Global Remittances Stays Durable But Slower In 2023

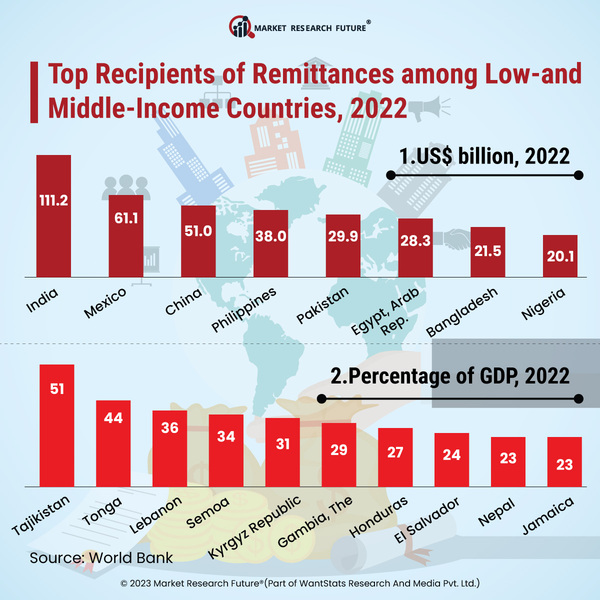

In the low-and middle-income countries (LMICS), the remittance flows are anticipated to grow 1.4 percent to USD 656 billion in 2023. According to World Bank's Migration and Development Brief released in June 2023, the reason behind the current condition of the remittance flow is that the source countries are ready to limit their employment and increase wages for the migrants.Based on a survey, incoming payments have declined in five of the ten most prominent recipients of remittances. Between 2021-2022, the remittance to LMICS has risen by 8 percent, but it was 10.6 percent for 2020-2021. The study also reveals that for the LMICs with high external debt, reasons like slower economic progress and decline in direct investments have made remittance inflows more necessary to countries, provided their durability stays as a source of external funds. According to one of the officials from the World Bank, remittances are essential to households when required and complementary to government cash transfers. Due rise in oil prices in the Gulf Cooperation Council (GCC) countries resulted in the increasing earnings of the migrants, a strong labor market in the United States, and a hefty sum of money transfer from the Russian Federation countries in Central Asia. India was among the top five recipient countries in 2022, with a reception of USD 111 billion, followed by Mexico, with a remittance of USD 61 billion. Tajikistan, with a recipient of remittance of 51 percent in the Gross Domestic Product (GDP) followed by Tonga at 44 percent and Lebanon at 36 percent GDP, relies on the remittance inflow for financing current accounts and the fiscal shortfalls, as reported by World Bank.