The global construction market was estimated at USD 15.17 trillion. It is expected to reach USD 18.96 trillion by 2024 with year-on-year growth rate of ~9-11%. The construction industry is experiencing commodity inflationary pressures and risk from economic uncertainties. The supply–demand balance for construction materials is improving, as the manufacturers have increased their production.

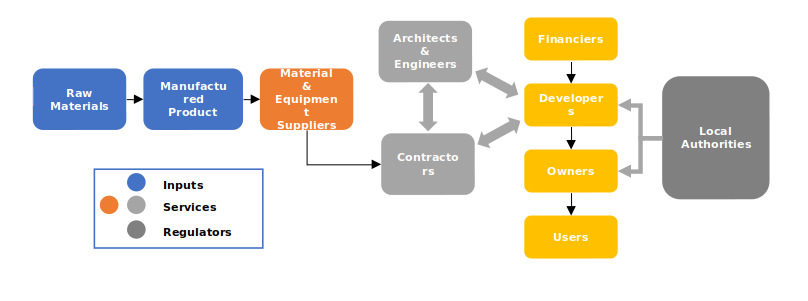

Construction Value Chain

Global Construction Market Outlook

The construction activities are back to normal with an increase in residential, commercial, and infrastructural projects across the world. The APAC region has the major share with approximately 40 percent, followed by Europe and North America. Countries, like the US, India, are planning to invest a lot for infrastructure development.

The construction activities have bounced back after the ease of COVID-19 restrictions and the supply-demand of construction materials is getting normalized in a slower rate. Economic slowdown and the trend towards the recession has slowed down the construction output in the region in H2 2022. High inflation levels and the economic uncertainties are expected to continue in the early next year.

-

Emerging Economies: The emerging countries have an average economic growth of 5 to 8 percent. Construction is one of the major contributing industries for the economic growth. The countries in Asia like India, China have major impact depending on the construction industry.

-

The drones or Unmanned Aerial Vehicles (UAV) are successfully being used by construction companies in Japan, US, etc., to conduct surveys of the construction sites and to monitor the progress in ongoing construction. The UAVs have also proved useful in providing surveyors, general contractors, and project/construction managers with up-to-date information on the project schedule and available resources on site for better management of the project, generation of 3D models, aerial images, and maps.

Regional Market Insights

-

In US, the residential construction is increasing with the growing population and their nature of being independent. The non-residential construction activity will normally be less for a developed country like United States when compared to the developing countries. The commercial spaces construction will have a share of approximately 7 percent of the overall construction market.

-

In Brazil, the demand for construction labor is always high, which has increased after the COVID-19 pandemic. Lack of skilled worker is a key component for the construction contractors, which becomes a hindrance for project completion.

-

Increasing expenditure on infrastructure projects is underway in major European countries to revive the slowing economic activities and constraining GDP of these nations. Germany, France, Austria, Spain, Sweden, and Switzerland are expected to experience a minimal growth in the construction industry.

-

The Indian engineering and construction industry is expected to double in size by 2022, driven by Foreign Direct Investment (FDI). The spend for construction in residential sector is more in APAC as the population growth rate is high which increases the demand for residential buildings. The Indian and Chinese governments are having projects for their infrastructural developments with huge investments.

-

The Chinese government’s initiative for improving living conditions for low-income earners will aid the industry’s growth. Also, in the next five years, 100 million farmers are expected to settle in urban areas with an increase in reasonable and low income houses available in urban areas. This is expected to further propel the growth in affordable housing construction. The demand for Green Building is rising, as the government is focusing on reducing carbon emissions by promoting the use of sustainable materials in construction under its ‘Beautiful China initiative’

-

The major construction activity is done in southern and western part of Africa with approximately 56 percent and the minimal construction activity is in central part of Africa with 6 percent. Countries including Zambia, Rwanda, and Tanzania are expected to have high growth rate with increase of 5 to 6 percent. The region is expected to invest on infrastructure, energy, and transportation projects particularly, as it can promote growth in other sectors.

-

The construction industry in Saudi Arabia has increased after the release of lockdown and the labor movement for work is back to normal. The overall employment rate of the country is dependent on the construction industry where the amount of people is increasing every year.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Construction services

Current economic conditions of major countries in Europe and North America are experiencing unfavorable conditions with slowdown in commercial activities, however the inflow in capital expenditure is expected to increase. The lack of construction workers is still a big hurdle for the suppliers even though travel restrictions are eased. The migrant construction workers are still facing difficulties.

Construction Services Delivery Methods

Supplier availability and supplier market maturity are key factors that influence decision making. In the U.S. and Canada, the supplier market is mature and hence the project owner can transfer risk to the contractor based on the experience and capabilities with confidence. Design build, Design bid build, CM at risk methods are in general practice, having the higher owner expertise in managing a construction project IPD Integrated Project Delivery model also stands lucrative for massive projects where parallel works proceeds among the stakeholders

Construction Services Supply Outlook

Majority of the top global construction firms are headquartered in the China and European cities, holding a sizeable regional market share. Suppliers in China are majorly state-owned operating in various geographies benefitting from relatively lower labor rates

Most of the construction firms have a large portfolio, cutting across a wide range of construction and related services across diverse industry segments. This helps them in negating overdependence on any sector. The dipping order backlogs have put further pressure on them to attract more projects into their account. There are many small to medium-sized private contractors and large local and international contractors that cater to the construction industry increasing the rivalry among the suppliers in emerging nations

Supplier Intelligence

The category intelligence provides insights on key global and regional players such as Skanska, Strabag SE, Vinci, ACS Group, among others.