Global Activewear Market Overview

Activewear Market Size was estimated at 357.79 (USD Billion) in 2023. The Activewear Market Industry is expected to grow from 367.92(USD Billion) in 2024 to 500 (USD Billion) by 2035. The Activewear Market CAGR (growth rate) is expected to be around 2.83% during the forecast period (2025 - 2035).

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Key Activewear Market Trends Highlighted

Consumers' growing interest in exercise and health is driving significant developments in the global activewear market. Demand for sportswear that skillfully combines style and practicality is rising as more individuals become health conscious.

The popularity of athleisure as daily clothing has further accelerated this trend by enabling customers to switch between casual and gym settings without sacrificing comfort or style. The development of fabric technology, such as breathable and moisture-wicking textiles, is in line with customer demands for apparel that is increasingly focused on performance.

Sustainability has also become a key consideration, with companies emphasizing environmentally friendly production methods and materials to satisfy customer demand for ethical fashion. There are several opportunities in this sector.

Activewear manufacturers now have the opportunity to interact directly with customers through tailored marketing techniques because to the growing popularity of digital fitness platforms and online fitness communities. Partnering with athletes and fitness influencers may increase brand awareness and connect with target consumers.

Additionally, adding plus-size and gender-neutral sportswear to product lines may reach a wider audience, encouraging inclusion and drawing in a varied clientele. tailored shopping experiences have been more popular in recent years, and many customers are looking for possibilities for tailored sportswear.

Brands are likely to stand out in the marketplace if they use technology to provide customized solutions, including sizes that can be adjusted or personal style preferences. Consumer enthusiasm in tech-savvy items that improve their exercise experience is also reflected in the incorporation of smart technology, such as fitness monitoring or integrated sensors, into sports apparel.

All things considered, the global activewear market is expected to expand as long as companies keep coming up with new ideas and adjusting to the shifting tastes and habits of consumers.

Activewear Market Drivers

Health and Fitness Consciousness

The increasing global awareness of health and fitness is a significant driver for the Global Activewear Market. With the World Health Organization indicating that physical inactivity is responsible for approximately 3.2 million deaths each year, there is a growing urgency among individuals to engage in physical activities.

By 2025, it's projected that more than 50% of the global population will engage in regular exercise, which may lead to an increased demand for activewear products.

Established retailers like Nike and Adidas have recognized this trend, investing in diverse product ranges that cater to different types of workouts. Their initiatives towards offering eco-friendly activewear also appeal to the environmentally conscious consumer, further accelerating sales in the Global Activewear Market.

Technological Innovations in Fabric

Advancements in fabric technology are another key driver of growth within the Global Activewear Market. Innovations such as moisture-wicking materials and anti-odor properties provide added functionality to activewear products, encouraging consumers to invest in high-performance clothing.

The textile industry reports that demand for technical textiles is expanding, with projections estimating a growth rate of 4.5% annually through 2030. Major brands, including Under Armour and Lululemon, are leading the way in Research and Development endeavors, constantly introducing innovative materials that enhance athletic performances.

This trend is deemed crucial as it not only improves the user experience but also contributes to the overall growth of the Global Activewear Market.

Rise of E-commerce and Online Retail

The growth of e-commerce has transformed the way consumers shop, making it a significant driver for the Global Activewear Market. In 2022, online sales for apparel, including activewear, accounted for nearly 25% of the total global apparel sales, indicating a shift in shopping preferences.

With platforms like Amazon and Zalando leading the charge, brands are increasingly focusing on online strategies to reach consumers directly.

This trend is reinforced by the increasing reliance on digital platforms for purchasing decisions; approximately 60% of consumers report using online reviews and social media for inspiration before making purchases. Such dynamics create opportunities for expansion in the Global Activewear Market.

Activewear Market Segment Insights:

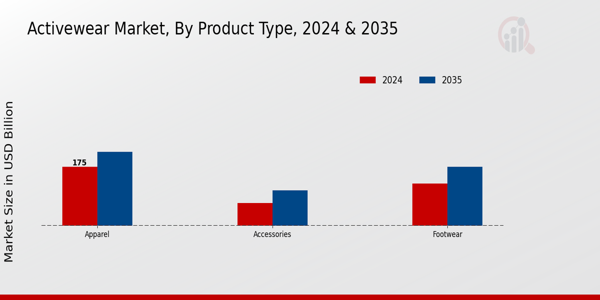

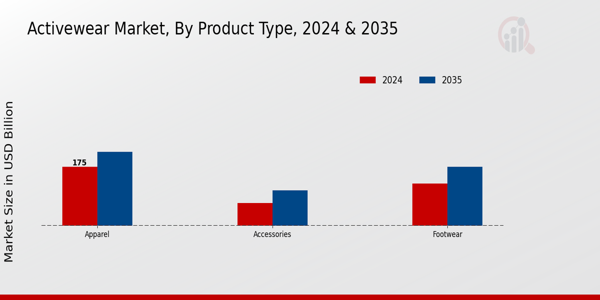

Activewear Market Product Type Insights

In the Global Activewear Market, the Product Type segment played a crucial role in shaping the industry's dynamics. The Apparel category dominated the segment, valued at 175.0 USD Billion in 2024 and expected to grow to 220.0 USD Billion in 2035.

This growth can be attributed to the increasing consumer interest in performance-driven clothing that combines functionality with fashion, particularly within the context of fitness and outdoor activities.

Footwear also represented a substantial portion of the Global Activewear Market, with a valuation of 125.0 USD Billion in 2024, rising to 175.0 USD Billion by 2035. The importance of this category lies in the innovation surrounding athletic shoes, which enhances performance, comfort, and even sustainability, catering to the increasing health-conscious consumer base.

Accessories, accounting for a valuation of 67.92 USD Billion in 2024 and expected to reach 105.0 USD Billion by 2035, contributed to the market by providing essential support gear and complementing apparel and footwear. This included items such as bags, moisture-wicking headbands, and fitness trackers, all of which are growing in popularity due to their enhancement of the overall fitness experience.

The Global Activewear Market statistics revealed a well-rounded growth trajectory driven by increasing health awareness and lifestyle changes among consumers.

As such, the footwear segment held a significant position, driven by advancements in technology and design that cater to various sports and activities, while apparel emerges as a majority holding segment due to the essential nature of clothing in any activewear ensemble.

Accessories, although smaller in market share compared to apparel and footwear, are gaining traction as fitness enthusiasts look to enhance their workouts. Thus, the Global Activewear Market demonstrated a diverse segmentation, with each Product Type bringing unique contributions and opportunities to capitalize on emerging trends within this fast-evolving industry.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Revie

Activewear Market Activity Type Insights

The Activity Type segment represents a vital aspect of this market, reflecting the diverse preferences of consumers engaged in various physical activities. This segment encompasses activities such as Yoga, Running, Gym, Cycling, and Swimming.

Each of these activities holds significant importance; for instance, Yoga apparel is popular for its comfort and functionality, attracting a large consumer base focused on wellness and relaxation. Running gear remains crucial due to the growing trend of health awareness, encouraging more individuals to invest in suitable attire.

Meanwhile, gym wear continues to dominate as fitness enthusiasts increasingly prioritize specialized clothing for gym workouts. Cycling has witnessed a rise in participation, fostering a demand for high-quality cycling apparel that promotes better performance and safety.

Swimming, though not as prominent, also commands attention with a niche market for swim-specific activewear. The growing interest in fitness and wellbeing drives the demand across these activities, shaping the landscape of the Global Activewear Market as it evolves to meet the diverse needs of consumers globally.

Activewear Market End-user Insights

The End-user segmentation of this market encompasses Men, Women, and Kids, reflecting diverse consumer demands and preferences. As health consciousness rises, men's activewear signifies a significant portion of the market, appealing to those seeking functionality and style for workouts and leisure.

Women's activewear is experiencing rapid growth, fueled by the increasing participation of women in sports and fitness activities, emphasizing stylish designs and versatility. Meanwhile, kids' activewear, although smaller, is important as parents prioritize comfortable and durable options for their children, highlighting market diversity.

The Global Activewear Market statistics reveal a well-rounded growth opportunity as brands focus on innovation in materials and sustainability to cater to these segments. Moreover, regional trends indicate that urban lifestyles and increased disposable income contribute to the growth and importance of these individual categories, thus driving the overall market growth.

Activewear Market Distribution Channel Insights

The Global Activewear Market showcases a diverse Distribution Channel landscape, playing a crucial role in shaping consumer access and purchasing behavior. The segmentation into channels such as Online, Offline, and Direct Sales highlights how consumers are engaging with activewear products.

Online channels are increasingly gaining traction due to the convenience and reach they offer, catering to tech-savvy consumers who prefer shopping from the comfort of their homes. Offline sales continue to hold significant importance, providing customers with the tactile experience of trying on products before purchasing.

Direct Sales also play a vital role by offering personalized shopping experiences through brand representatives. Each channel presents unique opportunities and challenges, driven by changing consumer preferences, emerging technologies, and competitive pricing strategies.

The blend of these channels contributes to the overall growth of the Global Activewear Market, allowing brands to target different demographics effectively. Understanding this Distribution Channel segmentation is essential for stakeholders aiming to navigate the market dynamics and capitalizing on growth prospects as consumer interest in activewear continues to rise.

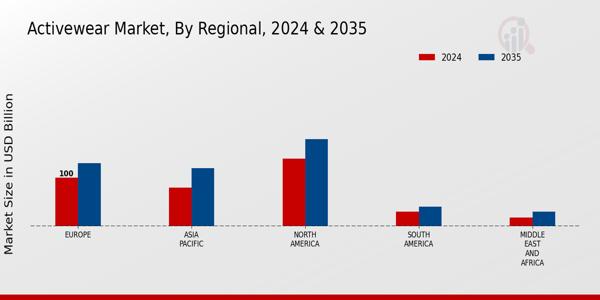

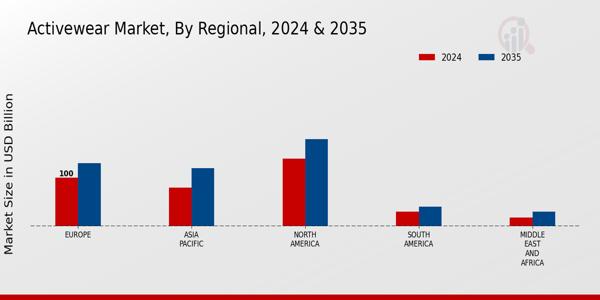

Activewear Market Regional Insights

The Global Activewear Market exhibited significant regional diversity, with North America holding a dominant position valued at 140.0 USD Billion in 2024, increasing to 180.0 USD Billion by 2035, driven by a trend towards health and fitness lifestyles.

Europe followed closely, with a market valuation of 100.0 USD Billion in 2024, projected to reach 130.0 USD Billion in 2035, reflecting a strong consumer interest in active lifestyle products. The Asia Pacific region, with a valuation of 80.0 USD Billion in 2024 and 120.0 USD Billion in 2035, was rapidly growing as fitness culture gains traction, showcasing a major opportunity for brands.

South America, although smaller, showed promise with valuations of 30.0 USD Billion in 2024 and 40.0 USD Billion in 2035, driven by a rising middle class and increased spending on fashionable activewear.

Lastly, the Middle East and Africa, valued at 17.92 USD Billion in 2024 and projected to grow to 30.0 USD Billion by 2035, witnessed a gradual increase in demand for activewear as health awareness rises and outdoor activities gain popularity.

Together, these regions contributed valuable insights into the global activewear market, displaying a range of growth drivers such as urbanization, lifestyle changes, and the push for fitness, creating numerous opportunities for brands to capitalize on emerging trends.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Activewear Market Key Players and Competitive Insights:

The Global Activewear Market is a dynamic and rapidly evolving sector characterized by intense competition and diverse consumer preferences. This market comprises a broad range of products designed for physical activities, including yoga, running, gym workouts, and outdoor pursuits.

Various brands are vying for market share, offering innovative designs, advanced materials, and targeted marketing campaigns that cater to specific consumer needs and lifestyle choices. Factors such as growing health consciousness, increasing participation in fitness activities, and the rise of athleisure trends have significantly driven demand in this segment.

The competitive landscape is constantly shifting, with companies striving to differentiate themselves through sustainability initiatives, technological advancements, and engaging collaborations with influencers and athletes.

ALO Yoga stands out in the Global Activewear Market due to its dedicated focus on yoga and mindfulness. The brand is well-regarded for its high-quality fabrics and stylish designs, which resonate with both fitness enthusiasts and lifestyle consumers. ALO Yoga's strengths include a strong online presence facilitated by a vibrant community and engaging content that promotes a holistic approach to wellness.

The brand emphasizes sustainability, employing eco-friendly materials and ethical manufacturing practices that appeal to conscious consumers. By fostering brand loyalty through a combination of appealing aesthetics and a commitment to quality, ALO Yoga has successfully carved out a niche in the competitive landscape, empowering customers to express themselves both on and off the mat.

Puma has established itself as a formidable player in the Global Activewear Market through its diverse product offerings that blend functionality with fashion. The company has a strong presence worldwide, catering to a wide demographic with both performance-oriented gear and athleisure styles that are suitable for everyday wear.

Key products include sports apparel, footwear, and accessories designed to enhance athletic performance while also appealing to fashion-conscious consumers. Puma's strengths lie in its innovative technology, commitment to quality, and strategic partnerships with various athletes and global influencers.

The company has pursued a proactive approach to growth through mergers and acquisitions, expanding its portfolio and enhancing market reach on a global scale. Such strategies have allowed Puma to maintain a competitive edge, engaging a wide audience and sustaining its position as a leader in the activewear sector.

Key Companies in the Activewear Market Include:

- ALO Yoga

- Puma

- Under Armour

- ASICS

- Adidas

- Fabletics

- Decathlon

- Reebok

- Lululemon Athletica

- New Balance

- Nike

- The North Face

- Gap Inc

- Columbia Sportswear

- H&M

Activewear Market Developments

In order to lessen the effects of U.S. tariffs, Nike said in June 2025 that it would move a sizable amount of its manufacturing out of China, estimating that these taxes would cost the company an additional $1 billion. The business announced aims to cut its manufacturing reliance on China to single-digit exposure by the end of fiscal 2026 as part of this strategic shift.

Following investor confidence over Nike's updated strategy, which included targeted price hikes in the United States, stringent cost control measures, and a renewed emphasis on core performance items, the company's stock increased by 15% in the same month. Nike also announced a better-than-expected fourth-quarter performance in June 2025, with a 12% loss in sales, which was less than the anticipated 14.9% drop.

The company also provided stronger outlook for Q1 2026, citing their "Win Now" campaign, which focused on sportswear-led growth and inventory reduction. Furthermore, citing internal manufacturing and quality concerns, Nike postponed the June 2025 U.S. debut of their eagerly awaited NikeSKIMS sportswear collection, a partnership with Skims.

In keeping with its larger sustainability objectives, Adidas stated in April 2023 that 96% of the polyester used in its goods was recycled, indicating that it is still on course to completely phase out virgin polyester by the end of 2024.

- Activewear Market Segmentation Insights

- Activewear Market Product Type Outlook

- Apparel

- Footwear

- Accessories

- Activewear Market Activity Type Outlook

- Yoga

- Running

- Gym

- Cycling

- Swimming

- Activewear Market End-user Outlook

- Activewear Market Distribution Channel Outlook

- Online

- Offline

- Direct Sales

- Activewear Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Activewear Market Report Scope

| Report Attribute/Metric |

Details |

| Market Size 2023 |

357.79(USD Billion) |

| Market Size 2024 |

367.92(USD Billion) |

| Market Size 2035 |

500.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

2.83% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Champion, Fabletics, New Balance, ASICS, Under Armour, The North Face, Lululemon Athletica, Adidas, Reebok, H and M, Columbia Sportswear, Nike, Gap, Puma |

| Segments Covered |

Product Type, Activity Type, End User, Distribution Channel, Regional |

| Key Market Opportunities |

Sustainable fabric innovations, Expansion in emerging markets, Growth of women's activewear segment, Integration of smart textiles, Increased online retail penetration |

| Key Market Dynamics |

health consciousness trend, increasing athleisure popularity, technological fabric innovations, sustainable materials demand, rising online sales channels |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Activewear Market was valued at 367.92 billion USD in 2024.

By 2035, the Activewear Market is projected to reach a value of 500.0 billion USD.

The expected CAGR for the Activewear Market from 2025 to 2035 is 2.83%.

In 2024, North America dominated the Activewear Market with a valuation of 134.0 billion USD.

The apparel segment of the Activewear Market is anticipated to be valued at 240.0 billion USD in 2035.

The footwear segment in the Activewear Market is expected to reach 170.0 billion USD by 2035.

Prominent players in the Activewear Market include Nike, Adidas, Lululemon Athletica, Puma, and Under Armour.

By 2035, the accessories segment of the Activewear Market is projected to be valued at 90.0 billion USD.

In 2024, the Middle East and Africa will have the smallest market size within the Activewear Market at 14.92 billion USD.

The Activewear Market is poised for growth due to increasing health consciousness and the popularity of athletic activities.