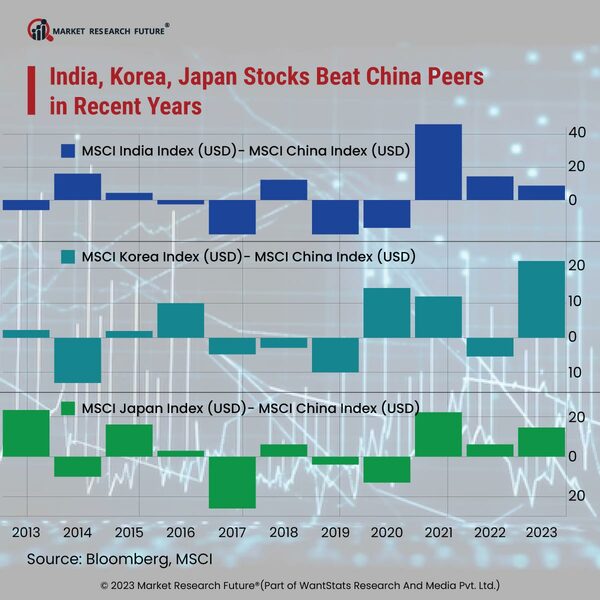

Other Asian Markets are Booming as China’s Stocks Sink

Asia's markets other than China are emerging as more attractive alternatives for global investors as China is stumbling over its equity market performance. Chinese stock gauge faced losses from its recent peak reach of 20 percent, just like benchmarks in India approached record height. In May 2023, Japanese stocks also hit a three-decade high, and Taiwan outperformed most of the stock markets around the globe.

As major world economies decouple from China, a shift in Asia -focused portfolios stay underway, surging concerns that a sink in Asia's largest economy will drag on equities elsewhere. Bright prospects for Korea and Taiwan, the world's leading chipmakers, and a comeback of inflation in India and Japan's flourishing consumption are the major factors in boosting their stocks. According to one of the officials at Asian equities at Abrdn (Aberdeen) plc., there are many opportunities in Asia outside China; Korea gives immense exposure to a good number of companies within the battery and tech supply chain; Taiwan is more than just Taiwan Semiconductor Manufacturing Company Limited, and Japan give access to global leaders in their fields.

With reversing outflows of 2022, Korea and Taiwan have earned at least USD 9.2 billion each in 2023, while overseas inflows into Japan have continued for eight weeks straight through May 26, 2023. Bullish Wall Street has called on China that it was dominant some months ago, then started falling flat as the economy falters and geopolitical tensions have turned key gauges into global underperformers. According to one of BNY Mellon Investment Management officials, a re-allocation distant from China may catalyze a broader rally across largely dispersed parts of Asia. The Chinese market pricing shows many negative outlooks, creating more opportunities in China during this period. Also, the recent selloff in the Chinese market has already opened ways for opportunities in sectors with secular tailwinds and compound earnings over time.