“Buy Now, Pay Later” is Used Mostly by Gen Z

With the advancement in technology day by day, people are adapting new schemes and techniques to cope with the current on-going scenario. E-shopping or buying products online provides customers with a wide range of variety of things to choose from. Like products, the modes of payment have also been easier these days with different portals. And different portals also offering different schemes as well.

According to the reports, the millennials of the United States emerge out as the “BUY NOW,PAY LATER” group. The people born between 1980 and 1994, 56 percent among them say they use online schemes which allows to pay later several instalments with interest free goods and services.

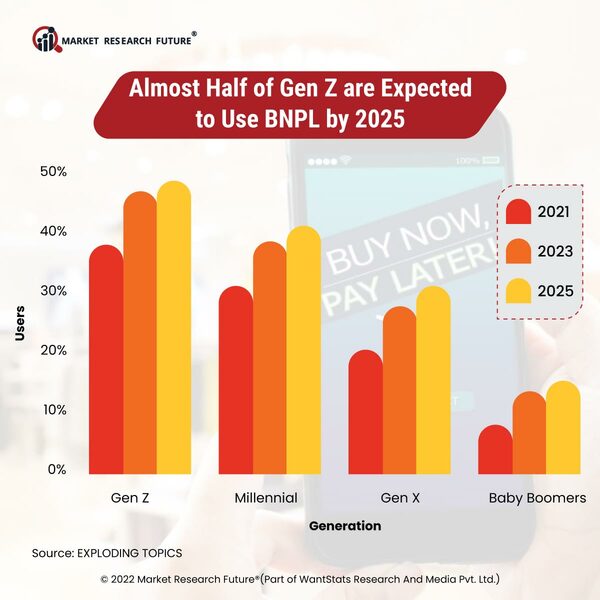

The survey data also says, PayPal is mostly used to provide the service of “buy now, pay later” among the young generation. Along with other services like After pay, Affirm and Klarna. On comparison of the data, it come out as 36 percent of those born in between 1965 and 1979 (Gen X) and 49 percent of those born after 1995 (Gen Z). These two groups said they use such services. The participation of those born between 1946 and 1964 is just 26 percent.

It is predicted that by 2023, the BUY NOW,PAY LATER (BNPL) market will be worth an impressive $3.27 trillion. And by 2025, it supposed to reach USD 531.53 billion.

Some payment plans with timelines are mostly free of interest while using BUY NOW, PAY LATER scheme and postponing payments could incur extra penny. Reports have proven that 14 percent of millennials taking part in the survey said, they started using this since past 12 months. When this number is compared 11 percent of Gen Z and 8 percent of Gen X.