The global ERP Software market was estimated at USD 49.2 billion. The ERP market is estimated to grow at a CAGR of 9.1 percent until 2029. APAC is expected to be the growth driving markets in the future. Supply is more consolidated, with the top five suppliers holding over 50 percent of the market share globally.

Global ERP Industry outlook

ERP Software Market Outlook

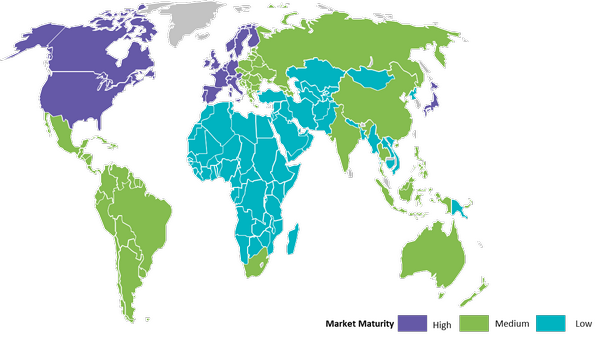

ERP penetration for large organizations is medium outside Europe and North America

SMBs in APAC and Latin America are witnessing increasing adoption due to the efforts of large global buyers to consolidate the supply base.

Organizations are focusing more on contact-less touch-points to establish an effective and a safe application interface. For instance, HR applications are replacing bio-metrics and swipe cards to facial recognition and attendance monitoring applications post the pandemic.

ERP suppliers are focusing more on enhancing the user experience and are extensively working to improve their user interface to provide a greater customer experience. This enables the customers with more user-friendly applications.

Apart from the large off-shore destinations, customers are looking at near-shore destinations in LATAM and Eastern Europe for implementation and support partners, who can support them from a similar time zone, cultural, and linguistic profile and cost-efficient pricing.

ERP suppliers are starting to collaborate with suppliers offering Industry 4.0 technology, to add value to their existing offering powered by new technology.

Impact of COVID-19 on Enterprise Resource Planning Software

The COVID-19 is a global public health hazard that drastically changed the way businesses engage. While ERP deployments and support is a mix of onsite and remote activity, there can be short-term delays in ERP deployment. With the requirement of continuous support and staying connected and strict client protocols and SLA’s, dependency on virtual connection has increased leading companies to adopt remote collaboration tools. In 2022, tech budgets may reach pre-pandemic levels or higher. That means more opportunities to hire and fill in missing skills that have held organizations behind. It might also go down by up to 3–5 percent if enterprises cut back on new tech projects. The worldwide supply chain disruption may affect new and proposed projects. As a result, the suppliers will need more time to start providing their services

ERP Software Cost Saving Opportunities

Leverage internal users during the deployment process (high employee knowledge transfer), which can reduce the cost and time of post implementation training

Training is vital to achieve 100 percent efficiency. The key factors influencing the training are user availability/commitment, practical training, continuous practice, training material, trainer and local language proficiency and trainer professionalism.

ERP Software Supply Analysis

The big data industry is expanding quickly, which highlights how crucial data is to practically every aspect of business operations. ERP systems' access to a wealth of data allows them to create better analytics relating to operations and market demands. For the majority of the functionality that firms will need when installing ERP in 2022, data and data analytics are necessary

Global suppliers are developing user-friendly interfaces and functionalities, moving away from the existing high degree of complexity in software

Enabling flexibility in deployment options. Hybrid cloud model in which an organization combines on-premise applications with cloud applications in its broader ERP package.