The global metal fabrication market is expected to grow from $268 Billion in 2021 to reach $302 billion in 2024 at a CAGR of 3.5–4.5 percent. Increasing demand for Electric Vehicle in the automotive sector is expected to boost the metal fabrication market globally.

Carbon Steel Market Outlook

Fabricators will benefit from a growing demand from Construction, Electronics, Aerospace and Defense, Medical, Energy, Technology sectors as well corporate spending on machinery and automation. Automotive sector is expected to face challenges in terms of supply chain disruptions and shortages in microchips and other components.

Due to increasing demand from Asia Pacific countries, many companies are shifting their manufacturing base to APAC, and this is expected to drive the regions Metal Fabrication services market growth

Metal fabrication is a customized process, based on project-based orders that constraints the standardization of the manufacturing process beyond a certain level. This constraint keeps the manufacturing costs high and increases pressure to reduce costs in a competitive market.

The zero-covid policy in China has significantly impacted the fabrication supply market; thereby leading to lead time delays and supply chain constraints.

Looking out for alternative sourcing, such as Mexico, Czech Republic, Poland, Vietnam, etc., low-cost labour, growing supply strength, proximity to major OEM production hubs, etc., are the key strategies to mitigate any potential supply side risks in the market.

Most of the metal fabrication suppliers for welding, brazing, cutting, coating, heat treatment, surface treatments operate on a spot market basis and are primarily service centers.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Carbon Steel

The supply–demand gap has increased, due to factors, such as lockdowns in China, Russia–Ukraine war, etc. This is expected to increase the prices of final products by 1–5 percent during Oct-Dec’22.

The Russia–Ukraine war has impacted the raw material supply (copper, aluminum, etc.), as Russia accounts for ~6 percent of global aluminum production and ~4 percent of global copper production.

Raw Material Pricing Insights: Stainless Steel and Aluminium

In the US, lack of demand at the mills that produce stainless steel in big quantities is the main problem the stainless market is currently facing. The end-user demand has significantly decreased, but input costs have gone up. With a 0.4% month-over-month increase in the CPI, LME nickel prices started to rise.

The COMEX price of aluminium is expected to consolidate and average around $2,340/MT in November 2022. Price sentiments remain supported on the growing risk of sanction on Russian Aluminium, as Alcoa raised concerns that around 250,000 tonnes of aluminium that entered LME-registered warehouses in October could be Russian.

Metal Stamping and Fabrication Supply Outlook

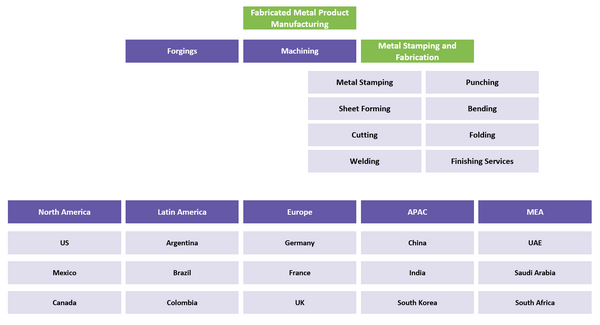

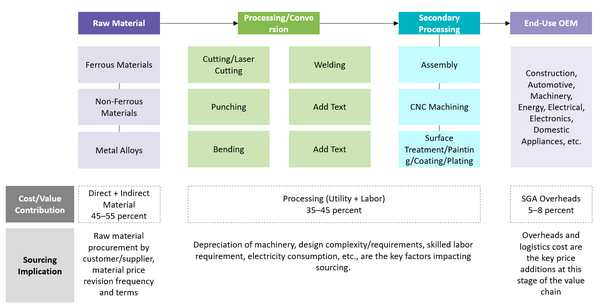

The global metal fabrication market is highly fragmented with the major supply bases spread across China, India, Germany, US, Japan, South Korea, etc. Supply base is categorized based on industry requirement, in terms of product tolerance levels. Industries, like aerospace, defense, and medical typically require high tolerance levels and thereby, high-end technologies. Steel and aluminum account for the major portion of the materials processed using the fabrication services at the global level.

Production of metal fabrication in high-cost countries, like the U.S., Germany, and in regions of Europe and North America, has a higher share of labour and raw material in the cost structure, when compared to low-cost countries, like China or India.

The shares of energy costs and the overhead costs are relatively higher in the LCC regions, due to the higher prices of electricity and the logistics associated with the production of fabricated metals.

Metal Stamping and Fabrication Chain

Regional Market Insights

Supply base concentration is found to be relatively higher in countries, such as China, the US, India, Germany, Japan, etc, mainly attributed to easy availability of raw materials and cheaper labour. North America accounts for a significant share for sheet metal fabrication market mainly due to growing construction projects as well strong focus on aviation and defence sectors. Emerging supply bases include Mexico, Poland, Czech Republic, Hungary, Thailand, Cambodia, Laos, etc..

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as Interplex Holdings Pte. Ltd. , Guangzhou Komaspec, KÖNIG METALL GmbH & Co. KG, Diehl Metall Stiftung & Co. KG, Mercury Corporation among others.

Majorly, suppliers are found to have ISO 9001 quality certifications and also adoption for availing TS 16949 certification is expected to increase in the metal fabrication supply base. Certification and Standards requirement are also becoming a part of standard requirements for procurement. The right metal fabrication company will offer services such as tamping, forming, extruding, bending,assembling etc. along with value added services such as welding, plating, heat treating, coating, painting, etc.

Segmentation Overview: