Summary Overview

Loyalty Programs Australia Market Overview:

The Australian loyalty program industry is steadily expanding, driven by rising consumer expectations and a competitive push in major areas such as retail, travel, financial services, and hospitality. This dynamic market encompasses a wide range of program types, from traditional point-based systems to cutting-edge, digitally driven experiences tailored to customer behaviours. Our research delves deep into changing trends in loyalty strategy, with a heavy emphasis on cost-efficiency, consumer engagement, and the strategic use of digital technologies to improve program success.

Key problems include controlling program expenses, maintaining scalability, safeguarding consumer data, and integrating loyalty systems across several client touchpoints. To maintain competitiveness, enterprises must embrace digital innovation. Strategic alliances and superior customer analytics. As consumer expectations shift, market intelligence is emerging as a crucial asset for improving program effectiveness and generating long-term growth.

Market Size: The Loyalty Programs Australia market is projected to reach USD 4.32 billion by 2035, growing at a CAGR of approximately 13.74% from 2025 to 2035.

Growth Rate: 13.74%

-

Sector Contributions: Growth in the market is driven by: -

Retail and E-Commerce Expansion: The rise of online shopping has increased demand for customer-centric loyalty programs that boost engagement, retention, and lifetime value.

-

Hospitality and Travel Revival: As tourism recovers, loyalty programs are critical for reactivating client ties and encouraging repeat reservations.

-

Technological Transformation: Advances in machine learning enable loyalty programs to provide predicted offers and hyper-targeted interaction.

-

Modular Program Design: Businesses are embracing adaptable, component-based solutions that are tailored to specific brand objectives and client preferences.

-

Innovation: Australia's robust internet infrastructure, particularly in urban areas, encourages the use of next-generation loyalty programs.

-

Regional Insights: Major adoption is focused on locations such as Victoria (Melbourne) and New South Whales (Sydney), with high vertical demand in retail, hotel, and finance

Key Trends and Sustainability Outlook:

-

Digital Ecosystems: Loyalty programs are increasingly being integrated with mobile applications, wallets, and online markets to suit shifting customer expectations.

-

Blockchain and Transparency: Blockchain is used to enable safe, traceable transactions and foster trust in decentralized loyalty networks.

-

Sustainability Alignment: Programs are increasingly including eco-friendly rewards and efforts to suit customer demand for responsible brand behaviours.

-

Vertical Customization: Tailored solutions for industries like retail, travel, and healthcare, addressing sector-specific challenges and opportunities.

-

Data-driven Strategy: Real-time data enable firms to measure engagement indicators, anticipate incentive redemptions, and fine-tune program design.

Growth Drivers:

-

Digital Acceleration: Rapid digital change across sectors highlights the importance of loyalty programs as crucial touchpoints in the consumer experience.

-

Customer Retention Priority: Rising acquisition costs encourage firms to invest on long-term loyalty over short-term incentives.

-

Scalability Requirements: Companies need for systems that can expand with their client base while preserving performance and customisation.

-

Compliance and Privacy: Programs must comply with growing privacy rules (such as GDPR and Australian Privacy Principles) while preserving data security.

-

Cross-Border Loyalty: As global businesses expand into Australia, there is a growing demand for loyalty programs that provide multi-market flexibility and compliance.

Overview of Market Intelligence Services for the Loyalty Programs Australia Market:

With increasing complexity and consumer expectations, companies use market data to build, assess, and optimize loyalty plans. Recent evaluations have identified issues such as controlling long-term program expenditures and providing individualized value at scale. These insights guide tactical decisions ranging from partner selection to compensation structure, resulting in demonstrable ROI and customer satisfaction.

Procurement Intelligence for Loyalty Programs Australia: Category Management and Strategic Sourcing

To remain competitive, enterprises are reconsidering their procurement strategy for loyalty systems and services. Strategic sourcing and vendor benchmarking assist to assure consistent performance, cost-effectiveness, and innovation alignment through expenditure monitoring and supplier review, organizations can optimize their loyalty tech stack and obtain advantageous terms positioning themselves for long-term success in a fast-evolving industry.

Pricing Outlook for Loyalty Programs Australia: Spend Analysis

The pricing environment for loyalty programs in Australia is likely to be somewhat dynamic, influenced by a variety of strategic and technical reasons. Key drivers include the increased need for digital-first solutions, the requirement for customisation and personalization, and regional differences in consumer interaction behaviours and program design.

Graph shows general upward trend pricing for Loyalty Programs Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To manage pricing volatility and keep costs low, organizations are focusing on streamlined procurement processes with clearer evaluation criteria and performance benchmarks, improved vendor management, ensuring alignment on innovation, support, and delivery timelines, and modular program architecture that allows brands to invest only in the features they need, reducing unnecessary complexity and costs.

Partnering with proven solution providers who provide long-term support, innovation, and strategic guidance; exploring flexible pricing models, such as subscription-based and usage-driven options, to better match changing program needs; and negotiating multi-year agreements that lock in rates and increase budget predictability. Despite rising prices, an emphasis on scalability, data-driven performance, and cloud-native platforms is critical to maintaining ROI and providing long-term customer value.

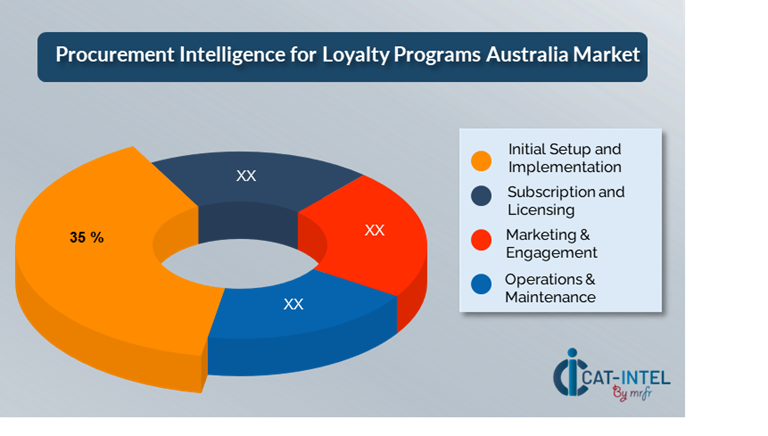

Cost Breakdown for Loyalty Programs Australia: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Setup and Implementation: (35%)

-

Description: This cost comprises the fees associated with launching the loyalty program, such as system integration, platform configuration, customisation, and first training.

-

Trend: As cloud-based loyalty systems gain popularity, setup and implementation costs have fallen because they provide more user-friendly, scalable solutions with a cheaper initial investment.

- Subscription and Licensing: (XX%)

- Marketing & Engagement: (XX%)

- Operations & Maintenance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In Australia’s competitive loyalty programs market, improving procurement methods and employing effective bargaining tactics may generate considerable cost savings and operational benefits. Organizations can benefit from more advantageous pricing structures, such as volume-based discounts, bundled services, and performance-based incentives, by forming long-term agreements with loyalty technology providers, particularly those that provide cloud-based, scalable solutions. Providers who value innovation, real-time analytics, and flexible design, help lower long-term operating costs by allowing for seamless integration of new features and effective scalability as client bases expand.

The integration of digital procurement technologies, such as contract management systems, use tracking dashboards, and vendor performance analytics, promotes transparency and control over program spending. These solutions enable companies to make agile, data-driven choices regarding supplier renewals or transfers. Implementing multi-vendor methods increases organizational flexibility, decreases dependency on a single supplier, and strengthens resilience in the face of service disruptions or vendor underperformance. By focusing on partnerships that provide flexibility, transparency, and future-ready capabilities, loyalty programs will continue to be a great tool for consumer engagement, retention, and long-term growth.

Supply and Demand Overview for Loyalty Programs Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The loyalty program industry in Australia is enjoying consistent and sustained growth, driven by businesses' initiatives to improve consumer interaction in a digitally driven, experience-oriented landscape. The market is formed by a combination of technology innovation, customer expectations, and industry-specific engagement tactics, with both demand and supply variables playing important roles.

Demand Factors:

-

Digital consumer Engagement: Companies in retail, hospitality, and finance are investing in loyalty programs to consolidate consumer data and provide automated, tailored experiences.

-

Cloud-Based Loyalty Platforms: As loyalty solutions become more cloud-native and subscription-based, there is a greater demand for scalable, agile platforms that shorten time-to-market.

-

Sector-Specific Customization: Industries like travel and banking demand loyalty solutions that are suited to their specific regulatory requirements, transactional complexity, and behavioural insights.

-

Omnichannel Integration: Businesses want loyalty platforms that work with e-commerce, mobile applications, CRMs, and point-of-sale systems to provide seamless, cross-channel customer experiences.

Supply Factors:

-

Technological Advancements: AI, real-time data, and machine learning enable loyalty providers to give predictive offers, dynamic segmentation, and automated interaction.

-

Diverse Vendor Ecosystem: With a growing mix of local startups and worldwide IT companies, buyers may choose from a variety of solutions, including plug-and-play platforms and highly configurable systems.

-

Economic Conditions: Currency exchange rates, technical labor costs, and regional cloud infrastructure maturity all have an impact on pricing models and platform availability.

-

Scalability and Modularity: Loyalty technology vendors are increasingly providing modular platforms that grow with business requirements, letting companies to pay only for the capabilities they utilize.

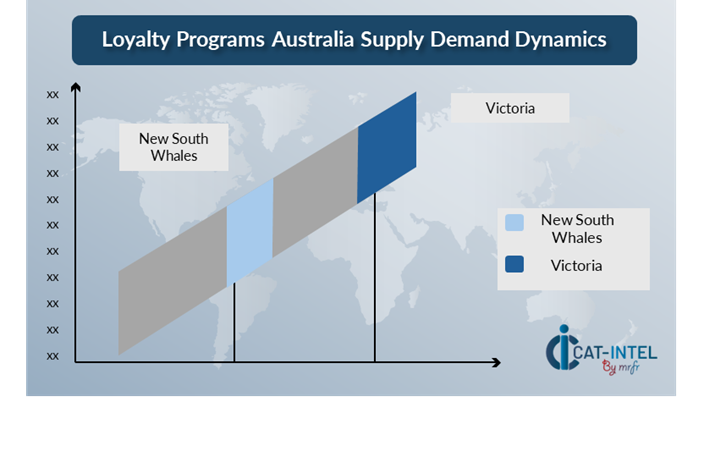

Regional Demand-Supply Outlook: Loyalty Programs Australia

The Image shows growing demand for Loyalty Programs Australia in both Victoria and New South Whales, with potential price increases and increased Competition.

Victoria: Dominance in the Loyalty Programs Australia Market

Victoria, particularly the Melbourne, is a dominant force in the Loyalty Programs Australia market due to several key factors:

-

Strong Retail and Consumer Ecosystem: Victoria has a broad and competitive retail sector that includes big national chains, niche labels, and e-commerce innovators, which is driving demand for enhanced loyalty solutions.

-

Innovation and Technology Hub: Melbourne is a major tech and digital innovation hub, home to several SaaS businesses, marketing technology suppliers, and fintech startups.

-

High Consumer Engagement and Urban Density: Victoria has a high degree of consumer involvement, which makes it an ideal environment for loyalty programs as businesses battle for attention and customer lifetime value.

-

Support for Digital Transformation: Victoria's government has demonstrated great support for digital innovation and company digitalization through subsidies, infrastructure, and tech precincts, which enables loyalty vendors expand.

-

Presence of Major Businesses and Headquarters: Victoria is home to several top Australian businesses as well as worldwide company regional offices, making it a key decision-making hub for customer experience and marketing initiatives.

Victoria Remains a key hub Loyalty Programs Australia Price Drivers Innovation and Growth.

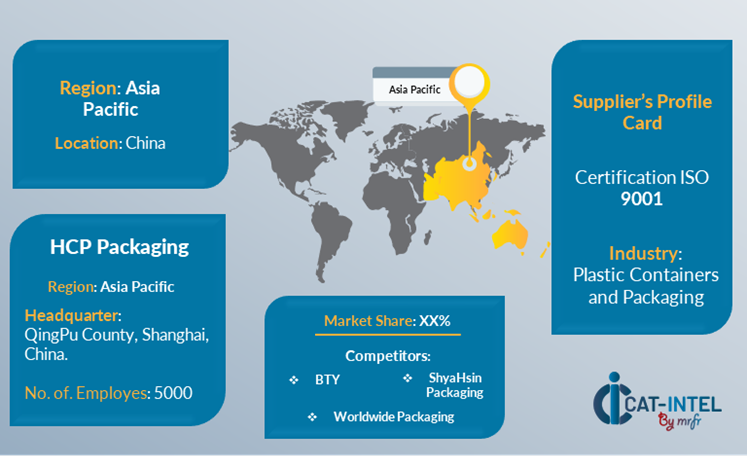

Supplier Landscape: Supplier Negotiations and Strategies

Australia's loyalty program supplier environment is varied and extremely competitive, with a mix of global heavyweights and dynamic local suppliers. These providers play an important role in determining price structures, platform flexibility, and service delivery expectations. The industry is made up of a mix of large-scale vendors offering full-featured loyalty networks and smaller, specialized suppliers who give personalized solutions for certain sectors or use cases, such as real-time personalization, gamification, or AI-powered engagement.

Innovative local technology companies that serve specialist markets like as hospitality, aviation, and retail, with a strong emphasis on customer experience and industry compliance. This dual presence guarantees that firms have access to a diverse set of capabilities, whether they want enterprise-grade technology or agile solutions tailored to local market subtleties. With customer expectations rapidly changing, supplier innovation is a critical differentiator. Companies that work with forward-thinking loyalty providers are better positioned to provide attractive, data-driven experiences that drive brand affinity and long-term value.

Key Suppliers in the Loyalty Programs Australia Market Include:

- FlyBuys

- Salesforce Loyalty Cloud

- Oracle CrowdTwist,

- Comarch

- Loyalty Now

- Tango Card

- Zinrelo

- LoyaltyOne

- Fivestars

- Qantas' Frequent Flyer Program

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The loyalty programs market in Australia is seeing solid expansion, driven by businesses prioritizing customer retention, customization, and long-term engagement strategies across retail, banking, and travel sectors. |

Cloud Adoption |

There is a significant trend toward cloud-based loyalty solutions that provide real-time interaction, scalable program administration, and remote accessibility which is especially important in hybrid and mobile-first contexts. |

Product Innovation |

Providers are improving loyalty platforms with AI-powered personalization, gamification, and data-rich customer journey mapping, while sector-specific modules are gaining popularity. |

Technological Advancements |

The convergence of machine learning, mobile applications, and blockchain technology is broadening loyalty capabilities by enabling predictive incentives, digital wallets, and safe, transparent payments. |

Global Trade Dynamics |

To promote cross-border consumer involvement, Australian firms' loyalty networks must comply with regional data protection rules, currency variances, and localization needs. |

Customization Trends |

Businesses want modular loyalty systems that interact seamlessly with CRMs, e-commerce, and mobile applications, allowing for bespoke experiences that are consistent with company identity and consumer expectations. |

Loyalty Programs Australia Attribute/Metric |

Details |

Market Sizing |

The Loyalty Programs Australia market is projected to reach USD 4.32 billion by 2035, growing at a CAGR of approximately 13.74% from 2025 to 2035.

|

Loyalty Programs Australia Technology Adoption Rate |

Over 70% of Australian mid-to-large businesses now use loyalty programs, with a strong shift toward mobile-first, cloud-native solutions.

|

Top Loyalty Programs Australia Industry Strategies for 2025 |

Key tactics include applying AI for tailored incentives, linking loyalty with payment systems, exploiting behavioural data for dynamic segmentation, and aligning programs with ESG and brand values. |

Loyalty Programs Australia Process Automation |

Approximately 60% of loyalty networks now automate activities such as points accrual, tier advancement, targeted offers, and consumer feedback loops.

|

Loyalty Programs Australia Process Challenges |

Businesses face hurdles including integration with legacy systems, fragmented customer data, lack of internal program ownership, and evolving compliance requirements.

|

Key Suppliers |

Leading vendors include FlyBuys, Salesforce Loyalty Cloud, Oracle Crowd Twist, Comarch, and local platforms with a wide range of sector specialties.

|

Key Regions Covered |

Major adoption is focused on metropolitan locations such as Melbourne, Sydney and Brisbane, with high vertical demand in retail, hotel, and finance.

|

Market Drivers and Trends |

Rising customer expectations for customisation, increased competition for consumer loyalty, and the requirement for real-time, data-driven program improvement all contribute to growth.

|