The global Li-Ion batteries market is expected to reach USD 94.15 billion by 2025 growing at a CAGR of 14-16% from 2022-2025. Surging demand from the EV industry, escalating demand for Energy Storage Systems (ESS), increasing adoption of Li-Ion batteries in consumer electronics, rising need for automation and battery-operated material-handling equipment, increasing demand for smart devices etc. backed by favorable government policies are likely to drive the growth for Li-Ion batteries globally.

Li-Ion Batteries Market Outlook

Currently, there is a shortage of li-Ion batteries globally, and the situation is expected to continue until 2023-24. EV sales have witnessed massive growth in 2022 estimated at approx. 8.2 million units globally, with China alone accounting for 48-53 percent of the global EV sales resulting in robust growth in battery demand. EVs, one of the major segments for Li-Ion batteries, witnessed a sharp spike in sales globally driven by favorable government policies. The governments in Europe and the US have announced their electrification targets for all new cars by 2030-35 coupled with investment in EV charging infrastructure. EVs are the major demand segment for lithium batteries and is expected to significantly dominate the category in the coming years, thereby providing strong growth prospects for Li batteries during 2022–2025.

The EV segment has witnessed significant growth in 2022, however with the current supply chain situation, the industry is concerned regarding an upcoming acute battery shortage by 2024-25.

Auto and battery makers are presently focusing on reducing cobalt content in batteries on account of legal and reputational risks related to cobalt mining from DRC.

Major Automotive and Consumer electronics companies adopt strategy of collaborating with cell manufacturers to secure their battery supply.

The demand for Li-Ion batteries in grids and PV systems is expected to increase, due to the installation of large-scale solar and wind power plants, to meet the growing demand for clean and energy-efficient storage systems.

Key Li-ion battery manufacturers are adopting strategies such as joint ventures, innovative product launches, geographical expansions, etc., to cater to the requirements of various end-use sectors, especially surging demand from the EVs.

Automotive batteries demand majorly rely on China due to their increasing domestic demand for EVs on account of increasing environmental pollution from combustion engines

COVID-19 and Economic Headwinds Impact on Batteries

Restrictions in manufacturing, lockdowns, and trade embargoes have adversely impacted the battery industry leading to global battery shortage caused due to supply chain bottlenecks, coupled with surging demand. Inflationary pressure and persisting supply chain constraints, raw material availability, fresh COVID infections in China etc. is expected to pose significant challenges for the category.

Li-Ion batteries Pricing Insights

Prices are expected to increase during Q4 2022, on account of continuous surge in critical raw material prices, such as Lithium coupled with supply chain bottlenecks and raw material availability concerns. There is a temporary drop in raw material prices due to the EV makers having already hit their production targets and logistical bottlenecks from Covid-19 controls in China etc. Lithium prices are expected to decrease through Q1 2023 due to weak demand. However, demand is expected to increase in Q2 2023. Inflationary pressure and persisting supply chain constraints, raw material availability etc. coupled with surging demand from the EV segment is expected to increase battery prices in the short to mid-term.

Li-Ion Batteries Supply Outlook

Currently, the battery market is facing shortage and players are competing aggressively for any spot tonnage available. With surging demand from the EV segment, the current plans for battery capacity expansion may not be sufficient to address the demand even after significant investments globally.

Inflationary pressure, persisting supply chain constraints, raw material availability especially lithium, shortage of skilled labor etc. are expected to create challenges for the batteries production. Lithium (one of the key battery ingredients) is expected to witness shortage in the coming years.

Currently, net cell production globally is just 10 percent of the requirement for the next 10 years, based on current electrification targets. EV players are partnering with mining firms, to secure their battery material requirements. Apart from mining, automakers are also entering agreements with battery raw materials processing and component manufacturing companies globally to secure its supply chain.

Capacity expansions and innovations from the manufacturers are mostly concentrated towards EV industry. At present, China controls 80 percent of the global raw material refining, 77 percent of the global cell capacity and 60 percent of the global component manufacturing.

Battery supply base is consolidated with suppliers catering to industries such as Automotive, Consumer Electronics, Energy Storage etc. However, with increasing mergers and acquisitions, the industry is likely to head towards more consolidation by 2030. Supply base concentration is found to be relatively higher in China as compared to other countries such as Germany, US, Japan, India etc. Currently, there is an increasing push to locate battery manufacturing in Europe so as to reduce the reliance on Asian players.

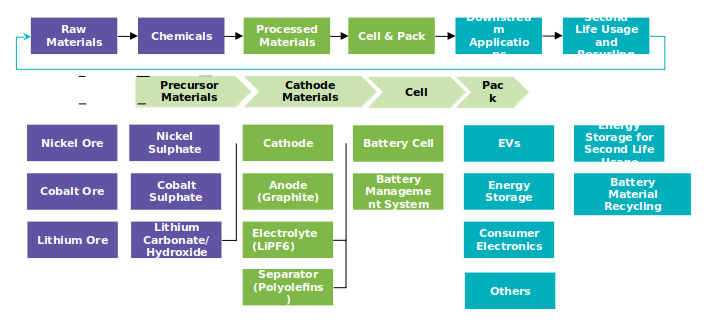

Li-Ion Batteries Value Chain

Regional Market Insights

APAC registers the highest demand share and is majorly supported by the rapid adoption of electric vehicles and growing uptake of Li-Ion cells for consumer electronics applications. The increasing deployment of EVs in countries, such as China and India, along with the high demand for electronics with urbanization and increasing power purchase parity, is also expected to drive the demand

Extensive investments in the R&D of battery production and well-established automotive sector in Germany, increased adoption of EVs in developed countries, and investments by governments for increasing the battery production are the key factors driving demand in Europe.

The Inflation Reduction Act (IRA) has been passed recently with an aim to shore up the battery supply chain in North America. OEMs who qualify the "component" and "critical mineral" requirements shall be awarded with USD7500 tax credit.

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as LG Chem, Samsung SDI, CATL, BYD etc. among others.

Key global players are investing in battery recycling. For instance, Battery Giant, Contemporary Amperex Technology Co Ltd (CATL) have invested upto $ 5 bn. for building a battery material recycling plant in the Hubei province, China in the form of a joint venture with Hubei Yihua Chemical Industry to recycle battery materials such as cobalt and lithium from used EV batteries. CATL has further announced a strategic partnership with German based battery chemicals maker, for supporting production and recycling activity plans for CATL in Europe.

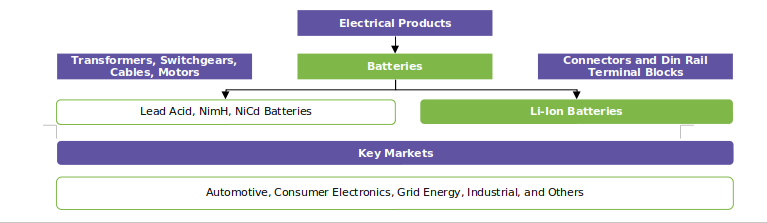

Segmentation Overview: