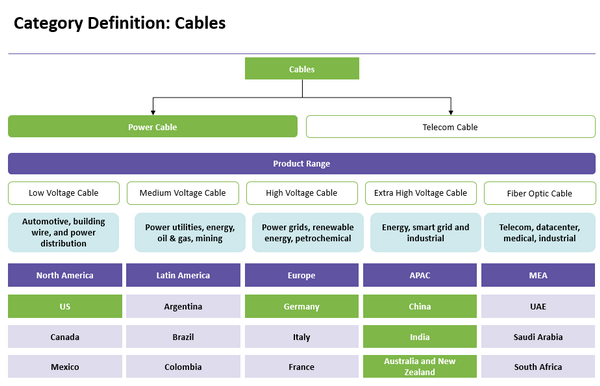

The global Cables market is expected to reach USD 177.70 billion by 2025 growing at a CAGR of 2-3% from 2022-2025. Increasing industrialization, need for power infrastructure, growing demand for telecommunication especially in data network drives the cable market globally. Cables industry will benefit from growing demand for renewable energy, where cable demand is 3–4 times higher for a 1 GW solar power plant than a conventional 1GW thermal power plant. In addition, the overhead electric transmission is moving underground in large cities, which will drive the demand for cables

Cables Market Outlook

China and India drive the market in the region, due to its rapid expansion of power infrastructure coupled with governments investment towards telecom infrastructure. Insulated metallic wire and cable market is witnessing traction in demand from key end-use sectors and various governments initiatives.

With an increased demand from the OEM/renewable sectors, as well as greater demand for fiber-optic, signal, control, and coaxial cable, the US has witnessed increasing demand.

Increase in demand from the ICT sector post Covid globally and high demand in intelligent systems and IoT are the key drivers of the telecom cables market

Increasing adoption of offshore windmill creates demand for sub-sea cable market. The developed countries are integrating wind and other renewable energies. Also, HVDC cables in the electrical transmission, LV cables for building and vehicles, and active fibre optic cable market in the telecom are the huge areas for growth.

Volatility in raw material prices and an increase in competition has created pressure on the manufacturers’ profit margin, due to which, some of the global suppliers in the industry have shifted their production facilities to regions that facilitate low cost of manufacturing

COVID-19 and Economic Headwinds Impact on Cables

China, India, and the US are the key supply bases for cables. The recent covid outbreak in China has impacted the supply chain and leading to delayed shipments for the cables industry.

Cables Pricing Insights

Prices are expected to increase during Q4 2022. The supply-demand gap has increased, due to factors, such as lockdowns in China, Russia-Ukraine war, etc. and this is expected to increase the prices of final products by 3-5 percent during Q4’22.

Considering the current situation, there is a shortage of copper impacting the cables industry. Copper prices are expected to increase globally M-o-M by 2.4 percent, while Polypropylene prices are expected to decrease by 3.8 percent M-o-M (December 2022) globally.

Cables Supply Outlook

Global suppliers like Prysmian, Nexans, Leoni, Axon and others compete along with regional/local manufacturers like RR Kabels, Saudi cable company and other players, where the supply base is moderately consolidated in nature.

End use industries like building & infrastructure, power transmission & distribution, mining, telecom drives low voltage, medium voltage, high voltage power cables and copper cables, optical cable segment, followed by automotive industry and others.

Emerging supply base like Czech Republic, Taiwan, Vietnam, Mexico gives regional buyers opportunities to the avail advantages like lead time, cost savings and mitigate potential supply chain threats.

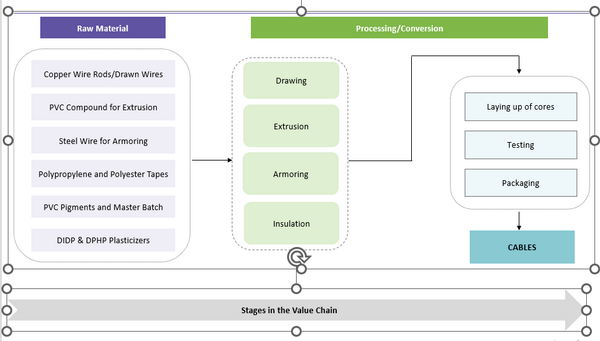

Cables Value Chain

Regional Market Insights

Asia Pacific holds approx. 35 percent of the global cable market share and will continue to dominate the market. It is expected to grow at the rate of 3-4 percent CAGR over the forecasted period. Presence of regional cable manufacturer along with global players create sufficient platform for stiff competition and fulfils the demand’s downstream industries.

Germany and UK are the largest markets in terms of revenue, holding about 15–18 percent each in the regional share. Leading players like Prysmian, Nexans, NKT have their headquarters in Italy, France and Sweden respectively holds significant share in the European market.

Electricity sector privatization in several Middle East economies, like Saudi Arabia, UAE, and Qatar, is expected to be a key industry driving factor over the next few years. Rapid growth in the industrial sector, especially petrochemicals and oil & gas, is expected to further increase the cables demand in Saudi Arabia.

All major global suppliers have cable manufacturing facilities and a strong distribution network in the region, which makes the supply strong in North America.

Brazil dominates Latin American economic output and cable demand for the past decade, holding about 60 percent of the Latin American market, followed by Argentina and Columbia, with 20 percent and 10 percent, respectively

Cost Structure Analysis

Copper/aluminum is the principal raw material used by the companies in the production of wire and cable products, representing ~50-70% percent of the total raw material costs for wire and cable. Thermoplastic is used in sheathing and enclosure of copper/aluminum rods as an outer cover. Rubber and non-metallic paper insulation elements are used inside the cables for strengthening and insulation of cables

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as Prysmian Group, Furukawa Electric, Fujikura Ltd, Sumitomo Electric etc. among others.