First Republic Bank Faces Losses Due to the Collapse of Two Major Banks in the U.S.

Recently, after the failure of two major banks in the U.S., imperilled regional bank saw nearly 50 percent of its share price in the tumbling state. According to the reports, Bank of America, JPMorgan, and Citigroup had transferred up to $30 billion in the uninsured deposits to First Republic on 16th of March to show and restore confidence upon the collapsing bank. But it shattered by ratings of agencies over the weekend.

According to some reports, one of the banks also said that it is downgrading First Republic due to its reliability on the short-term borrowing which would eventually have a negative impact on the bank’s profit margins in the up coming quarters. Another bank added the view saying that First Republic faced “substantial business, funding and profitability challenges.”

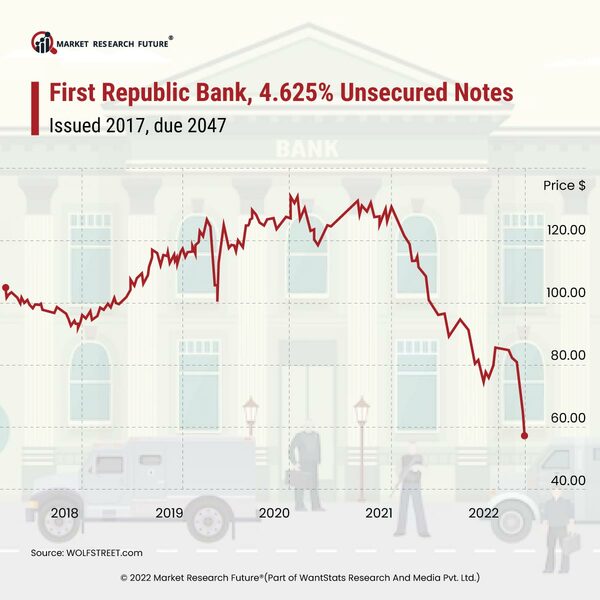

As per the data, First Republic lost around $70 billion in deposits due to the collapse of Silicon Valley Bank and Signature Bank. The collapse of Silicon brought down its share to fall more than 90 percent in the March. It also fall a victim to the distrust in the system of banking like clients withdrew their money from all these smaller banks and get it transferred to the bigger banks which are too big to collapse.

First republic is the hardest hit among all other regional banks. Even the regional banking shares rebounded in the early trading. According to critics, the solvency crisis of 2008 differs from the current one as it is more rooted in the contagious bank runs.