The global permanent recruitment market was estimated at USD 246 billion. It is expected to reach USD 345 billion by 2028 with year-on-year growth rate of ~6%. The Service providers have a higher bargaining power while for large contracts (>$25 million) the Buyers have a higher bargaining power. The US, UK, Japan, and Western European countries have high market maturity, while Australia, China, India, UAE, and Eastern European countries have medium market maturity.

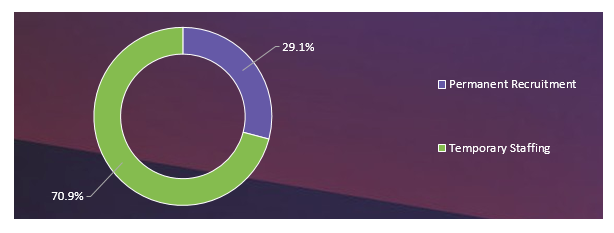

Global Staffing and Recruitment Industry: Revenue Break-up

Permanent Recruitment Market Outlook

The war in Ukraine, coupled with sanctions and recession fears across the globe has dropped recruitment prospects as companies halt their hiring activity & lay-off significant portions of their workforce, especially in North America & Europe. The US has the highest market maturity, followed by the UK, and then, Western Europe. In APAC, countries, like Australia and Japan, contribute moderately in the recruitment market. Other countries in APAC and Western LATAM and Eastern Europe are driving the demand for recruitment services such as RPO and Executive search in upcoming years.

The global recruitment service providers help in scaling up operations, while including tech integrations help to improve recruitment processes. This is expected to drive the costs marginally up, but in real terms, the buyer will find that these offerings improve its other processes, include quality of hire

Talent supply and demand gap is expected to remain high in low maturity markets, where there is an overdependence on local or regional recruitment agencies that will struggle to keep up with an adequate talent supply in an ever-changing talent landscape, where organizations are benefitting more from leveraging global talent and offshoring work to low-cost locations via remote workers through staffing options

Global growth rate has been moderate at 5.5% in 2022, and is expected to witness a slight increase in 2023 due to recessionary fears. As layoffs continue and an increasing number of workforce is released back to the job market, the demand-supply dynamics of talent is expected to change, favouring the inexperienced/ unskilled workforce.

RPO service providers are offering recruitment solutions and technological platforms. Companies either co-source or completely outsource technology platforms to RPO vendors. Various technology platforms exist and large companies have adopted it in the past

Most of the multinational companies are adopting various technology tools for recruitment purposes across geographies. There exists home-grown applications for automated reporting and analytics whereas, SAP and Oracle provides talent management suites for managing workforce

Suppliers integrating with artificial intelligence provide high decision-making ability compared to previous tools

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Permanent Recruitment

2022 has been a roller-coaster for the recruitment market, with hiring activities reaching new highs at the start of the year, but the war in Ukraine and recessionary fears bringing a halt to hiring prospects and forcing several employers to lay off employees in major organizational restructuring. Industries, such as Technology, Pharma, and Healthcare, have witnessed a sharp increase in demand with supply remaining constant, while demand for the retail and hospitality sectors has sharply fallen, while increasing supply. Highly skilled workforce is still in demand, even with massive layoffs across companies. The skill shortage is expected to persist in higher seniority levels. Operations of the BFSI industry has been least impacted, resulting in no significant changes in the job market.

Permanent Recruitment Pricing Insights

The complexity of services outsourced and the number of jobs filled are the major determinants for price. Longer contracts can yield more attractive pricing for the buyers, as suppliers will have an incentive to lower their profit margins, if assured of a continued business. Extent of outsourcing, level of hiring and volume of hire are the major internal prices driving factors influencing decision making process.

Permanent Recruitment Supply Outlook

Established service providers have been providing permanent recruitment services and RPO. Most of the global service providers are based out of the US and UK.

While organizations tried to retain talent through remote work, several employees moved to organizations offering better incentives and salary packages. The talent supply is expected to remain under stress with a widening talent gap, due to a skill shortage, which will not be able to keep up with the growing talent.

Regional Market Insights

North America and Europe are mature markets in terms of buyers and service providers. The outsourcing of recruitment services is high in North America and Western Europe. APAC and LATAM are witnessing increasing adoption due to the efforts by large global buyers to consolidate supply base.

Developed markets, such as Europe and North America have higher RPO Adoption Rate, Maturity of Service Providers, and Maturity of Buyers

Supplier Intelligence

The category intelligence provides insights on key global and regional players such as Korn Ferry, Cielo, AMS, Hays, ManpowerGroup, and Randstad among others.

Selecting a service provider includes in-depth analysis of their capability for successful service delivery to the firm. Short listing potential supplier for a firm is derived through the supplier selection criteria. Providers are offering additional services such as consulting, advisory, implementation strategies to support RPO implementation process. Regional RPO service providers are enhancing their geographical capabilities through join ventures or collaborations across continents.