Regulatory Influence on Market Dynamics

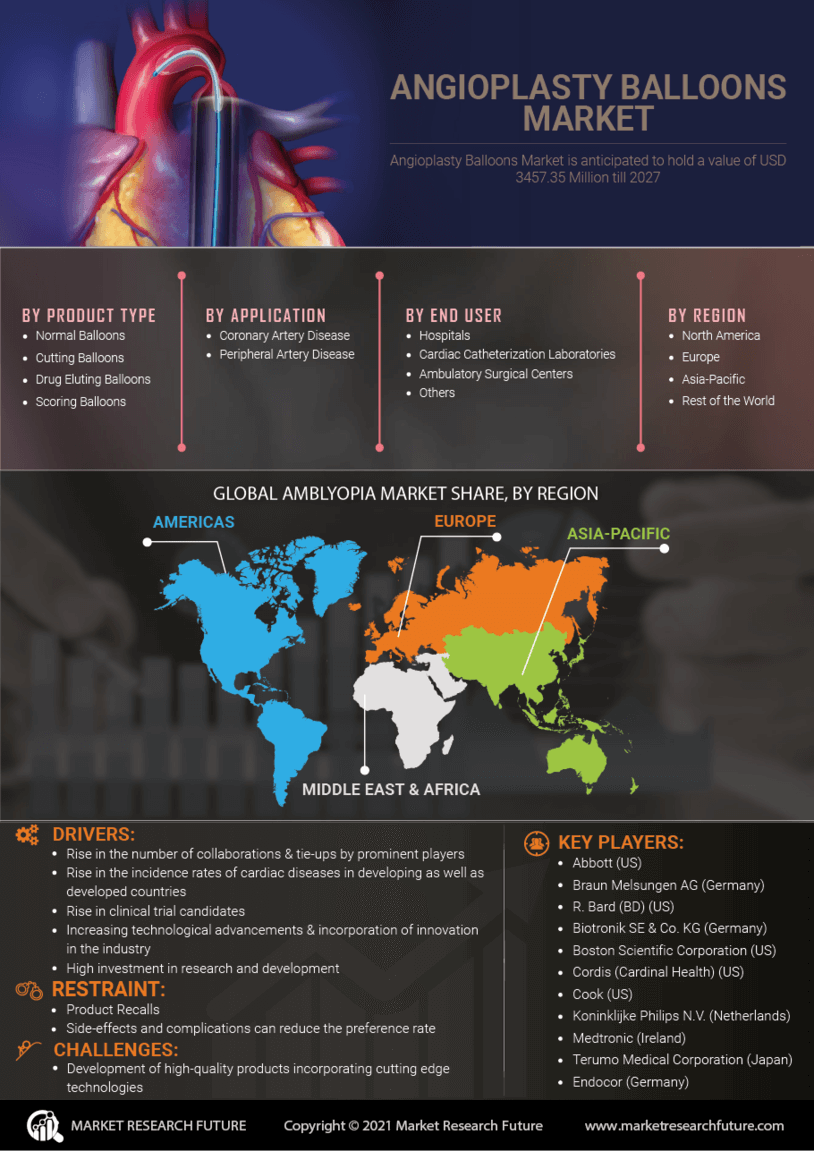

Regulatory frameworks play a crucial role in shaping the Angioplasty Balloons Market. Stringent regulations ensure the safety and efficacy of medical devices, including angioplasty balloons. Compliance with these regulations can be a double-edged sword; while they may pose challenges for manufacturers, they also foster innovation and quality improvements. Regulatory bodies are increasingly focusing on post-market surveillance and real-world evidence, which can influence product development and market entry strategies. As companies navigate these regulatory landscapes, the Angioplasty Balloons Market is likely to evolve, with an emphasis on transparency and patient safety. This dynamic environment may lead to the introduction of new products that meet regulatory standards.

Rising Prevalence of Cardiovascular Diseases

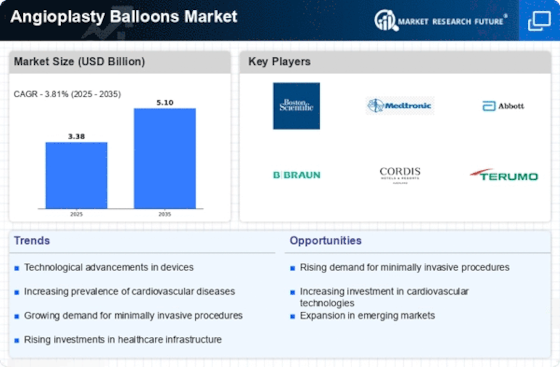

The increasing incidence of cardiovascular diseases is a primary driver for the Angioplasty Balloons Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options rises. Statistics indicate that cardiovascular diseases remain a leading cause of mortality worldwide, prompting healthcare systems to seek innovative solutions. Angioplasty procedures, facilitated by advanced balloon technologies, are becoming a standard treatment for conditions such as coronary artery disease. This growing patient population necessitates a robust supply of angioplasty balloons, thereby propelling market growth. The Angioplasty Balloons Market is thus positioned to expand as healthcare providers respond to this urgent need.

Growing Investment in Healthcare Infrastructure

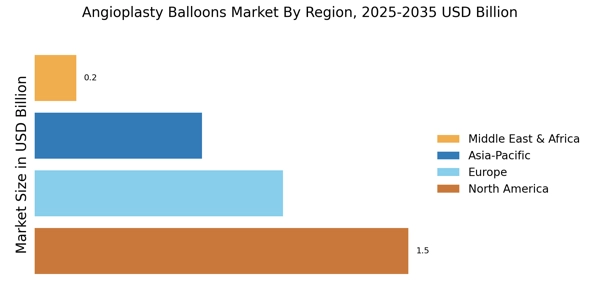

Investment in healthcare infrastructure is a significant driver for the Angioplasty Balloons Market. As countries prioritize healthcare improvements, the establishment of advanced medical facilities and the procurement of cutting-edge medical devices become essential. Increased funding for cardiovascular care, particularly in emerging markets, is expected to enhance access to angioplasty procedures. This trend is supported by government initiatives aimed at reducing the burden of cardiovascular diseases. Consequently, the demand for angioplasty balloons is anticipated to rise, as healthcare providers seek to equip their facilities with the latest technologies. The Angioplasty Balloons Market stands to benefit from this influx of investment, potentially leading to enhanced patient care.

Technological Advancements in Angioplasty Balloons

The Angioplasty Balloons Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as drug-eluting balloons and bioresorbable materials are enhancing the efficacy of angioplasty procedures. These advancements not only improve patient outcomes but also reduce the risk of restenosis, a common complication. The introduction of advanced imaging techniques and minimally invasive procedures is further driving the adoption of angioplasty balloons. According to recent data, the market for drug-eluting balloons is projected to grow significantly, indicating a shift towards more effective treatment options. As healthcare providers increasingly adopt these technologies, the Angioplasty Balloons Market is likely to witness substantial growth in the coming years.

Increasing Awareness and Education on Cardiovascular Health

The growing awareness and education surrounding cardiovascular health are pivotal for the Angioplasty Balloons Market. Public health campaigns and educational initiatives are informing populations about the risks associated with cardiovascular diseases and the importance of early intervention. As individuals become more knowledgeable about treatment options, including angioplasty, the demand for these procedures is likely to increase. Healthcare providers are also focusing on patient education, which can lead to higher rates of diagnosis and treatment. This heightened awareness is expected to drive the adoption of angioplasty balloons, as patients seek effective solutions for their cardiovascular issues. The Angioplasty Balloons Market is thus poised for growth as awareness continues to expand.