Oil Prices Drop On Uncertainty Over Chinese Demand

Prices of oil dropped more than $1 a barrel on Monday as Chinese health officials' reiterated their dedication to a strict COVID management strategy, shattering expectations for a recovery in oil demand from the largest crude importer in the world.

After reaching a low of $96.50 earlier, Brent crude futures decreased $1.20, or 1.2%, to $97.37 a barrel. Earlier in the day, U.S. West Texas Intermediate oil hit a session low of $90.40 per barrel before falling to $91.24 per barrel, down $1.37, or 1.5%.

The Chinese health authorities asserted, at a news conference on Saturday that they would continue to treat COVID cases according to their "dynamic-clearing" strategy as soon as they appeared. Chinese health authorities committed to maintaining the nation's zero-tolerance policy, which attempts to eradicate Covid infections as soon as they occur.

The first concurrent decline in China's exports and imports since May 2020 occurred in October as a result of an unfavourable confluence of domestic COVID restrictions and risks associated with a potential global recession, which further dimmed the outlook for the country's already precarious economy.

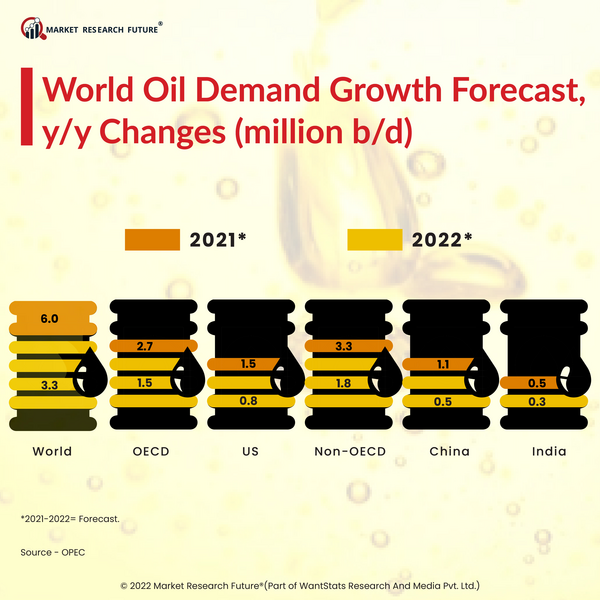

The amount for the first 10 months was still 2.7% lower than the same time a year earlier, at 413.53 million tonnes or 9.93 million bpd, despite China's imports of crude oil rising to their highest level since May.

Despite the fact that refineries throughout the world are increasing capacity, the price of oil has been bolstered by anticipation of tighter supply as a result of the European Union's embargo on Russia's seaborne crude shipments beginning on December 5.