Central Bank Digital Currencies Gaining Status In 2023

Central Bank digital currencies (CBDC) are gaining popularity as the digital currency acting approved by the government of that respective country. It is the fiat money having a claim on the central bank. Digital currency stands for virtual money instead of printing; the central banks are issuing electronic coins sponsored and controlled by governments like traditional currencies. More than 20 countries globally are anticipated to take the lead toward handling CBDCs in 2023.

According to the findings of the Atlantic Council, the European Central Bank is all set to begin its venture for the digital euros. Bank of England and Japan are also developing their prototypes for CBDC, keeping track of financial stability issues in both the public and private sectors. Brazil, Canada, and the United States have also laid concrete plans to launch CBDC. Simultaneously, countries like South Korea, India, Russia, Sweden, Thailand, and the United Arab Emirates are gearing up to launch CBDC by 2024, per trusted sources. The International Monetary Fund says Latin America and the Caribbean are ahead of others in adopting digital money. The reason behind the adoption of CBDCs by the government is to boost payment systems' flexibility and financial inclusivity. However, based on a survey by the European Central Bank, Europeans are negative about digital currencies showing concerns over payment privacy regarding digital euros. CBDCs are controlled by governments, hence, differ from non-traceable Bitcoins. The value of bitcoins and NFTs is diminishing but at the same time another face of virtual currency is creating space in the economy.

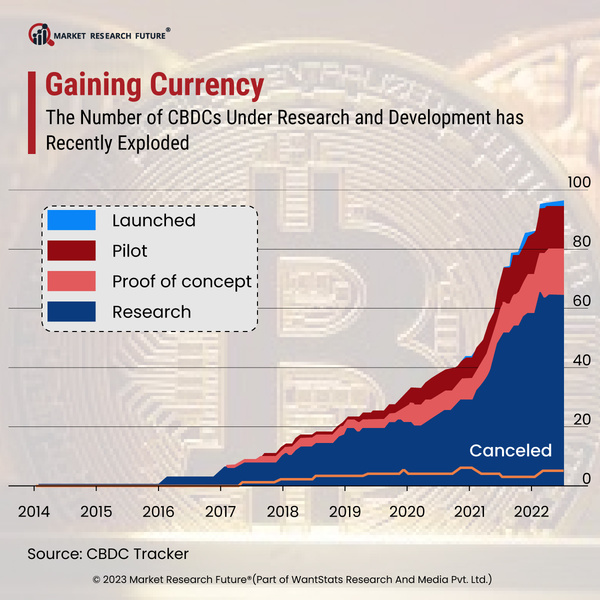

Gaining Currency