The global employee relocation market is forecasted to grow by $38.2 billion at a percentage of 4–5 by 2026. The rise in inflation, globally, has increased the cost of living. It would lead to an increase in assignment costs. The employees relocating offered relocation benefits to compensate for an increase in prices

Assignees are requesting an increase in their compensation package in impacted locations, due to the Ukraine–Russian conflicts

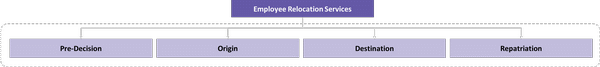

Value Chain: Employee Relocation

Employee Relocation Management Market Outlook

Cost containment is an important factor in relocation. The rise in inflation is a major cause for suppliers and buyers. The higher inflation has affected various factors, like the cost of fuel, packing materials, and labor. The management fee related to household goods movement has increased.

-

The rise in cost of living and the impact of inflation has increased the assignment cost. The employee relocation has been affected by an increase in real-estate costs. The recent housing market challenges will affect the selling and buying process of homes for the upcoming relocation.

-

The management fees related to household goods have increased. It is due to the rise in inflation that impacts the cost of fuel, packing materials, and labor. The Pacific rates from the US west coast to China has dropped by 72 percent since January 2022. The housing sector have gone by, as the restrictions have been reduced.

-

The lingering effects of COVID and the Russian–Ukraine conflict have an impact on inflation. The assignees are requesting a higher compensation package. It would lead to an increase in assignment costs. Assignees are requesting an increase in their compensation package in impacted locations, due to Ukraine–Russian conflict

-

The demand for relocation has increased in APAC. The household goods have increased 3X times in APAC. The household goods increase in the APAC have been three times, due to packing materials costs, fuel costs, and labor costs.

-

The suppliers are focusing on supply chain challenges to overcome the price rise. Suppliers planning to benchmark their prices among their supply chain partners for the best rates for quality service for their clients

-

The inflation has caused the cost of fuel, packing materials, and labor to rise. The shipping cost has increased range is 5-20 percent, on an average. The suppliers are trying not to increase their fees, and even destination service providers are trying the same.

-

Suppliers are requesting clients to take proactive measures to avoid unprecedented mobility peak season. For example, suppliers are asking clients to sign the lease documents as soon as possible to avoid losing the accommodation. To inform the required parties about the changes in an employee’s status or timeframe

-

Companies can negotiate, depending on the reduction in prices in the upcoming months. Companies can consider offering their relocated employees a furniture allowance. It enables employees to move into their long-term/permanent housing, while they are waiting for their household goods shipment

-

The demand for relocation will see a spike in the upcoming months. Temporary housing has seen an increase in rental rates, and there would be an increase in language/cultural training

Employee Relocation Trends

Suppliers have planned to optimize and improve their supply chain by conducting Robust Performance Management. Supplier has focused on their supply chain partners to assist their clients in Cost Management and Compliance. The suppliers are planning to reduce the cost by adopting Fixed rate contracts, E-procurement technologies, and sourcing the supply partner continuously

The rental prices and home prices are continuously rising. The main reason behind the increase in prices is attributed to low inventory, low-interest rates, and investment in vacation destinations. Apart from home prices, the rental rates have increased to 17 percent compared to previous years.

Post-pandemic, the technology emerged as a clear winner, as it has been adopted by most companies to support remote work. The advancement of technology has assisted the automation of compliance processes

It has led to greater efficiencies, but it poses challenges as digital tax requirements vary across the globe. Many companies have implemented work-from-home policies. The way companies have approached compliance post-pandemic entirely depends on the rise of a digitalized business

Employee Relocation Pricing Insights

The freight rates are coming down compared to Jan–Mar 2022 in the US and many other regions. Companies can expect a reduction in household goods movement in the coming months and next year. The labor cost, fuel costs, Insurance costs, and equipment costs have increased household goods in APAC compared to other regions

Few suppliers and destination service providers have not increased their fees. Supplier's fee for household goods has not increased. It is the direct costs for shipping that have risen between 5 percent and 20 percent

Employee Relocation Supply Outlook

The combination of two suppliers would give the existing clients and new clients an extended network of suppliers. The supply chain would be stronger compared to other competitors

The quality of services would improve. There is a possibility of premium prices, as it would reduce the delay in services and makes the process efficient

Clients prefer technology that helps them in all sectors by administering and reporting a relocation program with a single platform. The interested parties can also access it on a single platform

The relocation technology should accommodate any number of employees. While choosing the technology, clients can consider its relocation employee growth in the future. The technology should be customizable to the growing needs of the company and its expansion of the global footprint.

Regional Market Insights

Most of the global service providers have their presence in North America, and there are lot of small service providers catering to niche service portfolio HHG. Most of the global service providers have their presence here, and there are lot of small service providers catering to niche service portfolio HHG. The outsourcing levels are very high at around 60 percent, and the adoption of technology is also very high.

The buyers in the US are mature and prefer procuring technology support tools along with general relocation services to track the relocation assignee operations.

Supplier Intelligence

The category intelligence provides insights on key global and regional players such as SIRVA BGRS, Cartus Corporation, Santa Fe Relocation Services, Crown Relocation, and American Relocation Connections among others.

SIRVA and BGRS have merged

In the initial period, the suppliers would follow the models adopted previously. After a certain period, they would use a combined model for better operational efficiency

Initially, the two suppliers would use the existing technology platforms. The clients can consider focusing on the technology platform used by the suppliers after the merger. The suppliers would provide a single platform.