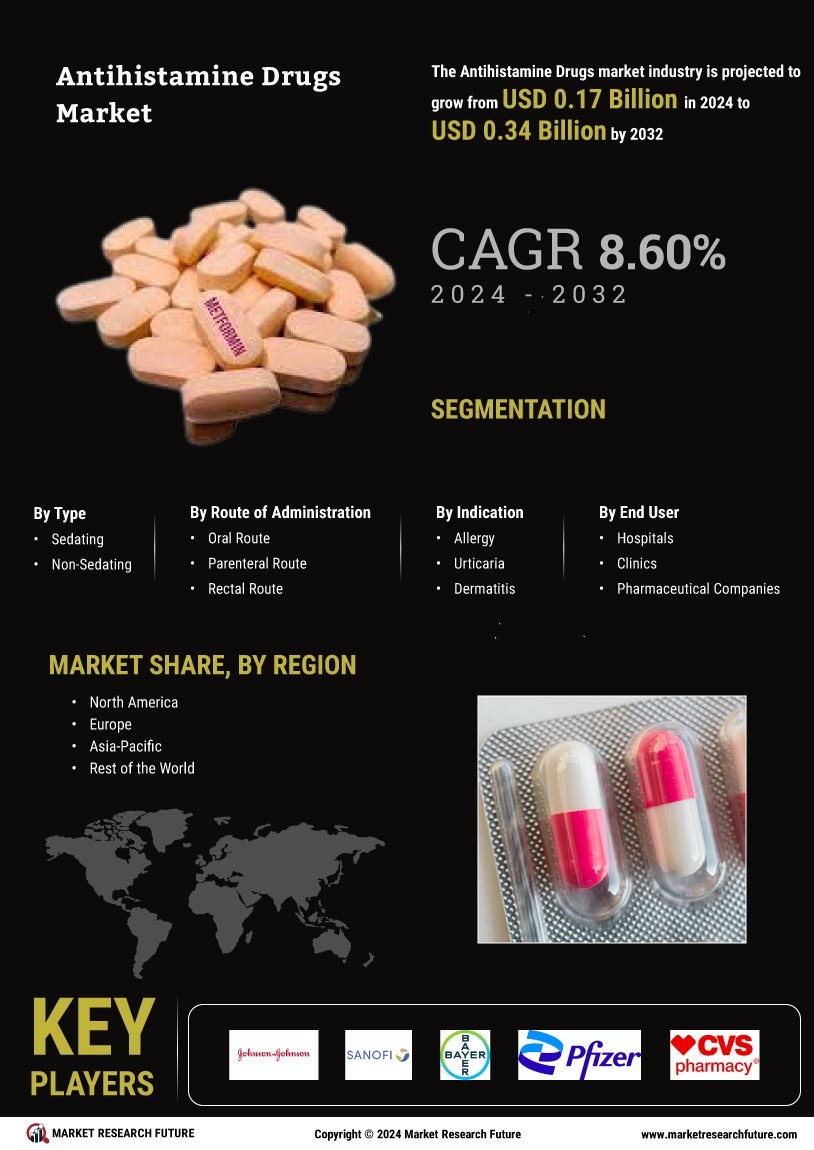

Innovations in drug formulations are playing a crucial role in shaping the Antihistamine Drugs Market. Pharmaceutical companies are increasingly focusing on developing new antihistamine products that offer improved efficacy and reduced side effects. For instance, the introduction of second-generation antihistamines has led to medications that are less sedating and more effective in managing allergy symptoms. Market analysis suggests that these advancements could lead to a significant increase in market share for newer formulations, as patients and healthcare providers seek out options that enhance quality of life. Additionally, the development of combination therapies that integrate antihistamines with other therapeutic agents may further expand the market, catering to a broader range of allergic conditions.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is influencing the Antihistamine Drugs Market in notable ways. As awareness of the importance of managing allergies before they escalate into more severe conditions increases, consumers are more likely to seek antihistamine treatments proactively. This shift towards prevention is supported by healthcare professionals who advocate for early intervention in allergy management. Market trends suggest that this proactive approach could lead to a rise in the consumption of antihistamines, as individuals aim to mitigate symptoms before they impact daily life. Additionally, educational campaigns aimed at informing the public about allergy management may further enhance the visibility and acceptance of antihistamines as a vital component of preventive healthcare strategies.