Run-on Deposit Saves Small Banks from Collapse

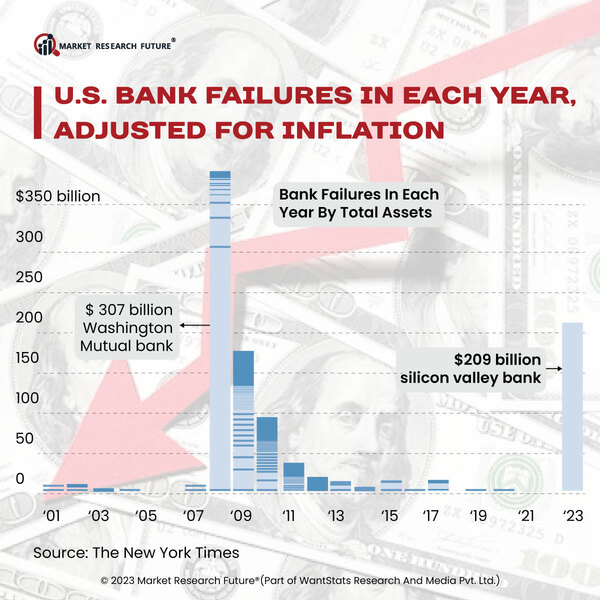

After the collapse of Silicon Valley Bank and Signature Bank spread, the fear that other banks might also fall increased. It resulted in a run-on deposit mostly at the smaller banks.

According to the information, the banks outside the top 25 banks in terms of domestic assets. It declined by a record breaking $192 billion. On the other hand, large banks initially benefited from the panic and gained $67 billion in deposits. The commercial banks in the United States which includes the United States branches of foreign banks, saw the deposits to decline by $170 billion in the week that ended March 15th.Although, the FED and the FDIC are stepping in quickly to contain the damage which made customers of failed Silicon Valley Bank and the Signature Bank whole and the promising additional liquidity to other banks struggling to continue with the withdrawal requests. Also, the deposit flights from the U.S. banks continued as Credit Suisse’s collapse further shake the confidence in the banking sector.

Fed says, the United States commercial banks lost $172 billion in deposits in March 2023, as the large, small and the non-U.S. banks witnessed the deposits to decline by $90, $40, and $42 billion respectively at the same time being of March 2023. The confidence in the financial system slowly getting into track as the further bank failures calmed down.