IT Services Outsourcing Market Overview

The global IT services outsourcing industry is steadily expanding, fuelled by rising demand in industries such as manufacturing, retail, healthcare, and logistics. This market encompasses a wide range of outsourcing services, including cloud-based, on-premises, and hybrid models. Our paper provides a detailed examination of procurement trends, with an emphasis on cost optimization tactics and the use of innovative digital tools to speed outsourcing operations and improve operational efficiency.

Looking ahead, important issues in IT services outsourcing include controlling service implementation costs, assuring scalability to accommodate corporate expansion, protecting data security, and integrating outsourced services with existing internal systems. Digital procurement technologies and strategic sourcing are crucial for optimizing outsourcing engagements and maintaining long-term corporate competitiveness.

-

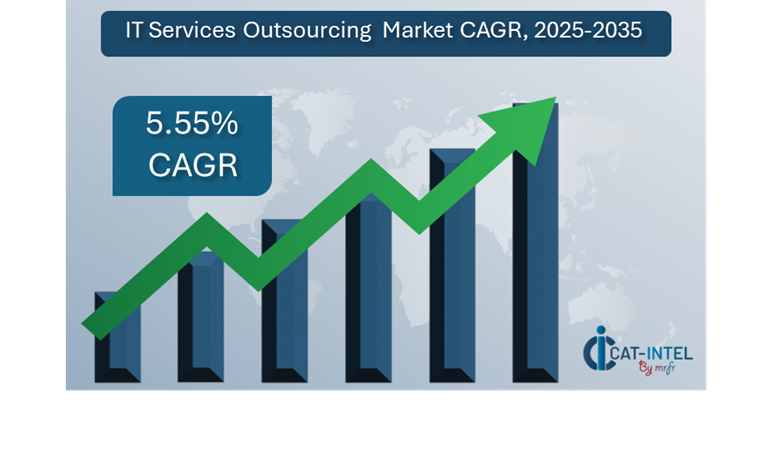

Market Size The global IT Services Outsourcing market is projected to reach USD 1398.3 billion by 2035, growing at a CAGR of approximately 5.55% from 2025 to 2035.

Growth Rate 5.55%

-

Sector Contributions Growth in the market is driven by -

Manufacturing and Supply Chain Optimization Real-time data and connected processes are driving firms to optimize their production and supply chain operations.

-

Retail and E-commerce Growth is driving organizations to implement advanced IT outsourcing solutions for better inventory management.

-

Technological Transformation Technological advancements in AI and ML are improving IT services outsourcing by enabling predictive analytics, automation, and smarter decision-making.

-

Innovations in IT Outsourcing Modular outsourcing solutions are gaining popularity, allowing firms to select and integrate only the services they require.

-

Investment Initiatives Companies are investing in cloud-based IT outsourcing to reduce infrastructure costs and improve scalability, as part of their digital transformation efforts and enable remote accessibility.

-

Regional Insights North America and Asia Pacific continue to lead the IT services outsourcing market due to their strong digital infrastructure and growing use of cloud solutions.

Key Trends and Sustainability Outlook

-

Cloud Integration Cloud-based IT outsourcing services allow businesses to grow operations, cut expenses, and increase access to important data, resulting in a more agile and adaptable approach.

-

Advanced Features Cutting-edge technologies like AI, IoT, and blockchain are transforming IT outsourcing by improving automation, decision-making, and transparency.

-

Focus on Sustainability Outsourced services can help achieve long-term sustainability goals through improved tracking and reporting capabilities.

-

Customization Trends Industry-specific outsourcing services are becoming increasingly popular, particularly in healthcare, industrial, and retail industries.

-

Data-Driven Insights IT outsourcing services offer advanced analytics, enabling organizations to estimate demand, manage processes, and measure performance metrics.

Growth Drivers

-

Digital Transformation Outsourcing IT services can help firms improve productivity and operational efficiency as digital technologies become more prevalent.

-

Demand for Process Automation IT services are being used to automate processes, decrease errors, and improve efficiency.

-

Scalability Needs Scalability is crucial for long-term success, requiring seamless integration of services and good performance during peak demand.

-

Regulatory Compliance IT outsourcing services assist firms meet regulatory obligations by automating compliance reporting and guaranteeing data veracity.

-

Globalization As businesses develop abroad, there is a growing demand for IT outsourcing solutions that can handle many currencies, languages, and international compliance requirements continues to grow.

Overview of Market Intelligence Services for the IT Services Outsourcing Market

Recent research has identified important problems in the IT services outsourcing market, such as high implementation costs and the need for customized solutions to satisfy specific company requirements. Market intelligence studies give significant insights that allow businesses to identify cost-cutting possibilities, enhance supplier relationships, and increase the success rate of outsourced service deployment. These insights help assure compliance with industry rules, excellent operating standards, and optimal cost management.

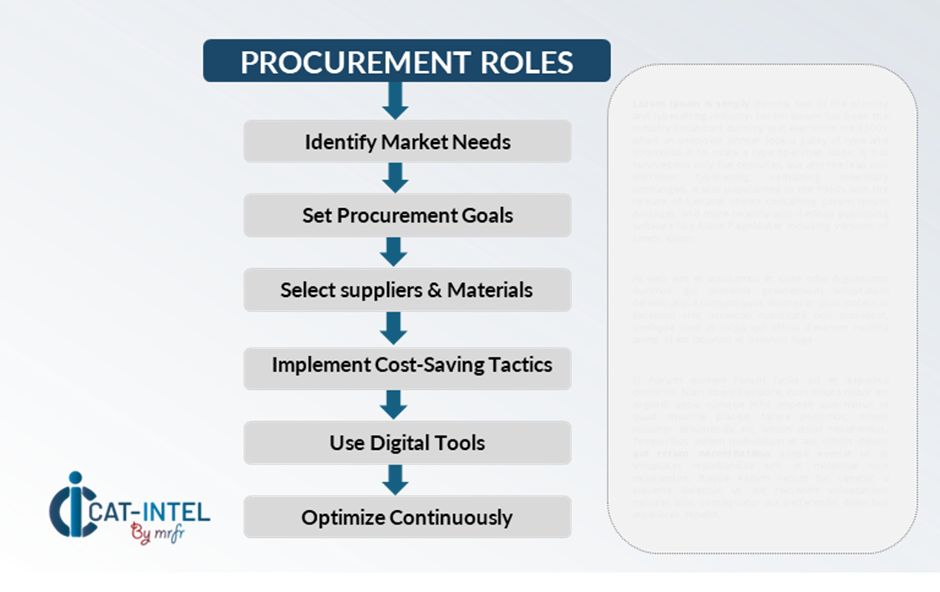

Procurement Intelligence for IT Services Outsourcing Category Management and Strategic Sourcing

To remain competitive in the IT services outsourcing industry, firms are improving procurement methods through spend analysis and supplier performance tracking. Competent category management and proactive sourcing are critical for lowering procurement costs while maintaining a steady supply of dependable IT services. Companies can use actionable market intelligence to improve procurement strategy, acquire advantageous terms, and ensure the delivery of high-quality outsourced services that meet their specific business requirements.

Pricing Outlook for IT Services Outsourcing Spend Analysis

The pricing outlook for IT services outsourcing is expected to remain moderately volatile, affected by several important factors. These include technological developments, increased demand for cloud-based solutions, the requirement for personalized services, and regional pricing differences. Furthermore, the growing usage of AI and IoT, combined with a greater emphasis on data security and compliance, is putting upward pressure on prices.

Graph shows general upward trend pricing for IT Services Outsourcing and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To decrease costs, firms must focus on refining procurement processes, enhancing vendor management, and implementing modular outsourcing solutions that provide flexibility and reduce complexity. Leveraging digital tools for market monitoring, using analytics for pricing forecasting, and establishing effective contract management procedures can all help to improve cost efficiency.

Partnering with reputable outsourcing companies, establishing multi-year contracts, and investigating subscription-based pricing structures are critical stages in managing IT services outsourcing expenses. Despite the obstacles provided by rising costs, focusing on scalability, solid implementation processes, and the use of cloud-based solutions can assist organizations in maintaining both profitability and performance excellence in their outsourcing strategy.

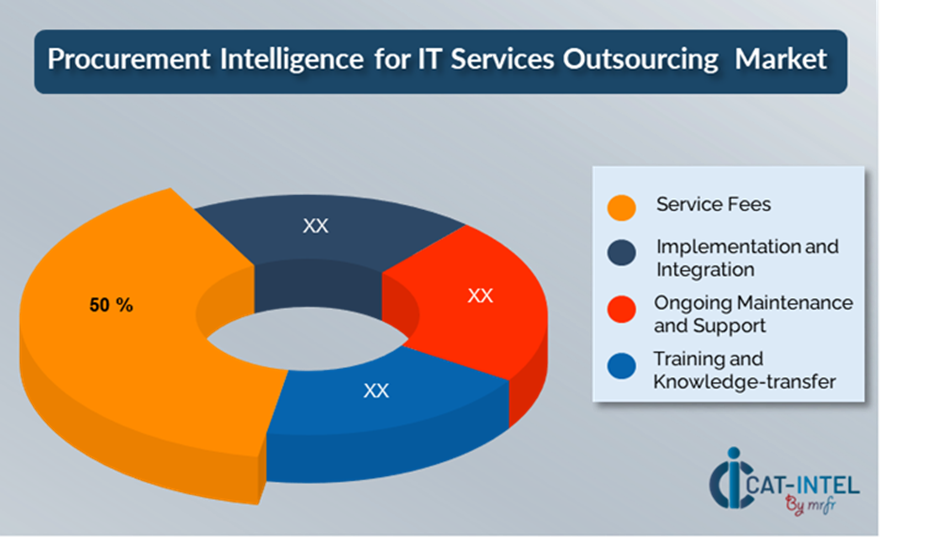

Cost Breakdown for IT Services Outsourcing Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Service Fees (50%)

-

Description This comprises the base prices for IT services such as software development, cloud management, system maintenance, and tech support.

-

Trend Performance-based pricing structures and subscription-based services are becoming more popular due to their flexibility and scalability.

- Implementation and Integration (XX%)

- Ongoing Maintenance and Support (XX%)

- Training and Knowledge-transfer (XX%)

Cost-Saving Opportunities Negotiation Levers and Purchasing Negotiation Strategies

In the IT services outsourcing industry, streamlining procurement processes and using strategic negotiation strategies can lead to significant cost savings and increased operational efficiency. Long-term collaborations with reputable service providers, particularly those providing cloud-based solutions, can result in more attractive pricing structures, such as volume discounts and packaged service packages. Subscription-based pricing arrangements and multi-year contracts also allow you to lock in reduced rates while protecting against future price hikes.

Collaboration with IT service providers who focus on innovation and scalability gives additional benefits, such as access to emerging technologies like AI, Machine learning and modular service frameworks can help cut long-term operational costs. Integration of these technologies helps improve decision-making, automate processes, and optimize service delivery. Using digital procurement technologies, such as contract management platforms and use analytics, improves transparency, reduces over-provisioning, and ensures efficient use of outsourced services. Furthermore, diversifying vendor portfolios and implementing multi-vendor strategies reduces reliance on a single provider, mitigating risks such as service disruptions and increasing negotiating leverage, thereby strengthening the organization's ability to secure more favourable contract terms.

Supply and Demand Overview for IT Services Outsourcing Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The IT services outsourcing market is expanding steadily, driven by the growing demand for digital transformation in industries such as manufacturing, retail, healthcare, and logistics. Technological improvements and industry specifics generate supply and demand dynamics

Demand Factors

-

Digital Transformation Initiatives IT outsourcing services are in high demand due to the trend of centralized data management and process automation across businesses.

-

Cloud Adoption Trends As enterprises shift to cloud-based solutions, there is a growing need for services that enable greater flexibility, remote access, and cost-efficiency, hastening the adoption of outsourced IT solutions.

-

Industry-Specific Requirements Healthcare and manufacturing industries require systems that fulfil regulatory standards, protect data, and interact smoothly with complicated operational workflows.

-

Integration Capabilities Companies are looking for outsourced IT solutions with strong integration capabilities to provide easier operations and improved data synchronization across several platforms.

Supply Factors

-

Technological Advancements AI, machine learning, and cloud computing are transforming the IT services outsourcing market, enabling organizations to adopt cutting-edge technologies.

-

Vendor Ecosystem The expanding number of IT service providers, including niche specialists and large-scale suppliers, provides customers with a wide choice of possibilities.

-

Global economic Factors Exchange rates, labour costs, and technology adoption rates, can impact pricing and availability of IT outsourcing services.

-

Scalability and Flexibility Modular IT outsourcing solutions enable service providers to deliver scalable solutions for enterprises of different sizes and operational complexities.

Regional Demand-Supply Outlook IT Services Outsourcing

The Image shows growing demand for IT Services Outsourcing in both North America and Asia Pacific, with potential price increases and increased Competition.

North America Dominance in the IT Services Outsourcing Market

North America, particularly the United States, is a dominant force in the global IT Services Outsourcing market due to several key factors

-

Technological Advancement North America is home to some of the world's biggest technological businesses, including IBM, Microsoft, and Google, which promotes ongoing innovation in IT services. -

Demand for Digital Transformation Many North American organizations are heavily investing in digital transformation to increase operational efficiency, improve consumer experiences, and remain competitive. -

Access to Global Talent Outsourcing IT services enables North American corporations to cut expenses by accessing global talent, particularly from nations with lower labour costs, such -

Robust IT Infrastructure North America boasts one of the world's most modern and dependable IT infrastructures, including significant internet access, data centres, and cloud services. -

Large Business Ecosystem The region's broad business ecosystem, which includes finance, healthcare, manufacturing, and retail, generates a large volume of IT outsourcing requirements to support corporate growth and technological needs.

North America Remains a key hub IT Services Outsourcing Price Drivers Innovation and Growth.

Supplier Landscape Supplier Negotiations and Strategies

The IT services outsourcing supplier landscape is both diversified and competitive, with a combination of global market leaders and regional competitors influencing industry dynamics. These vendors have an important role in deciding vital elements such as price models, service offers, customization choices, and overall service quality. While major, well-established outsourcing providers dominate the market with broad service suites, smaller, niche providers specialize in certain industries or offer unique features such as advanced analytics and AI integration. The outsourcing supplier ecosystem includes significant technology locations, including well-known worldwide suppliers and innovative local businesses that cater to specific industry needs.

As enterprises prioritize digital transformation and operational efficiency, IT outsourcing providers are expanding their cloud capabilities, integrating emerging technologies, and providing flexible, subscription-based models to match businesses' evolving needs. This transition assures that enterprises may easily scale their services, use cutting-edge technologies, and run cost-effective operations in a continuously changing market environment.

Key Suppliers in the IT Services Outsourcing Market Include

- IBM

- Accenture

- Cognizant Technology Solutions

- Tata Consultancy Services

- Infosys

- Capgemini

- Wipro

- Hewlett Packard Enterprise (HPE)

- DXC Technology

- SAP

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The IT services outsourcing market is expanding rapidly, owing to organizations' growing adoption of digital technologies to streamline operations, increase productivity, and better manage resources. |

Cloud Adoption |

A significant movement toward cloud-based IT outsourcing services is taking place, driven by rising need for scalability, cost-efficiency, and remote accessibility, particularly as hybrid work patterns become more prevalent. |

Product Innovation |

IT service providers are constantly increasing their products, adding cutting-edge technologies such as AI-powered analytics, real-time data processing, and industry-specific tools. |

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are improving IT outsourcing capabilities, allowing firms to increase productivity, save operational costs, and remain competitive. |

Global Trade Dynamics |

Changes in global trade legislation, compliance standards, and regional economic policies have a substantial impact on IT outsourcing adoption patterns.

|

Customization Trends |

Modular architectures and the integration of third-party technologies enable organizations to select only the services they need, resulting in flexibility and bespoke solutions that meet their specific operating requirements. |

|

IT Services Outsourcing Attribute/Metric |

Details |

Market Sizing |

The global IT Services Outsourcing market is projected to reach USD 1398.3 billion by 2035, growing at a CAGR of approximately 5.55% from 2025 to 2035.

|

IT Services Outsourcing Technology Adoption Rate |

Approximately 70% of firms globally have outsourced IT services, with a significant trend toward cloud-based solutions for scalability and flexibility. |

Top IT Services Outsourcing Industry Strategies for 2025 |

Key initiatives include integrating AI and machine learning for process automation, implementing cloud services for cost effectiveness and flexibility, improving cybersecurity, and embracing multi-vendor techniques to reduce risk. |

IT Services Outsourcing Process Automation |

To improve productivity and save operational costs, over 60% of IT outsourcing agreements incorporate the automation of regular processes such as data processing, customer assistance, and network monitoring. |

IT Services Outsourcing Process Challenges |

Key problems include maintaining vendor relationships, guaranteeing data security, dealing with service disruptions, and integrating outsourced services with changing corporate demands.

|

Key Suppliers |

Leading IT service providers include IBM (USA), Accenture, and Tata Consultancy Services, who provide a variety of IT outsourcing solutions across industries. |

Key Regions Covered |

North America, Europe, and Asia-Pacific are the most popular locations for IT outsourcing, with banking, healthcare, and retail industries driving growth. |

Market Drivers and Trends |

The need for digital transformation, rising demand for cloud-based solutions, cost optimization, and the incorporation of emerging technologies like AI, IoT, and robotic process automation (RPA) all contribute to growth. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide thorough research of the IT services outsourcing supplier market, identifying important suppliers and evaluating industry trends. We provide expenditure analysis, supplier reviews, and sourcing techniques to assist you find dependable outsourcing partners at affordable price.

We help you evaluate the total cost of ownership (TCO) for IT services outsourcing by considering vendor fees, implementation costs, ongoing maintenance, training expenses, and potential hidden costs.

Our risk management services concentrate on issues including data security, vendor lock-in concerns, and possible Service interruptions. We assist in developing strategies to reduce these risks and ensure secure, cost-effective IT service outsourcing.

Our Supplier Relationship Management (SRM) services assist in establishing solid, long-term collaborations with IT service providers. We help with contract negotiations, monitor vendor performance, and ensure seamless integration of outsourced services.

We advocate best practices such vendor segmentation, ROI analysis, contract transparency, and continuous service performance monitoring. These practices ensure that IT services procurement is effective, efficient, and transparent.

Digital tools optimize IT outsourcing procurement by automating vendor selection and improving contracts management and streamlining service integration.

Supplier performance management involves the continuous evaluation of critical parameters such as service delivery, uptime, responsiveness, and quality. This helps your outsourcing contractors deliver consistent and reliable performance over time.

We facilitate discussions by exploiting market knowledge, benchmarking price, and employing methods such as multi-year contracts, volume discounts, and performance-based conditions. These tactics aid in negotiating favourable price and terms with outsourcing providers.

Our technologies provide detailed insights into pricing patterns, vendor capabilities, service delivery strategies, and outsourcing estimates. These materials help you make data-driven decisions for your IT services outsourcing procurement strategies.

We assist in assuring compliance with industry rules and internal policies by ensuring that outsourced providers meet data security, privacy, and operational requirements. This helps to ensure regulatory compliance throughout the purchase process.

To reduce disruptions in IT service outsourcing, we advocate diversifying vendor relationships, adopting cloud-based solutions, and developing contingency plans. This ensures that activities continue even when faced with unforeseen problems.

Our monitoring solutions track critical performance parameters like service quality, delivery timeliness, support responsiveness, and cost-effectiveness. This allows you to assess supplier reliability and make informed decisions about future outsourcing engagements.

We prioritize sustainability by selecting providers who use energy-efficient data centers, promote green cloud solutions, and incorporate eco-friendly practices into their service delivery models.

Our pricing analysis compares vendor rates, monitors service pricing trends, and employs negotiation strategies to win cost-effective outsourcing agreements. This guarantees that you get the best value for your IT services while maintaining quality and performance.

We provide advise on how to manage the transition process by creating specific transition plans that ensure knowledge transfer. Our strategy also involves creating solid communication channels and monitoring key milestones to ensure a smooth, efficient transition with minimal disruptions to your operations.