The global payroll outsourcing market is forecasted to grow by $25.96 billion at a percentage of 5–8 by 2026. This year is a consolidation of the payroll services, as firms expand their regional capabilities and presence. Payroll suppliers are adding EOR to their services to benefit the remote workforce

Companies are engaging with multi-country payroll providers and reducing the engagement with multiple local suppliers. It would be a key to reduce the payroll complications, reducing the cost, and keeping compliance in check

Value Chain: Payroll Outsourcing

Payroll Outsourcing Market Outlook

Payroll transformation is the top priority among buyers. They face challenges such as compliance and controls, Payroll accuracy, Integration of technologies, and suppliers’ late submissions and corrections. Also, they are demanding the suppliers solve these issues.

The demand for suppliers with the latest technology or the technology that assists in multi-country payroll has been increasing. The technology also has been assisting the clients in line with the compliance part to reduce the cyber-attack, suppliers are working to enhance the payroll infrastructure resilience to support business growth moving forward.

There is demand from the buyer's side to improve certain processes such as Data security, Accuracy of employee pay, Reporting capabilities, Regulatory compliance, and Timeliness of employee pay. Also, the demand for improvement of these processes has been raised with regional suppliers.

In Asia, companies prefer processing payroll in-house. Post-pandemic companies have started realizing the importance of payroll outsourcing and the cloud solutions the suppliers offer. The demand for MCPO has increased. They prefer engaging with regional/local suppliers for their payroll operations

The adoption of AI in payroll would assist in identifying computation errors. Suppliers are also exploring chatbots for assisting employees through self-explaining payslips. It provides instant and detailed answers to payroll-related queries. The Client will face an additional cost based on the new technologies that would assist in automating the payroll.

Consolidation of payroll is still preferred as the prime opportunity in reducing cost. The consolidation would benefit the suppliers as they would offer volume-based discounts

In Asia, payroll outsourcing witnessed a spike in demand. Buyers in the region compare the cost incurred in-house vs the cost of payroll that has been outsourced. The initial cost of implementation would be on the higher side. In the long run, companies can reap the benefits of outsourcing.

The demand for Payroll outsourcing is moving towards Accuracy, Efficiency, and moving from a back-office function to a strategic business driver

The demand for payroll is increasing, and suppliers are increasing their specialties by incorporating modern technology, particularly cloud platforms, dynamic application programming interface (API) and integrations, cognitive automation, and analytic insights

In general, buyers are engaged with seven or more suppliers. They are planning to phase out suppliers by reducing engagement. In the coming years, the supplier's engagement might reduce to two to three suppliers

Global Payroll Outsourcing Industry Trends

The demand for suppliers with the latest technology or the technology that assists in multi-country payroll has been increasing. The technology has been assisting the clients in line with the compliance part.

Companies are facing challenges in long-tail countries. Companies are facing challenges with a lack of knowledge of the nuances in HR processes among long-tail countries

The number of employees is so low. They are faced with high fixed costs per employee, as the local HR service has become exorbitantly high. Clients are planning to invest in modern technology, particularly cloud platforms. It will assist organizations in truly automating, harmonizing, and transforming payroll into a single experience.

There is a sharp rise in data security and compliance laws such as GDPR. It will force companies to go with payroll suppliers equipped with the latest technology. Post-pandemic, the technology emerged as a clear winner, as it has been adopted by most companies to support remote work. The advancement of technology has assisted the automation of compliance processes

Payroll Outsourcing Pricing Insights

The increase in fixed monthly cost per entity by the suppliers would impact the clients. The automation of payroll will also lead to an increase in payroll prices. The clients that have quarterly indexation have been impacted compared to the companies that have yearly indexation.

Outsourcing payroll can reduce expenses by approximately 20 percent. For companies processing payroll in-house, due to the risk of compromising confidential data, suppliers are offering partial/hybrid payroll solutions, wherein the company can decide upon customized payroll sub-services as per the requirement.

Payroll Outsourcing Supply Outlook

Suppliers are continuing to boost automation capabilities, which include robotic process automation, artificial intelligence, machine learning, and chatbots to replace manual payroll processing activities. Suppliers are increasing their capability to provide MCPO services to satisfy the buyers’ demand for single-payroll processes/technology across all countries.

Increase in acquisitions of local suppliers by global suppliers

SD Worx, the payroll supplier, has acquired HR and Payroll Software Intelligo. This acquisition has assisted SD Worx to expand its presence in Ireland.

SD Worx has expanded its coverage in Spain by acquiring Integrho. It aims to be a leading European provider of integrated end-to-end HR solutions.

Regional Market Insights

Most of the global service providers have their presence in North America. Early adoption of payroll outsourcing has resulted in better realization of cost and time saving, thus resulting in higher adoption.

In general, payroll teams across North America focus on reconciliation, audits, controls, processing payroll, solving employee inquiries, data entry, process improvement activities, and technical support. Post COVID-19, only 10 percent of the employers use RPA to support their payroll operations. 27 percent of the companies are considering it.

Supplier Intelligence

The category intelligence provides insights on key global and regional players such as ADP, Alight Solutions, Neeyamo, Mercans, SD Worx and Paychex among others.

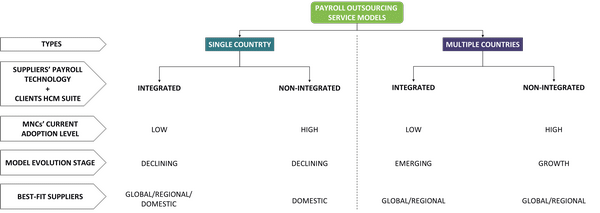

Suppliers manages about 65 percent of payroll services. Both global and regional suppliers are matured to deliver cost-effective solutions as the cost incurred towards data entry services are leveraged by these suppliers. Suppliers manages complete payroll process (i.e., from technology deployment to HR support services). Supply market witnessed the service capabilities consolidation between global and regional/domestic suppliers (i.e., strategic partnership) to deliver the services to MNC clients

Suppliers manages about 30 percent of payroll services (i.e., technology deployment and processing services). Service adoption level is low by MNCs’ via the MCPO model, as it involves high dependency on the requirement of in-house staff and the compliance rests within the client purview

Suppliers manage about 50 percent of payroll services. In addition to payroll processing services, post-payroll (i.e., regulatory and compliance filings) services were offered by the suppliers. Even though supplier maturity to offer managed payroll services via the MCPO model is high but the adoption level by MNCs’ is low as it involves payroll data entry by in-house staff which is a critical component to achieving payroll compliance.