The global Enterprise Routers market was estimated at USD 4.1 billion, while global Ethernet Switches market was estimated at USD 10.0 billion in Q3 2022, with an year-on-year growth rate of 5.6 per cent, and 23.9 per cent respectively. Key factors influencing market growth include growth in the usage of internet-enabled devices, and growing demand for hyperscale datacenters. Emerging technology trends in the market are SDN, NFV, and increased adoption of 100g ethernet switches.

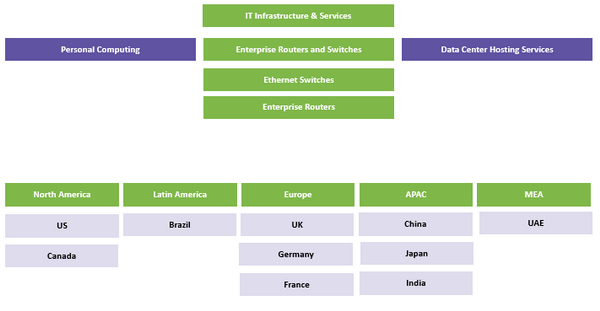

Category Definition: Enterprise Routers and Switches

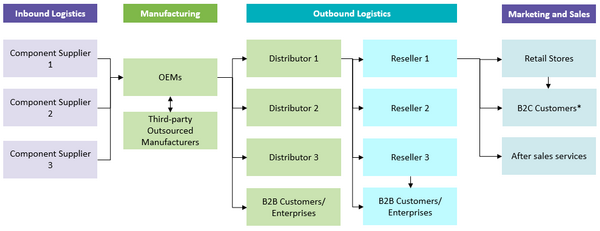

Value Chain: Enterprise Routers and Switches

Routers and Switches Market Outlook

Enterprise demand for routers and switches continues to be high and supply chain issues being exacerbated by the semiconductor shortage issue. In order to circumvent the effects of logistics cost increase, enterprises can evaluate options to extend lifecycle of existing equipment through third-party repair and refurbishment service.

For service provider high maturity regions include North America and Europe, while medium maturity regions are APAC and LATAM. Most of the major network hardware suppliers have a global presence. Few suppliers have a very strong presence in APAC.

North America and Europe are considered to be the mature buyer markets, whereas APAC is considered as the emerging markets. The Middle East and African markets have a low buyer maturity.

There is an increase in demand of 20–25 percent for utilizing refurbished telecom hardware, in order to control their cost expenditure, as refurbishment generally reduces 60–90 percent of cost compared to procurement of new equipment from OEMs

Semiconductor shortage impact is expected to affect the delivery of routers and switches even as the industry is shifting focus towards more software defined architectures and as-a-service models.

Market competition remains stable despite entry of cloud based providers as even the larger players have augmented their cloud offerings.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Enterprise Routers and Switches

The recent outbreak of COVID-19 around the world has hit the categories of network equipment, including Ethernet Switch, Routers in both enterprise and service provider segments. Semiconductor shortage impact is expected to affect the delivery of routers and switches even as the industry is shifting towards more software-defined architectures and as-a-service models. Chip prices have increased between 10 percent to 40 percent as demand outstripped supply and this further impacted on final device products

Enterprise Routers and Switches Pricing Insights

As supply delays continue despite operations inching back to normal, price of new routers and switches are expected to increase. This is on the back of chip shortage which has impacted key input components like transceivers which are critical for routers and switches. The semiconductor shortage is expected to last till early-mid of 2023 and hence price stabilization is not expected till early 2023.

Enterprise Routers and Switches Supply Outlook

Supply chain constraints had slowed down the adoption of switching and routing in enterprise and service provider segments, primarily driven by the semiconductor shortage. Large companies, like Cisco, are expected to face supply delays until throughout 2023.

Regional Market Insights

Global Ethernet Switches Market

Ethernet Switches market in US grew by 29.5 per cent in Q3 2022, while Canada market witnessed 16.7 percent growth in the same quarter. LATAM market grew by 46.1 per cent in Q3 2022.

In APAC, China market grew by 17.5 percent, and Japan market declined by 1.8 per cent. Excluding these two countries, APAC region market for ethernet Switches grew by 24.8 per cent.

Mixed growth was registered throughout Europe. Western Europe witnessed 25.8 percent growth and Central and Eastern Europe witnessed a decline of 5.4 percent in Q3 2022.

Global Enterprise & Service Provider Router Market

US witnessed 16.7 percent growth, while Canada witnessed 0.1 percent decline in Q3 2022. LATAM market grew by 35.2 percent in the same quarter

In APAC, 4.4 percent decline is witnessed in China, while in Japan, market grew by 9.3 percent. Excluding these two regions, 7.7 percent decline is registered in APAC

In Q3 2022, 11.8 percent growth is witnessed in Western Europe, while in Central & Eastern Europe, the market declined by 25.9 percent Y-o-Y

Supplier Intelligence

The category intelligence provides insights on key global and regional players such Cisco, HP Enterprise, Arista, Huawei, and Juniper among others.

The supply market is globally consolidated, where the top three or four vendors have a strong market presence within the region and are intensively competing for the market share. However, in the past couple of years, network hardware providers are facing competition from advancements of SD-WAN and 5G.

Through the implementation of SD-WAN, service providers are able to reduce cost and are also able to engage with smaller players, which was not feasible earlier

Owing to the increase in adoption of ethernet switches for data center infrastructure, service providers are focusing on introduction of high capacity ethernet switches. The market has been experiencing numerous M&As, where service providers are acquiring content providers, security service providers and smaller service providers (e.g., HPE acquisition of Aruba networks)

Regional consolidation and F500 enterprise typically tend to consolidate their supplier base to one or two vendors/region. The predominant model is a multi vendor engagement model.