The global stainless-steel market is expected to reach 64.2 million tons by 2024 growing at a moderate CAGR of 2.2% from 2021-2024. Rise in disposable income, increasing demand from engineering and construction sector and automobile industry are likely to drive the growth in the emerging markets, primarily in Asia.

Stainless Steel Market Outlook

Despite a slowdown in activity at the year-end, most market participants remain optimistic regarding the prospects for 2022. Buyers have become increasingly cautious with their purchasing. The spread of the Omicron variant, rising inflation and ongoing supply chain constraints will continue to challenge business operations in the current year.

Mills have more material in stock than they have typically held in the last year and a half. With nickel prices falling, offering prices from non-mill sellers - distributors, brokers and others is expected to weaken. However, Stainless sheet buyers remain under allocation with mills asking for orders eight to 12 weeks before rolling and shipments arriving 12 to 16 weeks after the order is placed. As far as demand from the appliance industry has slowed, while automotive demand is still strong. The oil and gas industry is still busy and construction is still pretty good.

In Asia, anticipated reductions in raw material costs, coupled with seasonally low demand, are likely to exert negative pressure on selling values. However, output cuts, in the region, should restrict supply and limit the size of any price decreases. Transportation within Wuxi has almost returned to normal over April’s end following restrictions imposed to contain the spread of Covid-19. Buyers are expected to return to the market to buy stainless steel.

Supply tightness is expected to continue till end of 2022, supporting the domestic prices as the delivery times are currently around 12-15 weeks, while imports are restricted by a combination of safeguards and anti-dumping duties. Stainless steel production in Europe and US is fed primarily by stainless steel scrap, but all steelmakers require refined nickel for a proportion of their melt and have relied primarily on Russian supply based on the benchmark LME nickel price to meet this demand. The sanctions placed on the Russian financial system combined with concerns around the functionality of the LME after seriously disrupt European stainless-steel production.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Stainless Steel

Buying sentiments in Europe are declining, due to concerns associated with inflation, wherein low end-user demand is putting downward pressure on prices. Market uncertainty is expected to persist in short term. One of the major concerns is surrounding the high degree of volatility in the energy sector. Trading activities are expected to be weak during due to the sluggish end users’ consumption level.

Stainless Steel Pricing Insights

With a sharp decline in supply due to production cuts and a drop in demand, the EU appears to be approaching a recession. Up until 2023, and possibly even through the first part of that year, real demand is anticipated to stay at its current levels. It is predicted that most European smelters would reopen by the end of January. As liquefied natural gas imports reached record highs and helped to offset a blast of winter weather that is putting the region's ability to weather the energy crisis to the test, European natural gas prices decreased. LNG imports into northwest Europe have significantly increased recently. Due to the increase in Nickel prices, this is not motivating smelters to continue smelting.

Stainless Steel Supply Outlook

According to figures released by International Stainless-Steel Forum, World stainless steel melt shop production rose by 10.6 per cent year on year in 2021 to 56.3 million tonnes. Output increased in all regions monitored by the ISSF, with Asia, outside of China and South Korea, showing the largest climb of 21.2 per cent year on year to 7.8 million tonnes. However, this made up just 13.8 per cent of the overall total as 2021 has been an exceptional year for the global stainless-steel industry.

Supply tightness is expected to continue till, supporting the domestic prices as the delivery times are currently around 12-15 weeks, while imports are restricted by a combination of safeguards and anti-dumping duties. Stainless steel production in Europe and US is fed primarily by stainless steel scrap, but all steelmakers require refined nickel for a proportion of their melt and have relied primarily on Russian supply based on the benchmark LME nickel price to meet this demand. The sanctions placed on the Russian financial system combined with concerns around the functionality of the LME after seriously disrupt European stainless-steel production.

Stainless Steel Value Chain

Regional Market Insights

There has been a growing concern in the nickel supply as major producers like China, Russia and Indonesia have concern on their own. China has zero covid policy which is restricting logistics movement, whereas Russia is currently involved in war and Indonesia is planning to impose a ban on nickel export. So, buyers are worried about the supply and started restocking their inventories even if the nickel market is oversupplied.

With a sharp decline in supply due to production cuts and a drop in demand, the EU appears to be approaching a recession. Up until 2023, and possibly even through the first part of that year, real demand is anticipated to stay at its current levels. As liquefied natural gas imports reached record highs and helped to offset a blast of winter weather that is putting the region's ability to weather the energy crisis to the test, European natural gas prices decreased. LNG imports into northwest Europe have significantly increased recently. Due to the increase in Nickel prices, this is not motivating smelters to continue smelting.

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as Acerinox, AK Steel, Aperam, Outokumpu, POSCO, Tata Steel among others.

Key global players have announced the reduction plant of carbon footprint. For instance, China's biggest steelmaker, Baowu, has set up a global alliance with some of the world's major steel producers and miners to develop and promote a low-carbon steel industry. Announcing the establishment of the Global Low Carbon Metallurgical Innovation Alliance (GLCMIA) at its expo center in Shanghai. Technological innovations will be shared among members of the alliance.

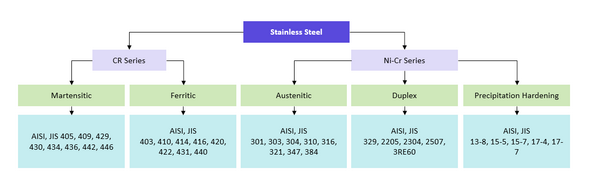

Segmentation Overview: