The global carbon market is expected to reach 2.04 billion tons by 2025 growing at a moderate CAGR of 1.2% from 2021-2025.Rise in disposable income, increasing demand from construction and automobile industry are likely to drive the growth in the emerging markets, primarily in Asia in the long term.

Carbon Steel Market Outlook

The passing of the CHIPS Act in the US will promote greater investment in domestic semiconductor manufacturing, so that the microchips that are necessary for many essential products will be made locally in the US rather than being imported from overseas. This is expected to address the chip supply challenges faced by US automakers, and boost the steel demand from the sector in the long term. Demand is expected to remain weak in Europe during Q4 2022, on the account of destocking activities and macroeconomic headwinds.

Matured markets, such as the US and few European countries (Germany, UK, France, Italy, and Spain), have witnessed a slowdown in the automotive demand over the last few years and this was further exacerbated by supply chain disruptions and sanctions due to the Russia-Ukraine war

China's Purchasing Managers' Index (PMI) for the country's manufacturing industry retreated to 41.7 in October 2022, The October PMI was dragged down mainly due to sluggish and dull downtrend in demand.

The outbreak of covid in China and China’s zero covid policy has hindered any considerable growth steel markets in 2022.

Demand from the construction and infrastructure and automotive segment are the key factors affecting the steel markets, as they constitute more than 60 percent of the steel use.

During mid-November 2022, the Indian government has removed export duties on steel products and iron ore imposed in late-May. Export duties on nine steel products with HS code 7201, 7208, 7209, 7210, 7213, 7214, 7219, 7222 and 7227 will attract nil duty compared with the 15 % levied earlier.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Carbon Steel

Buying sentiments in Europe are declining, due to concerns associated with inflation, wherein low end-user demand is putting downward pressure on prices. Market uncertainty is expected to persist in short term. One of the major concerns is surrounding the high degree of volatility in the energy sector. Trading activities are expected to be weak during due to the sluggish end users’ consumption level.

Carbon Steel Pricing Insights

Prices in the Asia, dropped by 5% on a monthly basis which averaged at 523 USD/MT during October. The drop in feedstock prices also put downward pressure on the steel prices during the month. For instance, Iron Ore prices (Iron ore 62% Fe fines, cfr Qingdao, $/tonne) dropped by ~6.64% on a monthly basis in October 2022. In the US, several service centers and distributors are still in destocking mode and are trying to sell their inventories as buyers are procuring only when it is absolutely needed.

Carbon Steel Supply Outlook

China monthly production of crude steel dropped by 8% on a monthly basis to 79.76 million tonnes in October 2022. Additionally, the nation's average daily steel production was 2.57 million tonnes/day, declining 11.2% month over month following two consecutive months of growth.

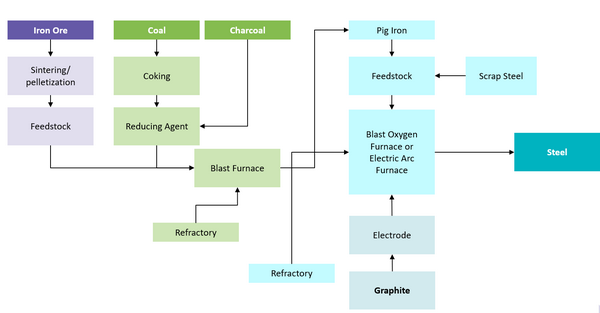

Raw material is the major cost driver of steel and hence several regions in the Asian continent have a greater control over its pricing in comparison due to its self-sufficiency. Iron ore, coking coal, ferrous scrap, etc are some of the key raw materials in manufacturing of steel. It accounts for more than 60 percent of the total manufacturing cost globally.

In recent years, India accounted for almost 15 % of HRC imports into the EU. With the recent removal of the export duties by the Indian government, it could reignite India’s exports to the EU in the medium-long term. However, given weak demand, strong service centre destocking and competitive local prices, it is unlikely to have a considerable impact in the short term.

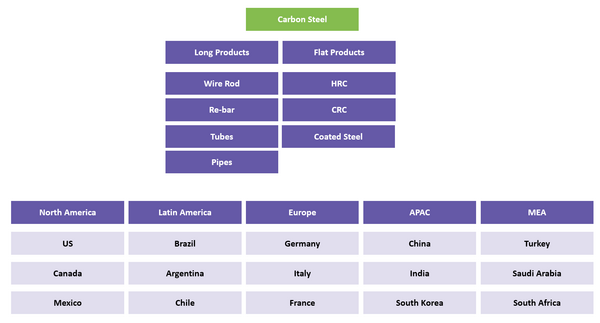

Carbon Steel Value Chain

Regional Market Insights

Canada and Mexico accounted for nearly 38 percent of the total US steel imports, with Brazil’s and EU’s share following at 12 percent, and Korea’s share at 5 percent. Under the current section 232 laws, the exporters in South Korea, Canada, and Mexico can be competitive with the US mills because they are not subject to tariffs. In the long run, a higher degree of competitively priced imports from these nations will likely exert downward pressure on domestic steel pricing.

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as ArcelorMittal, POSCO, Hesteel Group, US Steel Corp, Nippon Steel, Nucor Corp, Tata Steel among others.

Key global players have announced the reduction plant of carbon footprint. For instance, starting 2026, Baosteel will reduce carbon emissions of steel used in vehicles by 50-80% via the hydrogen-based shaft furnace-electric-arc furnace process, compared with traditional steelmaking. And it will provide green steel with carbon reduction by 95% in the future.