- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

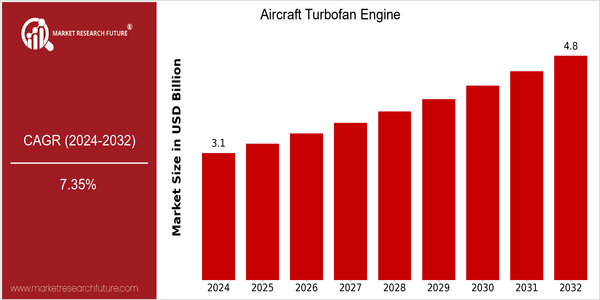

| Year | Value |

|---|---|

| 2024 | USD 3.11315 Billion |

| 2032 | USD 4.76444 Billion |

| CAGR (2024-2032) | 7.35 % |

Note – Market size depicts the revenue generated over the financial year

The Aircraft Turbine Engine Market is expected to reach USD 4.7644 billion by 2032. This growth is projected at a CAGR of 7.35 % between 2024 and 2032. The growing demand for fuel-efficient and high-performance engines is the main driving factor for this market. Technological advancements, such as the development of advanced materials and new engine designs, are also expected to increase the efficiency and performance of aircraft engines. The industry players, such as General Electric, Pratt & Whitney, and Rolls-Royce, are heavily investing in R & D to develop next-generation engines that can meet the stringent regulatory requirements and improve the performance of aircraft engines. Strategic initiatives, such as joint ventures and strategic alliances, aimed at enhancing engine technology and reducing emissions, are also contributing to the positive outlook of the aircraft engine market.

Regional Market Size

Regional Deep Dive

AIRCRAFT TURBOFANS MARKET: The Aircraft Turbine Engines Market is characterized by significant regional dynamics, driven by technological advancements, increasing air travel, and stricter regulations. Each region shows unique growth potential, influenced by local economic conditions, regulatory framework, and presence of key players. North America continues to lead in terms of innovation and production, while Europe focuses on regulatory compliance and green technology. Asia-Pacific is rapidly expanding owing to the growing middle class and the increasing air travel. The Middle East and Africa are emerging economies with substantial investment in aviation. Latin America, though smaller, is undergoing a revival due to modernization efforts in the aviation industry.

Europe

- European manufacturers like Rolls-Royce and Safran are at the forefront of developing hybrid-electric propulsion systems, reflecting the region's commitment to sustainability and reducing carbon footprints in aviation.

- The European Union's Green Deal and associated regulations are compelling manufacturers to innovate, leading to increased investments in research and development for cleaner engine technologies.

Asia Pacific

- The Asia-Pacific region is growing rapidly. The turbofan engines developed by Mitsubishi Aircraft and China National Aircraft as well as COMAC have been adapted to meet the demand for short-haul flights.

- Government initiatives, such as China's 'Made in China 2025' plan, are fostering domestic production capabilities in the aviation sector, aiming to reduce reliance on foreign technology and enhance local expertise.

Latin America

- Latin America is focusing on modernizing its aviation sector, with countries like Brazil investing in new aircraft and engine technologies to improve operational efficiency and safety.

- The region's unique economic challenges, including fluctuating currencies and political instability, are influencing investment decisions in the turbofan engine market, prompting companies to adopt flexible strategies.

North America

- The North American market is heavily influenced by major players such as General Electric and Pratt & Whitney, which are investing in next-generation turbofan technologies to enhance fuel efficiency and reduce emissions.

- Recent regulatory changes, including the FAA's push for sustainable aviation fuels (SAFs), are driving innovation in engine design and operational practices, positioning the region as a leader in environmentally friendly aviation solutions.

Middle East And Africa

- The Middle East is witnessing significant investments in aviation infrastructure, with companies like Emirates and Qatar Airways expanding their fleets, which in turn drives demand for advanced turbofan engines.

- Regulatory bodies in the region are increasingly adopting international standards for emissions and safety, encouraging manufacturers to innovate and comply with global best practices.

Did You Know?

“Did you know that modern turbofan engines can achieve a bypass ratio of over 10:1, meaning they can produce more thrust from the bypass air than from the core engine, significantly improving fuel efficiency?” — Aerospace Technology Institute

Segmental Market Size

Aircraft engines play a crucial role in the aviation industry, which is experiencing steady growth due to rising demand for air travel and improvements in fuel efficiency. A major driver of the market is the need for more sustainable aviation solutions, driven by stricter regulatory policies and increasing public demand for reduced emissions. A further boost to performance and efficiency comes from technological innovations, such as the development of high-bypass turbofan engines. These developments have attracted the interest of both manufacturers and operators. During the current phase of the market for turbofan engines, the main players are GE and Rolls-Royce. They are actively involved in integrating these next-generation engines into new aircraft, such as the Boeing 787 and Airbus A350. In the commercial, military and business jet markets, the main requirements are for high performance and reliability. In addition, government initiatives to reduce emissions and increase the sustainability of aviation are accelerating the market growth. Advances in materials and manufacturing, such as additive manufacturing, are defining the future of turbofan engines.

Future Outlook

The Aircraft Turbine Engine market will be growing steadily from 2024 to 2032, with a CAGR of 7.35%. It will be a consequence of the growing demand for fuel-efficient and environmentally friendly aircraft, in response to the increasingly stringent regulatory framework aiming to reduce the carbon emissions of the aviation industry. The increased emphasis on sustainability in the aviation industry will result in the accelerated adoption of advanced turbofan technology, which will increase its fuel efficiency and reduce noise pollution. Its use will spread both in civil and military aviation. The development of geared turbofan engines and the introduction of hybrid-electric propulsion systems will reshape the competitive landscape. These innovations will not only bring improvements in performance metrics, but also align with the global initiative to achieve zero emissions by 2050. The post-pandemic growth of air traffic, the expansion of low-cost carriers, and the introduction of new aircraft models will also contribute to the demand for the next-generation turbofan engine. In this way, the players in the aircraft manufacturing and maintenance industry must be prepared for a dynamic market environment characterized by rapid technological change and increased investment in sustainable aviation solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.9 Billion |

| Market Size Value In 2023 | USD 3.11315 Billion |

| Growth Rate | 7.35% (2023-2030) |

Aircraft Turbofan Engine Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.