The global PCB market is estimated to be $64.1 billion in 2022 and is expected to grow at a CAGR of 4–6 percent to $74.2 billion by 2025. PCB market witnessed marginally declining trend in 2020, considering the global recession in major economies and weak demand. After the pandemic, the demand from the emerging applications, such as 5G, IoT, AI, Robotics, Cloud computing, EV, etc. significantly increased in 2021 and 2022.

Strong propulsive demand from the end-use sectors Automotive, Consumer, Communication etc., amidst pandemic, is expected to be the key driving factor for the market growth

Printed Circuit Board Market Outlook

Shift in the manufacturing base of major electronic and communication manufacturers to low-cost countries, like Vietnam, Taiwan, and South Korea, is expected to support the demand for PCBs and PCBAs in APAC. Environmental rules and laws set by the governments of various countries are expected to support the growth in recycling of PCBs until 2025

-

Considering the fragmented nature of the market, the market competition is expected to be on an increasing trend.

-

Considering the current scenario operating with increasing demand and limitations in supply, supply demand gap is moderately large.

-

The upstream raw materials of PCB, such as copper clad laminate and copper foil which had been in severe shortage in 2021 have been gradually improving but not fully, with increasing prices, due to high inflation, increased logistic tightness. The supply of copper is tight, owing to surge in demand from different end markets.

-

The supply of glass fiber is also gradually improving due to softening fuel and raw material prices.

-

Integration of automation or robotics in the manufacturing space drives higher output productivity by enabling seamless assembly of electronic components

COVID-19, and Economic Headwinds Impact on Printed Circuit Board Market

Supply tightening is continuing with the upstream PCB industry, as the cost of feedstock elements is continuing the rising trend, energy prices are also increasing and altogether exerting more pressure toward the downstream PCB industry. Considering these factors, most of the suppliers have issued price increase statements.

Printed Circuit Board Pricing Insights

Upstream PCB manufacturer, such as CCL suppliers, possess strong bargaining power, and hence, considering the mixed sentiments in copper price increase and CCL supply shortage situations, input cost is expected to increase by 4–5 percent. Copper is the key raw material being absorbed for copper foils and copper clad laminates, which is increasing, owing to multiple demand from various end uses. The PCB prices are witnessing a price increase of up to 2 to 4 percent.

Printed Circuit Board Supply Outlook

Looking at the long-term supply trend for PCB, the industry is expected to focus more on 5G, data centers, automotive etc. and the change in the industry supply pattern rather than upstream copper-clad laminate price fluctuations. The PCB supply consumption would be based on the penetration of data centers and 5G smartphones from mid-2023 to 2025 which is expected to be booming. The PCB supply is expected to normalize and match the demand in mid-2023 with lead-times normalizing by end of 2023.

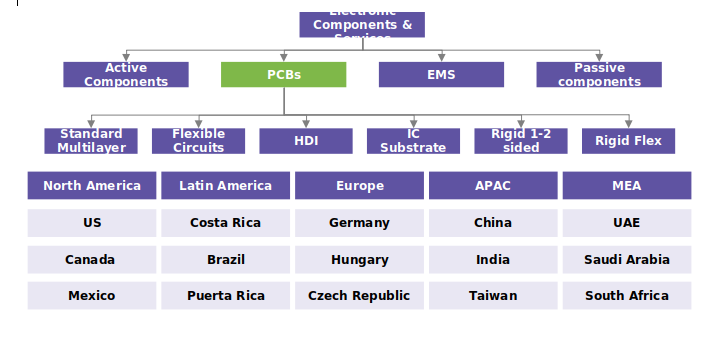

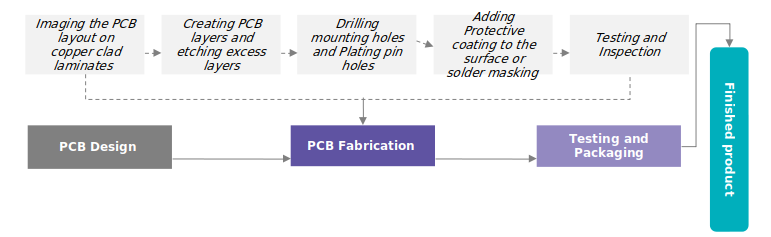

PCB Value Chain

Regional Market Insights

Considering the revival of economic activities, the PCB industry has greatly benefited from the surge in demand from Automotive, 5G network sites, Smart appliances, large data centers, etc.

The APAC, contributing to more than 90 percent of the global production, is expected to be a key influencing factor for the PCB market. The US–China trade war with intensity of US Chips Act is expected to influence the market growth of PCB, as EMS companies are more active with respect to expansion to other Asian countries, and it is expected that diversification of PCB supply base happens at the same time .

According to IPC, PCB bookings in North America have witnessed a steady decrease of 19 percent in October on an y-o-y basis and 22 percent on an m-o-m basis and it clearly indicates that the recession in North America is expected to have influenced PCB bookings.

Regulations about safety and automation, adoption of electric vehicle and sophistication in automotive industry are the key driving factors for PCB demand in the European automobile industry. The same is expected to support new technologies in both PCB and PCBA design industries.

Supplier Intelligence

The category intelligence covers some of the key global players such as ZD Tech, Nippon Mektron, TTM Technologies, Unimicron, Compeq.

-

Key global players have announced the reduction of carbon footprint as part of their sustainable strategies. For instance, Sanmina plans to reduce carbon emissions by 40 percent in 2030 and net-zero by 2050. Also, they plan to integrate various energy sources, such as solar, wind, biomass, hydro, and geothermal to aid in the reduction of GHG emissions. Compeq plants in Taiwan and mainland China implemented 17 programs and 9 programs relating to energy conservation, respectively, to save electricity consumption up to 10,999,705.68kWh

Segmentation Overview: