The global staffing industry revenue is estimated at USD 688 billion with a growth of 11% in 2022. The revenue generated in 2021 is $620 billion. The temporary staffing industry generated $533.2 billion (86 percent) revenue in 2021.

Key factors influencing market growth include technology optimization, an increase in the use of gig economy/freelancers, an increase in mergers and acquisitions, minimum wages, and upskilling and reskilling of the workforce.

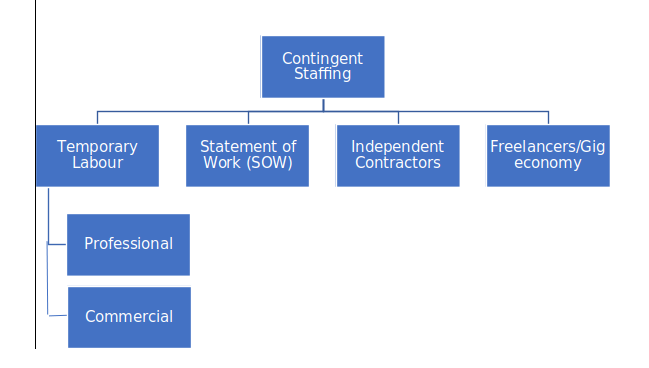

Supply Landscape Categorization, By Service Line

Temporary Labour Market Outlook

The US, Japan, and the UK comprise a major revenue stake revenue with 53 percent of total revenue, while the top 15 countries combined accounted for 88 percent of total global staffing revenue. Additional 12 countries generated at least $5 billion in staffing revenue.

Staffing revenue generated by Americas (North and South) regions last year is $204.6 billion, EMEA is $254.2 billion, and APAC is $167.4 billion. In all the regions, temporary staffing dominated the major share of revenue, with five largest countries by staffing revenue are US (30 percent), Japan (15 percent), UK (8 percent), Germany (6 percent), and France (6 percent).

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Temporary Labour

COVID-19 and Russia–Ukraine war crisis have changed the approach and working of the temporary labor industry in recent times. Technology adoption and innovations have taken a major step ahead and advanced the way the world works. Organizations have been investing in training programs to up-skill, re-skill, and cross-skill their workers. And simultaneously, organizations and staffing firms are acquiring small and medium-based tech firms to build diverse product and service portfolios, expansion programs, etc., to support workers and employers in this changing world of work.

Temporary Labour Pricing Insights

Percentage of spend pricing is the most adopted and preferred model by clients in mature and developed markets. Companies look to bundle a few countries into a single spend and have a percentage fee, based on managed spend pricing model to obtain maximum volume discounts. Markups or margin billing rate is preferred in countries with high regulatory norms and where the buyer has low standalone spend

Temporary Labour Supply Outlook

The majority of the top global Supplier firms are headquartered in the US and hold sizeable market share.

Organizations are engaging with staffing agencies to support employees that were laid-off during the COVID situation. Brussels Airlines concludes partnership with Randstad to help temporarily unemployed staff get back to work in another sector.

Supplier management strategies are positively correlated with buyer size VMS, MSP, programs to encourage the use of diversity/woman/minority staffing suppliers, and trying out new staffing suppliers

Regional Market Insights

The temporary labour market is expected to witness strong growth across North America followed by Europe and APAC.

North America has most of the global supplier’s presence in this region. With an increase in staffing M&A activity, adoption of the latest technology (artificial intelligence, chatbots, digitization, etc.), and an increase in Gig economy/freelancers/SOW/ICs, the suppliers are high on the maturity level.

Europe region comprises a large number of global suppliers who have well-established themselves in the market. The increase in staffing M&A and acquisition of third-party tech-enabled providers lead to better provision of services by suppliers, which increases maturity.

The APAC is an emerging region where global suppliers are prevalent in high matured markets, such as Japan, Australia, and Singapore. The global suppliers are entering more local markets, thus improving supplier maturity in the region.

Supplier Intelligence

The category intelligence provides insights on key global and regional players such as ManpowerGroup, Allegis Group, Kelly Services, Adecco, and Randstad

Suppliers have been building and investing more in in-house technologies, digitization, and automation techniques. Staffing agencies are setting up new technology platforms to support their operations. For example, Allegis introduces digital talent solutions by introducing its technology-powered platform for agile hiring, AGS INTELLECT Hire.